Key Takeaways

- Growth is a Journey, Not a Leap. Mergers and acquisitions work best when driven by strategy, structure, and shared purpose, not speed.

- The Real Value Lies in Alignment. A successful M&A is built on cultural fit, leadership clarity, and strong governance, not just valuation numbers.

- Scale Can Be Sustainable. When planned with discipline, mergers help businesses expand without losing control, culture, or credibility.

- Guidance Turns Complexity into Clarity. With the right mentors, frameworks, and community, like those at S45 Club, founders can turn M&A from a transaction into a transformation.

Business growth often depends on a company’s ability to evolve, adapt, and expand with discipline. Mergers and acquisitions (M&A) enable this evolution by helping businesses combine strengths, acquire new capabilities, and create long-term value.

When executed with the right strategy and governance, M&A can:

- Open new markets and customer segments.

- Strengthen financial resilience.

- Improve operational efficiency.

- Build institutional readiness for larger opportunities.

This article explores how well-planned M&A strategies can support sustainable, scalable growth for Indian enterprises, while highlighting both advantages and challenges.

Understanding Mergers and Acquisitions ( M&A)

To appreciate the benefits, let us begin with the basics.

What Is a Merger?

A merger takes place when two or more companies unite to form a single, stronger organisation.

- The goal is to achieve shared efficiency, expand resources, or improve competitiveness.

- Example: Two regional manufacturers merging to combine production capabilities and reduce operational costs.

What Is an Acquisition?

An acquisition occurs when one company purchases another to gain control, access to technology, or enter a new market.

- It helps the acquiring company strengthen its portfolio or capabilities.

- Example: A trading company acquiring a logistics firm to optimise supply chain operations.

Why Businesses Choose M&A

Companies pursue mergers and acquisitions to:

- Accelerate growth without starting from scratch.

- Access new products, technologies, or intellectual property.

- Build stronger market positions and customer trust.

- Attract institutional investors by improving governance and scale.

Types of Mergers and Acquisitions

Type | Purpose | Example Scenario |

Horizontal Merger | Combine competitors in the same sector | Two textile exporters merge to expand global market share |

Vertical Merger | Integrate different stages of the value chain | A manufacturer acquires a distributor to control delivery timelines |

Conglomerate Merger | Diversify across unrelated industries | A food processing firm acquires a packaging company |

India’s growing economy, policy reforms, and increasing institutional participation have made M&A a preferred growth path for ambitious SMEs.

These transactions are no longer limited to large corporations; mid-sized enterprises are increasingly adopting M&A to strengthen governance, scale efficiently, and prepare for IPO-readiness.

Also Read: Indian Startup Valuations and Funding Trends

Key Benefits of Mergers and Acquisitions

Mergers and acquisitions are powerful tools for transformation. They allow businesses to combine strengths, reduce inefficiencies, and accelerate growth without losing strategic control.

Below are some of the most significant benefits of mergers and acquisitions, particularly relevant for Indian enterprises seeking to build sustainable, long-term scale.

1. Accelerated Growth and Market Expansion

M&A provides an immediate pathway for expansion that would otherwise take years to achieve through organic means.

Key advantages include:

- Entry into new geographies and market segments.

- Access to established customer bases and distribution networks.

- Increased capacity to serve national and international demand.

Example: A mid-sized engineering firm is acquiring a regional competitor to strengthen its footprint across South India.

At S45 Club, founders are guided to evaluate such expansion opportunities with structured due diligence and sustainable scaling frameworks, ensuring growth is strategic, not speculative.

2. Enhanced Financial Strength and Valuation

When two financially sound businesses merge, they create stronger balance sheets and improved access to capital.

Key outcomes:

- Combined cash flows improve liquidity and creditworthiness.

- Larger valuations attract institutional investors and funding options.

- Reduced costs of borrowing due to stronger consolidated performance.

For SMEs, these advantages are critical when preparing for IPOs or institutional partnerships.

Also Read: How to Achieve Sustainable Business Growth Strategies

3. Access to New Capabilities and Technologies

Many mergers and acquisitions are driven by the need to innovate.

M&A helps businesses:

- Acquire modern technology or R&D capabilities.

- Bring in specialised talent and leadership expertise.

- Strengthen operational systems through digital integration.

Capability Area | How M&A Adds Value |

Technology | Adopts advanced solutions faster |

Talent | Gains experienced professionals |

Research & Development | Speeds up innovation |

Operations | Introduces efficient, scalable processes |

Through its mentorship network, S45 Club connects entrepreneurs with sector experts who help evaluate capability-driven M&A opportunities, aligning them with long-term growth goals.

4. Operational Synergies and Cost Efficiency

Combining complementary resources often results in cost reduction and better utilisation of assets.

Operational synergies can emerge in:

- Procurement and supply chain management.

- Manufacturing, logistics, or warehousing.

- Sales and marketing alignment.

These efficiencies help businesses maintain profitability even while expanding.

Example: A food manufacturer is acquiring a packaging supplier to reduce dependency and production delays, improving margins and delivery timelines.

5. Diversification and Risk Mitigation

M&A allows companies to diversify into new sectors or markets, reducing dependency on a single revenue source.

Benefits include:

- Stability during economic fluctuations.

- Exposure to multiple customer bases.

- Long-term risk management through portfolio diversification.

Diversified firms often show stronger resilience and investor appeal, especially in cyclical industries like manufacturing and trading.

6. Stronger Brand and Market Presence

M&A can enhance brand perception and market dominance by combining credibility, visibility, and reach.

Key outcomes:

- Increased brand recall through combined presence.

- Better negotiation power with suppliers and partners.

- Greater ability to attract strategic alliances or collaborations.

With the right positioning, guided by platforms such as S45 Club, founders can use M&A to strengthen brand trust while retaining their company’s legacy.

7. Institutional Readiness and Governance Maturity

Perhaps one of the most valuable benefits is the opportunity to build robust governance frameworks.

Post-merger integration often encourages:

- Formalised leadership structures.

- Stronger audit and compliance mechanisms.

- Adoption of transparent reporting standards.

For SMEs preparing to transition toward institutional or public markets, this maturity is essential.

Disadvantages and Challenges of Mergers and Acquisitions

While mergers and acquisitions offer many advantages, they also bring complexities that require foresight and planning. Understanding these challenges helps businesses prepare better and sustain value after the deal.

1. Cultural and Leadership Misalignment

When two organisations come together, their cultures, management styles, and values may differ.

Common issues include:

- Conflicting decision-making approaches.

- Unclear leadership roles and responsibilities.

- Resistance from employees or teams adjusting to new systems.

If left unaddressed, these factors can slow integration and reduce overall efficiency.

2. Integration Challenges

M&A success depends on how effectively the two entities integrate operations, systems, and people.

Integration gaps can appear in:

- Technology and data systems.

- Financial reporting and compliance.

- Product, brand, or supply chain alignment.

Platforms such as S45 Club help entrepreneurs plan integration phases through structured governance models and experienced mentors, ensuring post-merger alignment from day one.

3. Overestimation of Synergies

In some cases, businesses expect more value from the merger than is realistic.

This may result in:

- Underperforming revenue projections.

- Unmet cost-reduction goals.

- Reduced investor confidence.

Accurate due diligence and realistic forecasting are essential before finalising the transaction.

4. Financial Strain and Dilution

Financing mergers or acquisitions can stretch working capital or create short-term cash flow pressure.

Typical risks include:

- Debt overhang from leveraged buyouts.

- Delayed returns on investment.

- Equity dilution occurs if too much ownership is exchanged.

5. Regulatory and Legal Complexities

Every merger or acquisition must comply with legal, tax, and competition regulations.

Key compliance challenges:

- Multiple regulatory approvals.

- Overlapping contracts and liabilities.

- Tax implications that impact valuations.

At S45 Club, founders are encouraged to treat governance as a value multiplier, not a hurdle. The platform’s network of legal and financial advisors helps SMEs approach compliance proactively and confidently.

Acknowledging these challenges allows entrepreneurs to navigate M&A with awareness and discipline, transforming potential risks into structured learning opportunities.

Also Read: SME Growth and Challenges in India Over Last Decade

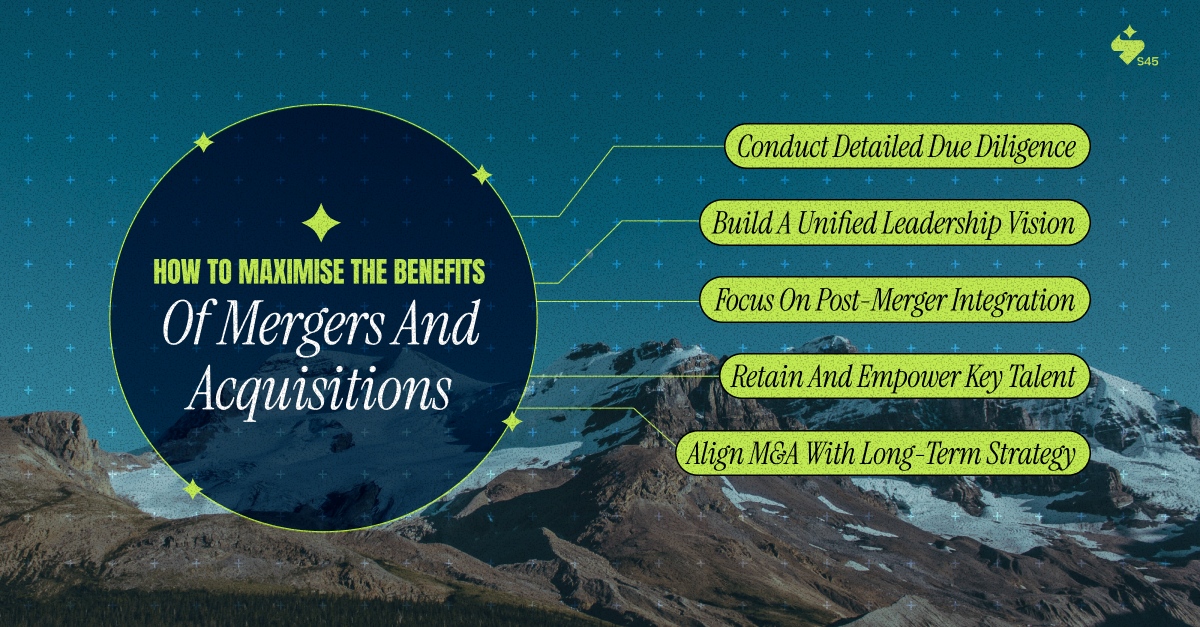

How to Maximise the Benefits of Mergers and Acquisitions

The success of any merger or acquisition depends on what happens after the agreement. Effective planning, governance, and integration are crucial to convert potential into lasting performance.

1. Conduct Detailed Due Diligence

Thorough due diligence protects both buyer and seller. It should assess:

- Financial health, liabilities, and forecasts.

- Operational and legal readiness.

- Cultural compatibility and leadership alignment.

2. Build a Unified Leadership Vision

Leadership unity determines the pace of integration.

Steps to strengthen alignment:

- Define shared objectives early.

- Communicate transparently with teams.

- Empower cross-functional leadership committees.

3. Focus on Post-Merger Integration

Integration begins before the deal closes.

Best practices include:

- Developing a 90-day integration plan.

- Aligning brand identity and communication.

- Tracking synergy progress through measurable KPIs.

Integration Focus | Action Step |

Governance | Establish joint oversight teams |

Finance | Consolidate systems and controls |

Culture | Encourage collaboration and shared goals |

Operations | Harmonise production and delivery processes |

4. Retain and Empower Key Talent

Human capital is often an overlooked success factor. To maintain continuity:

- Identify key performers and offer retention plans.

- Communicate future opportunities and growth pathways.

- Encourage mentorship and knowledge-sharing.

5. Align M&A with Long-Term Strategy

Each merger or acquisition should fit within the company’s strategic roadmap.

Questions leaders should ask:

- Does this partnership strengthen our market position?

- Will it improve governance and investor readiness?

- Is the growth sustainable over five to ten years?

Through its mentorship and capital frameworks, S45 Club helps entrepreneurs align short-term transactions with long-term strategic vision, ensuring that every decision contributes to scalable, sustainable growth.

M&A success relies on disciplined execution, strong leadership, and clear communication. When supported by structure and expert guidance, it becomes a transformative tool for purposeful, lasting growth.

Case in Point – Strategic M&A Success Stories

While large-scale mergers often dominate headlines, they offer valuable insights for growth-oriented businesses.

Case Study 1: Zomato–Blinkit Acquisition (2022)

- Zomato approved the acquisition of Blinkit for around ₹4,447 crore in a stock-swap deal.

- Blinkit, a quick-commerce company, became a wholly-owned subsidiary of Zomato on 10 August 2022.

- Strategic rationale: Zomato moved into quick-commerce to access new customer segments, leverage logistics & technology, and diversify its business model.

- Lesson for growing enterprises: Before executing M&A, assess how the transaction enhances your core business, governance, and future scalability.

Case Study 2: HDFC Bank & HDFC Ltd. (2023)

- The merger between HDFC Bank and HDFC Ltd became effective from July 1, 2023.

- Combined entity created a financial-services conglomerate with enhanced scale, governance, and institutional readiness.

- Lesson for SMEs: A strong strategic fit, regulatory clarity, and governance frameworks are key to unlocking value.

What These Stories Offer to Growth-Ready SMEs

Learning Point | Relevance to SMEs |

Strategic Fit | Ensure the target business strengthens your roadmap and core strengths |

Governance Upgrade | Use the deal as a catalyst to raise governance, leadership, and investor readiness |

Brand & Market Leverage | Combine assets to strengthen presence, credibility, and scale |

Conclusion

Mergers and acquisitions are powerful strategic tools when approached with clarity, purpose, and discipline. For businesses seeking scale, the right M&A move can deliver market expansion, stronger capabilities, improved governance, and investor appeal.

Equally, the journey demands enlightened leadership, rigorous planning, and integration capability.

As you consider an M&A pathway, keep the following in view:

- Define what you aim to achieve: growth, technology, markets, or brand.

- Ensure your leadership, culture, and governance models are ready for the change.

- Plan for integration early, rather than treating it as an afterthought.

- Use external expertise and community support to guide the journey.

If you are an entrepreneur ready to elevate your business and build a legacy, we at S45 Club stand ready to guide you, from base camp to global heights.