Flipkart made 19,000 employees richer through a single ESOP buyback in 2023. Swiggy minted 500 crorepatis through its IPO. These aren't lucky accidents. They're the result of founders who understood one thing early: your team won't just work for you, they'll build with you when they own a piece of the outcome.

But here's the catch. Most founders delay creating their ESOP pool until investors force their hand during fundraising. By then, the dilution hits harder, the strike prices are higher, and early employees lose out on the wealth they helped create.

If you're building a startup in India, you need an ESOP pool. Not someday. Not when investors ask. Now.

This guide provides a step-by-step guide on setting up your ESOP pool, including when to create it, how much equity to allocate, and the necessary legal steps. More importantly, it helps you avoid costly mistakes that can erode talent, control, and trust.

Key Takeaways

- Proactively build your ESOP pool to protect founder equity and attract long-term talent before investors dictate the terms.

- Align your ESOP design with your company’s next phase of growth, ensuring it supports both hiring and governance readiness.

- Use data-backed modeling to size your pool realistically and forecast dilution across funding rounds.

- Treat compliance, valuation, and transparent employee communication as core to trust and retention, not just paperwork.

- Regularly review and refresh your ESOP to ensure it remains relevant to evolving roles, performance, and business goals.

What Is an ESOP Pool and Why Does It Matter to Founders?

An ESOP pool is a portion of a company’s equity that is set aside for employee stock options. It serves as a structured reserve from which options are granted to employees over time. These stock options typically come with a vesting schedule and allow employees to purchase company shares at a predetermined price after meeting certain conditions.

Establishing an ESOP pool is a strategic move for early and growth-stage companies. It plays a significant role in building long-term value through people. The rationale behind creating an ESOP pool includes several key considerations:

- Attracting skilled talent while managing cash constraints. Early-stage companies often operate with limited budgets. Offering equity through stock options provides a way to compete with larger firms in talent acquisition without relying on high salaries.

- Retaining employees through long-term ownership incentives. Structured vesting periods, commonly spread over four years with an initial one-year cliff, encourage team stability and reduce attrition during critical growth phases.

- Aligning employee performance with business outcomes. When employees hold stock options, their interests become more closely tied to the success of the company. This can influence decision-making, accountability, and long-term focus.

- Meeting institutional investor expectations during fundraising. Most investors expect an ESOP pool to be in place before investing. Without it, founders may be required to create one post-term sheet, absorbing the full dilution themselves.

- Preparing for leadership hiring and future scale. As companies expand, experienced executives often expect equity participation. A well-structured ESOP pool enables such hires without the need for repeated cap table adjustments.

Founders who structure ESOP pools early gain a strategic edge. You can reach out to platforms like S45 Club, which works with SMEs who are navigating this exact transition, helping them build the governance structures and capital strategies needed to scale from family-run operations to institutional-grade businesses.

When Should You Create an ESOP Pool?

Timing your ESOP pool setup is just as important as the structure itself. Creating it too early may tie up equity you don’t use. Creating it too late often leads to unnecessary dilution, usually at your expense.

For early-stage startups (pre-seed to pre-Series A)

If you’ve just raised an angel or pre-seed round, it’s worth creating a modest ESOP pool early, even if hiring hasn't fully started. This gives you flexibility to bring on early team members without scrambling later.

Example: You're running a bootstrapped SaaS startup, just closed a ₹1 crore angel round. You’re planning to hire a founding engineer, a sales lead, and a product manager in the next 6 months. This is a good time to set up a 10–12% ESOP pool so you’re ready to offer meaningful equity from day one.

For growth-stage companies (Series B and beyond)

At this stage, the question isn’t whether you should create a pool; it’s whether your existing pool is still enough.

By now, you’ve probably granted options to early hires. However, the next phase, which involves hiring VPs, functional heads, or expanding into new markets, requires a more competitive equity strategy.

What to assess before your next round:

- How much of the current pool is already granted or promised?

- What roles are you hiring for in the next 18–24 months?

- Will you need flexibility to attract leadership or advisory talent?

Example

Suppose you're running a profitable consumer brand and are preparing for Series B. You have 5% left in your ESOP pool, but plan to hire a Head of Marketing, CFO, and Tech Advisor. Instead of waiting for the term sheet, you can proactively plan for a pool refresh to 15–18%, and structure it as part of your upcoming raise, with investor alignment.

In short, set up your ESOP pool with your next 18–24 months of hiring in mind. When done proactively, it protects your cap table, supports growth, and builds trust with both employees and investors.

How Much Equity Should You Allocate to the ESOP Pool?

There's no universal answer on how much you should allocate, but there are smart benchmarks. The correct allocation depends on your company’s stage, your hiring roadmap, and how much ownership dilution you're prepared to take.

That said, most Indian startups follow standard benchmarks that help them balance equity planning with investor expectations.

Stage-Wise Benchmarks

- Seed stage: 10 to 12 percent is standard. This should support roughly 15 to 20 key hires over 18 to 24 months.

- Series A: 12 to 15 percent to cover functional heads and expansion hiring. Typical grants: VP-level 0.5 to 1 percent, mid-level 0.2 to 0.3 percent, junior 0.05 to 0.1 percent.

- Series B and beyond: 15 to 20 percent, allowing for senior leadership packages and refreshes.

What Investors Look For

Investors often don’t just look at the total size of the pool; they look at what’s left. If you’ve already granted 8% out of a 10% pool, they’ll expect you to expand it before or during the next round. To stay ahead of this, model your hiring plan over the next two years, estimate equity required per role, and add a buffer.

Example

Suppose you're raising a Series A at a ₹50 crore post-money valuation. Your hiring plan includes:

- 5 senior roles at 0.5% each = 2.5%

- 10 mid-level roles at 0.2% each = 2%

- 15 junior roles at 0.1% each = 1.5%

That totals to 6%. Adding a 30% buffer for future or unexpected hires brings you to 7.8%, which rounds up to a 10% ESOP pool, enough to support hiring and meet investor expectations.

Impact on the Cap Table

Creating a pre-money ESOP pool immediately dilutes the value of existing shareholders' shares. Example:

- Before an ESOP pool, after an angel round: Founders 80 percent, Angels 20 percent.

- After creating a 10 percent pre-money pool: Founders 72 percent, Angels 18 percent, ESOP 10 percent.

- If you then raise Series A for 20 percent new equity, everyone dilutes proportionally, and the pool shrinks further.

The right approach is to size your pool based on short to mid-term hiring needs, include a buffer, and align pool timing with your runway and fundraising plan.

Before finalizing your ESOP pool, consider seeking guidance from experts like S45 Club, who understand both capital strategy and team incentives. Weigh down your choices through tailored advice, investor insights, and a strong peer community, to get your structure right the first time.

How to Create and Structure an ESOP Pool in India?

Creating an ESOP pool in India involves following a legal framework that ensures compliance with the Companies Act 2013 and protects both the company and employees.

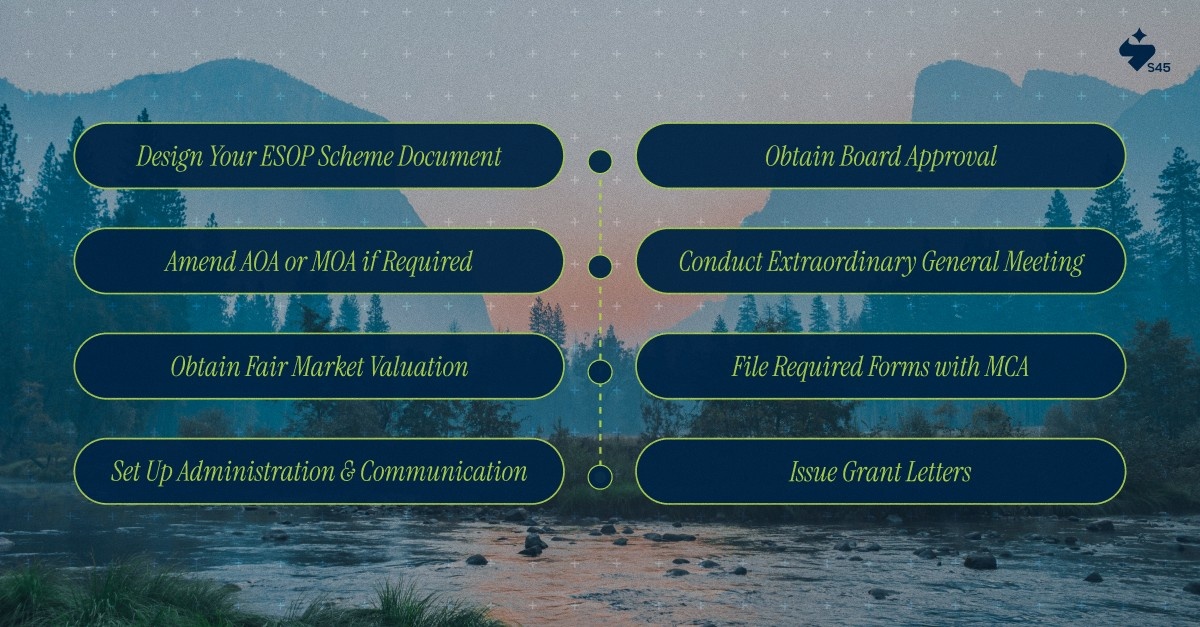

Here's the step-by-step process to set up your ESOP pool correctly.

Step 1: Design Your ESOP Scheme Document

Before obtaining any formal approvals, you must create your ESOP scheme document. This blueprint defines how your entire ESOP program will operate. Your lawyer or law firm will help draft this, but you need to make key decisions first.

The document should clearly define the following:

- Total pool size as a percentage of equity

- Eligibility criteria for employees

- Vesting schedule and cliff period

- Exercise price determination

- Exit-related provisions, including:

1. What happens to options when someone leaves the company

2. Buyback and liquidity provisions (if any)

3. Governance structure, including who will administer the scheme

Don’t rush this step. The terms you set now will govern every grant you make for years. Be fair to employees while protecting the company’s interests. Standard vesting is four years with a one-year cliff, but you can adjust based on your needs. Remember that Indian regulations require a minimum 12-month cliff period.

Step 2: Obtain Board Approval

Once your ESOP scheme document is ready, you need approval from your board of directors. This happens through a formal board meeting where directors review and vote on the scheme.

The board resolution should include:

- Approval of the ESOP scheme document.

- Authorization of the total ESOP pool size.

- Appointment of any person or committee to administer the scheme.

- Approval to call an Extraordinary General Meeting (EGM) for shareholder approval.

Document everything properly. Your board meeting minutes become part of your legal record and will be reviewed during due diligence by investors and auditors.

Step 3: Amend AOA or MOA if Required

Before proceeding, review your company’s foundational documents to ensure they permit ESOP issuance and cover the required share volume for your pool.

If your Articles of Association (AOA) do not mention issuing shares under an ESOP scheme, you will need to amend them. This requires:

- A board resolution approving the amendment.

- Shareholder approval via a special resolution.

While many modern startups include ESOP provisions at the time of incorporation, it's essential to double-check to avoid complications later.

If your Memorandum of Association (MOA) doesn’t allow for the number of shares you plan to allocate under the ESOP pool, you’ll also need to amend your authorized share capital. This process also involves:

- A board resolution.

- Shareholder approval.

- Filing with the Ministry of Corporate Affairs (MCA).

Plan this early, as both amendments take time and may delay the rest of your ESOP setup if not handled upfront.

Step 4: Conduct Extraordinary General Meeting

Now you need shareholder approval through a special resolution at an Extraordinary General Meeting (EGM). This is a mandatory step under the Companies Act.

Send notices to all shareholders at least 21 days before the EGM. The notice must include an explanatory statement detailing the ESOP scheme, the pool size, and how it affects the cap table. Shareholders need to understand what they're approving.

During the EGM, pass a special resolution approving the ESOP scheme and any necessary amendments to the AOA or MOA. This also requires approval from at least 75% of shareholders voting.

Step 5: Obtain Fair Market Valuation

Before you can grant any options, you need a valuation report from a registered valuer. This determines the Fair Market Value (FMV) of your shares, which is critical for tax purposes when employees eventually exercise their options.

Under Indian tax law, the difference between the exercise price and the FMV at the time of exercise is treated as perquisite income for employees. Having a proper valuation protects both you and your employees from tax disputes.

Update your valuation at least annually or whenever there's a significant event like a funding round. Stale valuations create problems during audits.

Step 6: File Required Forms with MCA

After shareholder approval, file the necessary forms with the Registrar of Companies (RoC). This includes Form MGT-14 for the special resolution and Form SH-7 if you've increased authorized capital.

Maintain your Register of Employee Stock Options in Form SH-6. This register records all details about grants, including employee names, number of options, grant dates, vesting schedules, and exercise details. Keep this updated with every grant and exercise.

Step 7: Set Up Administration and Communication

Decide who will administer your ESOP scheme. Many startups appoint a committee or designate a specific person authorized by the board. This administrator handles grant approvals, tracks vesting, manages exercises, and maintains records.

Create clear communication materials for employees. They need to understand several key aspects, including how ESOPs work, the meaning of their grants, vesting schedules, tax implications, and the process of exercising their options. Consider using ESOP management software or platforms designed for Indian compliance.

Step 8: Issue Grant Letters

When you're ready to grant options to specific employees, issue formal grant letters. Each letter should specify the number of options granted, the exercise price, the vesting schedule, and key terms from your ESOP scheme.

Keep copies of all grant letters and have employees acknowledge receipt. These documents become crucial in the event of disputes about terms or entitlements.

The entire setup process typically takes 4-8 weeks, provided you're well-organized and have good legal support. Don't let the complexity discourage you. Thousands of Indian startups have successfully implemented ESOP schemes.

Setting up your ESOP correctly is only half the story. To protect your ownership, it's essential to understand how changes to your cap table affect future dilution.

How Does an ESOP Pool Affect Your Cap Table and Dilution?

Understanding dilution is non-negotiable. If you don't model it correctly, you'll end up owning far less than you expected.

When you create an ESOP pool, everyone on the cap table gets diluted proportionally. If founders own 80% and angels own 20%, a 10% ESOP pool dilutes founders to 72% and angels to 18%.

But here's the key distinction: pool size versus option grants.

- Pool size is the total percentage reserved for ESOPs. It sits on your cap table, regardless of whether you've granted all the options. If you create a 10% pool but only grant 6% over two years, you still show 10% reserved.

- Option grants are the actual options you've issued to employees. These come out of the pool. As you grant more options, the unallocated portion of the pool shrinks.

Investors care about both. They want to see a large enough pool to cover hiring needs, but they also want to see you're actively using it. An unused 15% pool signals either over-allocation or poor hiring execution.

Refreshing the pool: when and how

Most companies refresh their ESOP pool every 18-24 months or during a funding round. Refreshing means adding more equity to the pool, allowing you to continue hiring.

You have two choices when refreshing:

- Dilute all existing shareholders proportionally (fair but painful)

- Negotiate with new investors to create a refresh post-money, so they share the dilution

The second option is better for founders but harder to negotiate. Investors will push back. Your leverage depends on the deal's attractiveness and whether you have competing term sheets.

- The hidden cost of over-allocating: If you create a 20% pool but only need 12%, you've diluted yourself unnecessarily. That extra 8% could have stayed in the founders' hands. Later, if the company exits, that 8% represents real money left on the table.

Model your hiring plan carefully. Allocate enough to cover 24 months of hires plus a 20-30% buffer. No more.

Once you grasp dilution mechanics, it becomes easier to identify where founders often go wrong. Let’s look at the most common ESOP mistakes and how to avoid them early.

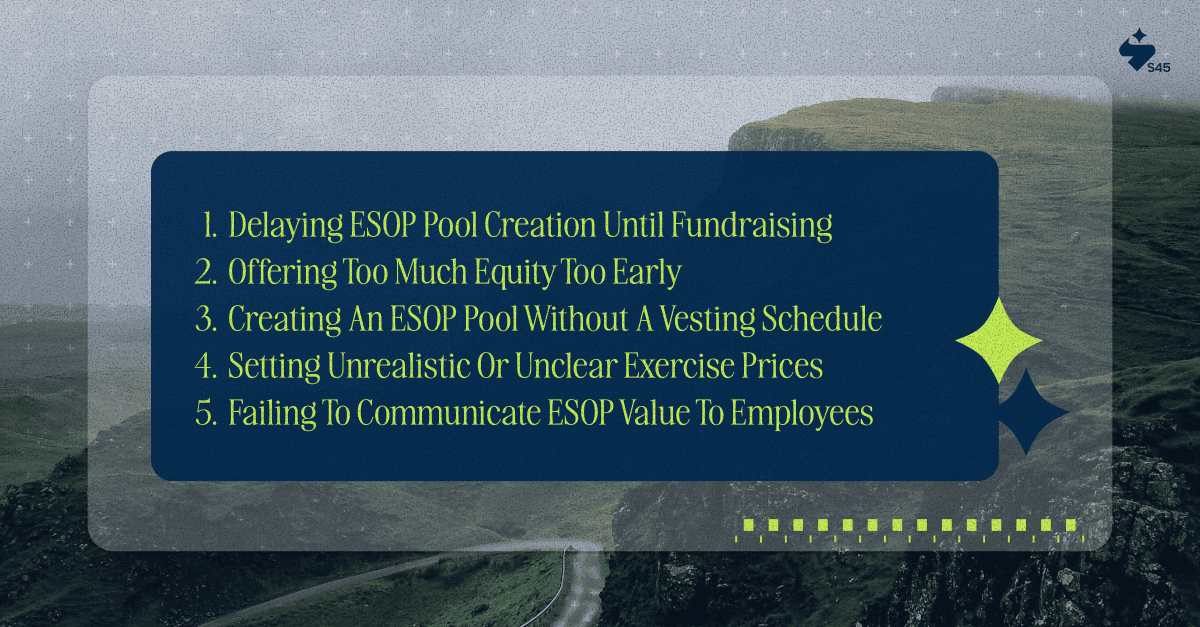

Common Mistakes Founders Make with ESOP Pools and How to Avoid Them

Even experienced founders stumble here. The mistakes are predictable, but the consequences can be costly. To avoid such mistakes, you need to know them beforehand and plan.

Mistake 1: Delaying ESOP Pool Creation Until Fundraising

Founders often agree to create an ESOP pool during fundraising but postpone the actual implementation until the next round. This happens because setting up ESOPs feels complex, and founders want to focus on building the product.

The cost? Early employees get options at a much higher strike price, or worse, don't get them at all. When your first engineer joins at a ₹10 crore valuation and you finally grant ESOPs at ₹50 crore, their upside shrinks by 80%. They'll feel cheated, and rightly so.

How to avoid this:

- Create the ESOP pool and scheme before your first institutional round.

- Even if you don't grant all the options immediately, having the structure in place lets you grant at fair strike prices as you hire.

- Seed-stage founders should establish the pool as soon as they plan to expand beyond their founding team.

Mistake 2: Offering Too Much Equity Too Early

First-time founders often over-grant ESOPs to early hires, either because they're overly generous or don't understand dilution math. Giving your first engineer 3% might feel fair in the moment, but it sets an unsustainable precedent.

If each of your first five hires receives 2-3%, you'll exhaust your pool before reaching product-market fit. Then you're forced to refresh the pool, diluting yourself again.

How to avoid this:

- Follow market benchmarks. Early engineers (first five hires) should receive 0.5-1% of the total compensation.

- Mid-level hires get 0.1-0.3%. Senior leaders (VP-level) get 0.5-1%.

- Adjust based on seniority and risk, but avoid significant deviations from established standards.

- Overpaying in equity is just as bad as underpaying in cash.

Mistake 3: Creating an ESOP Pool Without a Vesting Schedule

Some founders grant ESOPs with no vesting or with vesting terms that don't align with retention goals. An employee who gets 1% equity upfront with no vesting can walk away after three months with full ownership.

How to avoid this:

- Always use a four-year vesting schedule with a one-year cliff. This is industry standard in India. The cliff ensures employees stay for at least 12 months before earning any equity.

- After that, vesting occurs on a monthly or quarterly basis. This structure rewards long-term commitment and protects you from early attrition.

Mistake 4: Setting Unrealistic or Unclear Exercise Prices

If your exercise price is set too high, employees may be unable to afford to exercise their options. If it's set too low without proper valuation, you risk tax complications.

Some founders fail to communicate the exercise price at the time of grant, leaving employees unclear about their actual ownership. This erodes trust.

How to avoid this:

- Set the exercise price at fair market value (FMV) based on a registered valuer's report.

- If you want to be generous, set it at face value (₹10 per share), but be aware of the tax implications.

- Always disclose the exercise price in the grant letter.

- Provide employees with a calculator that shows potential outcomes at different valuations.

Mistake 5: Failing to Communicate ESOP Value to Employees

Most employees don't understand ESOPs. They see "0.25% equity" and think it's insignificant. Without context, ESOPs feel like a bonus, not a wealth-building tool.

How to avoid this:

- Educate your team. When you grant ESOPs, sit down with each employee and walk them through the math.

- Show them scenarios: if we reach ₹500 crore valuation, your 0.25% is worth ₹1.25 crore. If the IPO is at ₹2,000 crore, the value is ₹ five crore. Make it real.

- Create a one-pager with FAQs, vesting timelines, and a simple calculator. The more they understand, the more they'll value it.

Avoiding mistakes is crucial, but strategic execution separates great ESOPs from good ones. Getting expert guidance can help you structure, communicate, and optimize your ESOP plan effectively.

How S45 Club Helps Founders Build Smarter ESOP Pools?

Creating an ESOP pool is about preparing your company for the next stage of growth. That means thinking beyond percentages and paperwork, and aligning your ESOP with how your business scales, raises capital, and builds governance maturity.

That’s where the S45 Club can play a meaningful role. As a platform focused on helping founders build institution-grade businesses, S45 Club supports you in aligning your ESOP strategy with your broader growth and funding goals.

Here’s how their approach adds value to your ESOP journey:

- Governance and institutional readiness: ESOPs work best in companies with solid governance structures. S45 Club helps you strengthen board processes, reporting systems, and controls, so your business meets the standards investors expect.

- Capital planning and funding strategy: When you’re deciding pool size or timing, S45’s advisory frameworks can help you see how ESOPs fit into your capital roadmap. Their experience around SME funding and IPO preparation enables you to model scenarios that balance ownership with growth.

- Investor perspective and negotiation support: Through their founder network and market experience, S45 Club brings insights into what institutional investors typically expect from ESOP structures. That perspective helps you make better decisions during fundraising or due diligence.

- Founder community and shared learning: One of S45’s biggest strengths is its network. You get access to other founders who’ve navigated ESOP creation, capital rounds, and exits, giving you a practical understanding of what’s worked for peers at a similar stage.

In short, S45 Club helps you see your ESOP pool not as a one-off HR exercise but as part of your company’s institutional evolution, one that attracts and retains talent while preparing you for sustained growth.

Final Thoughts!

Setting up an ESOP pool is a strategic decision that shapes your company's future. Done right, it attracts the talent you need, aligns your team with your vision, and signals to investors that you understand what it takes to scale.

The founders who win are the ones who move early. They create the ESOP pool before fundraising, structure it thoughtfully, communicate it clearly, and plan for liquidity.

If you're running a profitable SME with ₹100 crore+ revenue and 30%+ growth, you're at the exact stage where ESOP pool structuring becomes critical. The next 12-24 months will define whether you scale into an institutional business or stay a founder-dependent operation.

Don't navigate this alone. The mistakes are expensive, and the stakes are high. Work with advisors who have experience in this area and understand both the ambition and the complexity.

S45 Club helps founders like you build ESOP strategies that balance dilution, retention, and investor expectations. Whether you're structuring your first pool or preparing for an IPO, their team provides the strategic clarity and execution support to get it right. Book a call today!