Key Takeaways

- Venture capital fuels faster growth by providing not only capital but also investor networks, market access, and strategic direction.

- Readiness is critical: investors prioritize product–market fit, strong teams, scalable models, and financial clarity before engaging.

- The VC journey follows a clear process, from building an investor list to pitching and conducting due diligence.

- Each stage of venture funding serves a distinct purpose, preparing the company for an IPO or acquisition.

- S45 Club helps founders navigate this journey by providing guidance and access to quality networks that make businesses funding-ready.

You’ve built something worth scaling, but growth takes money, and personal savings or bank loans can only take you so far. The hard truth? Nine out of ten startups in India fail within their first five years, most often due to running out of capital. For many founders, this is the single biggest barrier between an idea with potential and a thriving business.

That’s why understanding how to apply for venture capital is so important. Venture capital can provide more than just funds; it also brings credibility, valuable networks, and strategic guidance. But the application process itself can feel like a black box: What do investors actually look for? When is the right time to approach them? And how do you make your pitch stand out in a crowded market?

This guide answers those questions. We’ll break down the VC process step by step, show you how to prepare your business for investor scrutiny, and give you a roadmap to approach fundraising with clarity and confidence.

What is Venture Capital and How Does It Work?

Venture capital (VC) is a form of private equity financing where investors fund early-stage, high-growth startups in exchange for equity ownership. Unlike traditional loans, VCs don’t expect monthly repayments. They invest in your potential and earn returns when your company is acquired or goes public through an IPO.

VC works on a portfolio model. Investors back multiple companies, aiming for one strong performer that can deliver returns of 10 times or more. This is why they seek businesses with rapid growth potential.

Access to capital is a major challenge for founders. Research shows that running out of cash is a top reason startups shut down. VC funding addresses this challenge and can help companies scale faster than bootstrapping alone, as shown by India attracting US$26.4 billion across 593 VC deals in the first half of 2025.

Here is how venture capital works in practice:

- Fundraising: VCs raise money from limited partners such as pension funds, endowments, or wealthy individuals.

- Investment: They deploy this capital into startups over a 3–5 year period.

- Equity stake: Investors typically hold a 10–30% ownership stake, depending on the round and valuation.

- Involvement: Many take board seats, offer strategic guidance, and open doors to new customers.

- Exit: Since VC funds have a 10-year lifecycle, they prioritize startups with a clear path to acquisition or IPO.

For founders, this process can feel overwhelming, from building a pitch deck that resonates to finding the right investors and navigating due diligence. That’s where organizations like S45 Club step in. By helping growth-stage companies refine their pitch, strengthen governance, and access the right networks, they make the VC journey more strategic.

Is Your Startup Ready for VC Funding?

This question matters even more than the pitch deck itself. Approaching investors before you’re ready can make future conversations harder, while timing it right builds credibility and momentum.

VCs look for startups with clear product–market fit, scalable growth, and a team that can execute. Here’s how to evaluate your own readiness:

- Traction that proves demand: Show evidence that people want what you’re building: steady revenue growth, user acquisition, engagement metrics, or signed contracts. Investors want to see momentum, not just potential.

- A team that can execute: VCs invest in people as much as ideas. Your founding team should bring complementary skills and relevant experience. Gaps in technical leadership, product development, or operations can raise concerns. If you’re a solo founder, consider building a strong leadership team before seeking institutional funding.

- Clear financials and unit economics: Know your customer acquisition cost, lifetime value, burn rate, and runway. Even pre-revenue, you should have projections based on realistic assumptions. Investors will scrutinize these numbers closely during the due diligence process.

- Market size that justifies the risk: To generate venture-level returns, your startup needs to target a large and growing market. Even capturing a small share of a big market should create meaningful value.

- A scalable business model: Your revenue should be able to grow faster than your costs. Software and technology models often fit well, while service-heavy businesses that scale linearly are less attractive to VCs.

If you’re not there yet, focus on strengthening your team, building traction, and proving your model works. That way, when you do reach out, the conversation shifts from convincing investors to take a chance to showing them why they can’t afford to miss out.

Now that you know your readiness, the next step is to identify which type of funding aligns with your startup’s stage and growth ambitions.

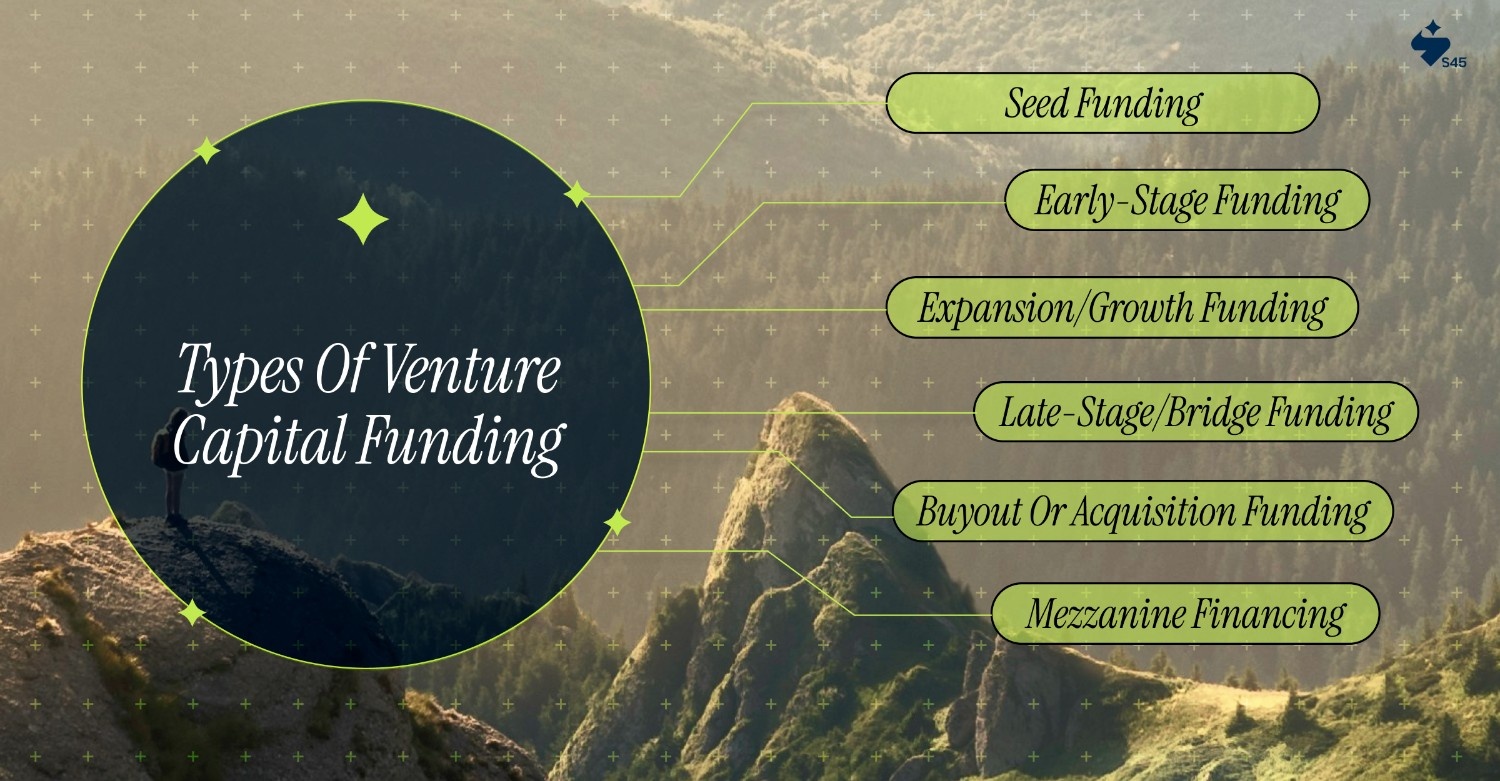

Types of Venture Capital Funding

Venture capital funding is structured around the stage of a startup’s growth. Each type serves a specific purpose and is designed to help businesses scale, refine operations, or prepare for large-scale expansion. Understanding these types helps founders target the right investors and set expectations for funding and growth.

Seed Funding

Seed funding is the first external capital a startup raises to turn an idea into a tangible product or prototype. This stage focuses on validating your concept and testing the market to determine its viability. Investors focus on your founding team, the uniqueness of the idea, and early traction, such as prototypes, pilot users, or market research.

Used for:

- Building a working prototype or MVP.

- Conducting early customer tests or pilots.

- Hiring essential early team members.

- Validating product-market fit.

Early-Stage Funding (Series A)

Series A funding supports startups with a working product and some initial traction. The goal is to refine the business model, formalize operations, and prepare for broader market entry. Investors look for scalable growth, product-market fit, and a capable team.

Used for:

- Expanding the team to cover key functions.

- Launching targeted marketing campaigns.

- Strengthening operational processes and tools.

- Increasing customer acquisition and retention efforts.

Expansion/Growth Funding (Series B & C)

Growth capital helps startups with proven revenue and a validated business model scale operations. Investors focus on efficiency, sustainable growth, and strong unit economics.

Used for:

- Scaling sales and distribution channels.

- Entering new regional or international markets.

- Upgrading technology or infrastructure for efficiency.

- Building partnerships or strategic alliances.

Late-Stage/Bridge Funding (Series D+)

Late-stage funding targets mature startups preparing for major growth, acquisitions, or IPOs. Investors prioritize governance, strategic readiness, and long-term sustainability.

Used for:

- Expanding operations into new verticals or markets.

- Supporting mergers, acquisitions, or product line expansion.

- Strengthening corporate governance and reporting structures.

- Preparing the company for IPO readiness or exit.

Buyout or Acquisition Funding

Buyout funding is used when a startup is acquired or restructured. Investors often take active operational and strategic roles to improve performance.

Used for:

- Streamlining operations and integrating teams.

- Consolidating market position or expanding reach.

- Optimizing financial and operational performance.

- Implementing strategic growth initiatives under new ownership.

Mezzanine Financing

Mezzanine financing combines debt and equity, typically used before IPOs or exits. Investors may convert debt to equity based on performance targets.

Used for:

- Funding large-scale expansion without immediate equity dilution.

- Bridging capital needs between late-stage growth and exit.

- Maintaining momentum during pre-IPO or acquisition preparation.

- Reducing financial risk while meeting growth objectives.

Knowing the funding stage can only help you plan effectively, but securing capital requires following a structured process that guides you from preparation to closing the deal.

How to Apply for Venture Capital: Step by Step

Securing venture capital follows a structured process. While each investor relationship is unique, these steps provide a reliable framework for managing them.

Step 1: Calculate Your Business Valuation

Your startup’s valuation determines how much equity you offer for the capital you raise. For revenue-generating businesses, start with annual recurring revenue and apply industry-standard multiples. SaaS companies typically trade at 5–15 times revenue, depending on growth and margins.

- For pre-revenue startups, valuation depends on the strength of your team, market size, early traction, and competitive positioning.

- Research comparable companies in your sector that recently raised funding to benchmark your valuation.

- Consider working with a financial advisor familiar with startup valuations in your industry.

- Ensure your valuation method aligns with local regulations (Companies Act, SEBI rules, RBI, FEMA) and any cross-border or sector-specific guidelines.

Step 2: Determine Your Funding Target

Calculate how much capital you need and what you'll do with it. Most founders start with runway needs: the monthly burn rate multiplied by the number of months before they need to raise again.

Create multiple scenarios:

- Minimum: What you need to hit key milestones

- Ideal: Your target amount

- Extended: What you'd do with more capital if investors offer it

Each scenario needs a clear plan for deploying funds across hiring, product development, marketing, and operations.

Be realistic about dilution. If raising your target requires giving up more than 20-25% at this stage, reconsider timing or adjust valuation expectations.

Step 3: Build Your Target Investor List

Not all VCs are right for your business. Research firms that invest in your industry, stage, and geography.

Review their portfolio companies to understand their investment thesis and the founders they support.

Prioritize investors who've written checks at your stage and in your sector recently. A VC that hasn't done a seed deal in two years won't start with you.

If they've never invested in B2B SaaS and that's your model, you're probably not a fit.

Create a tiered list:

- Tier 1: Dream investors who are perfect fits.

- Tier 2: Solid options who might be interested.

- Tier 3: Your backup list.

Start with tier one, but don't burn through them too quickly. Learn from early conversations and refine your pitch before approaching top choices.

Step 4: Prepare Your Executive Summary and Business Plan

Your executive summary is typically 1–2 pages and introduces your startup to investors. Make every word count.

- Include: Company overview, problem, solution, market opportunity, business model, traction, team credentials, and funding ask.

- Business plan: Detailed financials (historical and projected), competitive analysis, go-to-market strategy, product roadmap, and risk factors.

Ensure all numbers are consistent, defensible, and comply with sector-specific reporting standards. Investors will cross-check projections against industry benchmarks.

Step 5: Create a Compelling Pitch Deck

Your pitch deck is the primary tool for capturing investor interest. Aim for 10–15 slides that tell a clear, engaging story.

- Cover problem, solution, market opportunity, product, business model, traction, competition, team, financials, and funding ask.

- Use visuals, such as charts, graphs, and screenshots, to make data more digestible.

- Maintain large font sizes and sufficient white space so each slide communicates a single core idea.

- Prepare two versions: one for live presentations and a self-explanatory version for email distribution.

Step 6: Secure Warm Introductions

Cold emails rarely succeed. Investors prioritize deals from trusted referrals.

- Leverage mutual connections through advisors, other founders, lawyers, or accountants.

- Participate in demo days, pitch competitions, or accelerator programs to connect directly with investors.

- Make introductions easy by providing a concise, forwardable email that clearly explains your business and why it aligns with the investor's interests.

Step 7: Navigate Initial Meetings and Due Diligence

The first meetings are about generating interest, not closing the deal. Investors will probe areas of concern or curiosity.

- Present your pitch deck, but be ready to answer unexpected questions.

- Listen carefully to investor questions, as they reveal priorities and areas needing strengthening.

- Prepare a data room with organized documents, including financial statements, contracts, employment agreements, cap table, and incorporation papers.

- Stay responsive and transparent during due diligence, which can take weeks or months.

Step 8: Review Term Sheets and Close the Deal

Term sheets outline the investment terms and set the framework for the final agreement.

- Review valuation, equity, board composition, voting rights, liquidation preferences, anti-dilution provisions, and vesting schedules.

- Negotiate terms thoughtfully and utilize leverage if multiple offers are available.

- Hire a lawyer experienced in startup financing to review all documents.

- Once agreed upon, legal teams draft the final contracts, and funds are typically wired within days after signing.

Once you’ve completed these steps, programs like S45 Club can offer a founder-first approach, providing resources, operational guidance, and connections to support your venture capital journey.

Pros and Cons of Venture Capital

Venture capital can accelerate growth trajectories, but it's not the right fit for every business model. Evaluating both advantages and disadvantages can help you make informed decisions about pursuing this funding path.

Pros

- Access to significant capital: VC funding provides more capital than personal networks or traditional loans, allowing faster hiring, product development, and market expansion.

- No repayment obligation: You don’t owe the funds back if the business underperforms, reducing financial stress and letting you focus on growth.

- Strategic guidance and mentorship: Experienced investors provide operational insights, help you avoid common pitfalls, and act as valuable thought partners.

- Network access: VCs connect you to potential customers, partners, talent, and future investors, often accelerating growth as much as the funding itself.

- Market validation: Backing from reputable investors signals credibility to customers, employees, and other stakeholders, reinforcing confidence in your business.

Cons

- Equity dilution: You give up a portion of ownership, which can add up over multiple rounds, reducing your stake in the company you built.

- Loss of control: Investors may hold board seats and voting rights, which can influence key decisions such as hiring, budgeting, or strategic pivots.

- Pressure to grow fast: VC timelines create pressure to prioritize rapid growth over sustainable development, which can misalign with your long-term vision.

- Potential misaligned incentives: Investors may target earlier exits or aggressive growth strategies that differ from your preferred pace or business plan.

- Time-intensive fundraising: Securing capital can take months, diverting focus from product development and customer engagement.

Deciding whether venture capital is right for your startup depends on your growth goals, capital needs, and comfort with trade-offs. For businesses that need rapid scale and are open to sharing control, VC funding can be a powerful accelerator. If maintaining autonomy or growing profitably without external capital is your top priority, then consider alternative funding paths.

Build a Funding-Ready Business Framework with S45 Club

Securing venture capital requires more than a compelling pitch. It demands operational discipline, governance structures, and strategic planning. Many founders know what investors want, but fewer understand how to demonstrate readiness for institutional capital. S45 Club can bridge that gap by providing guidance and infrastructure to help growth-stage startups access funding while maintaining control and long-term value.

Here’s how S45 Club helps founders navigate the process:

- Timing your funding: Assessing your growth stage to determine the right moment for raising capital, pursuing secondary exits, or joining pre-IPO opportunities.

- Investor-ready due diligence: Reviewing valuation drivers, cap table structure, and governance gaps to ensure your business is always ready to present to investors.

- Access to quality deal flow: Connecting founders to late-stage pre-IPO deals and opportunities usually reserved for insider networks.

- Strategic equity guidance: Advising on ESOP liquidity, partial exits, and long-term capital planning beyond a single funding round.

- Governance and operational frameworks: Setting up board structures, reporting routines, and decision-making systems that align with investor expectations and reduce friction during funding rounds.

With these structures in place, founders can approach investors with confidence, scale their business efficiently, and maintain control over their company’s future. Join the S45 club today and take the first step towards building a strong, investor-ready framework and accessing smart funding strategies.