What You Need to Know

- You're not alone in the funding struggle: 5.7 crore MSMEs face a ₹30 lakh crore credit gap, with only 16% of formal credit reaching micro enterprises.

- Crowdfunding isn't just about raising money, it's a strategic tool for market validation, community building, and preparing for institutional investment.

- Choose platforms based on your business model. Equity platforms like Pepcorns for tech MSMEs, debt options like Recur Club for revenue-generating businesses, and reward-based platforms for product launches.

- Integration is key: Crowdfunding works best when combined with traditional financing to create a balanced capital structure.

- Bottom line: The right crowdfunding platform depends less on features and more on where you are in your business journey and where you want to go.

You've built something real. Your manufacturing unit is running, your service business has consistent clients, or your D2C brand is gaining traction. Revenue is flowing, but growth capital? That's the bottleneck.

Banks want collateral you don't have. VCs want hockey-stick growth you can't promise. Angel investors want equity you're not ready to give up. You're stuck in the classic MSME funding gap, too established for family loans, too "small" for traditional institutional money. In India, there’s a ₹30 lakh crore credit gap, with only 16% of credit going to micro enterprises that make up over 95% of MSMEs.

This is where crowdfunding comes in. However, picking the wrong crowdfunding platform isn’t just a failed campaign; it can damage your brand and set unrealistic investor expectations.

This blog isn’t a generic list of platforms. It’s a strategy to find crowdfunding partners who align with your vision for sustainable growth, not short-term money.

The Four Funding Models Every MSME Founder Gets Wrong And How to Get Them Right

Not all crowdfunding is created equal, and certainly not all of it suits MSMEs at different stages. Here's how to think about the four primary models:

Equity Crowdfunding: When It Works (And When It Doesn’t)

Equity crowdfunding involves selling stakes in your business to multiple small investors. It’s ideal for tech-enabled MSMEs like SaaS, D2C brands, or innovative manufacturers planning to scale.

- The catch: Complex cap tables, compliance burdens, and managing shareholder expectations.

- Best for: MSMEs with ₹5-25 crore revenue and a clear growth path.

- Not for: Family businesses or traditional manufacturers where ownership matters for operations.

Debt Crowdfunding: For Revenue-Generating MSMEs

Debt crowdfunding (P2P lending) lets you raise capital without giving up equity. It’s perfect for businesses with predictable cash flow, doing ₹2-50 crores annually.

- The advantage: You keep ownership and maintain a clean cap table.

- The catch: Monthly repayments require financial discipline but prepare you for future institutional funding.

- Not for: This isn't for pre-revenue startups.

Reward-Based Crowdfunding: Market Validation in Disguise

Ideal for new product lines or market expansion, reward-based crowdfunding offers capital while providing direct market feedback.

- The insight: Backers are customers revealing what they value. The comments, questions, and pledge patterns reveal market psychology.

- The challenge: Managing logistics and timelines. Delays hurt your brand.

- Best for: Product businesses testing market fit, manufacturers launching consumer-facing lines, service businesses productizing their offerings.

Donation-Based Crowdfunding: When Impact Drives Your Growth

For MSMEs with a strong social impact angle, donation-based crowdfunding taps into CSR budgets and impact-focused donors.

The play: Build a community around your mission.

The limitation: It’s not suitable for purely commercial growth needs.

At S45, we see MSME founders treating crowdfunding as a transaction when it should be a strategic milestone. Your choice of platform, terms, and the community you build during crowdfunding will shape your next five years of growth.

Next, we’ll explore the specific platforms where India’s serious MSME founders are raising capital.

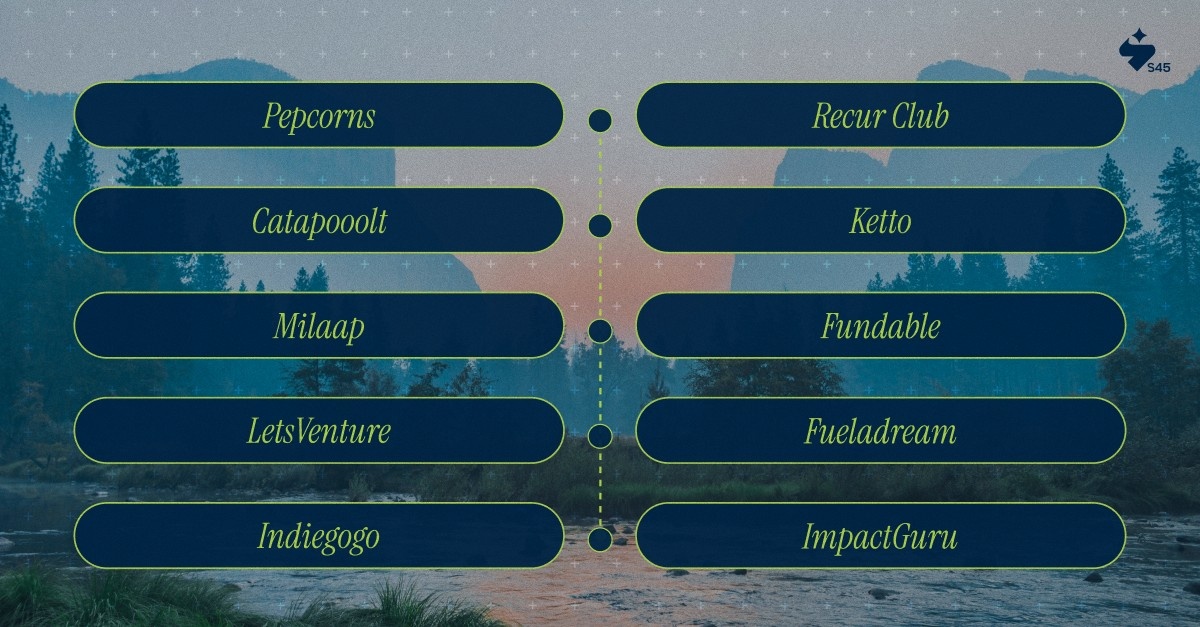

The Top 10 Crowdfunding Platforms for MSME Founders: Strategic Evaluation

Instead of listing every crowdfunding platform in India, let’s focus on the ones that are genuinely deploying capital to businesses like yours, no fluff, just real opportunities. Here’s a breakdown of the top platforms, organized by strategic fit:

1. Pepcorns

Pepcorns is an SEBI-compliant equity crowdfunding platform tailored for businesses looking to scale up with institutional-grade processes.

- Funding Model: Equity Crowdfunding

- Best For: Tech-enabled MSMEs, D2C brands with ₹5+ crore revenue

- Funding Range: ₹50 lakh to ₹5 crore

- Platform Fee: 2-5% of funds raised

- Timeline: 45-60 days campaign + 30-45 days fund disbursement

- Minimum Investment: ₹10,000

- Why it matters: SEBI-compliant platform ensures institutional-grade processes. Ideal for businesses eyeing VCs or PE firms.

- The Catch: Requires solid traction and financial transparency. Expect preparation time of 8-12 weeks before going live.

- Best For: Scalable businesses building credibility for larger funding rounds.

- Avoid: Traditional family businesses or inconsistent revenue models.

2. Recur Club

Recur Club provides debt financing for revenue-generating businesses with predictable, recurring income streams.

- Funding Model: Debt/Revenue-Based Financing

- Best For: SaaS, D2C subscription businesses, revenue-generating MSMEs

- Funding Range: ₹40 lakh to ₹100 crore

- Platform Fee: Interest-based (12-18% APR)

- Timeline: 48-hour funding after approval

- Eligibility: ₹5 crore+ annual revenue, predictable cash flows

- Why it works: No equity dilution—just straight debt financing based on predictable revenue streams.

- The Discipline: Repayment scales with growth, making it flexible.

- Best For: Profitable, subscription-based businesses that want to maintain control.

- Avoid: Pre-revenue or highly seasonal businesses.

3. Catapooolt

Catapooolt offers a hybrid funding model to help businesses validate market demand before committing to equity dilution.

- Funding Model: Reward-Based + Equity Crowdfunding (Hybrid)

- Best For: Consumer product businesses, creative ventures

- Funding Range: ₹5 lakh to ₹5 crore

- Platform Fee: 5-7% (rewards); 3-5% (equity)

- Timeline: 30-45 days campaign

- Flexibility: Start with rewards, switch to equity based on market interest.

- The Execution Challenge: Ensure fulfillment infrastructure for rewards campaigns.

- Best For: Businesses looking to test market demand before scaling production.

- Avoid: Pure B2B businesses or service-focused companies.

4. Ketto

Ketto is a donation-based crowdfunding platform focused on supporting MSMEs with a social impact angle.

- Funding Model: Donation-Based Crowdfunding

- Best For: Social enterprises, CSR-driven MSMEs

- Funding Range: ₹1 lakh to ₹50 lakh

- Platform Fee: 0% fee (donor pays optional fee)

- Timeline: 30-90 days

- Why it works: Perfect for businesses with social impact goals—helps build a community of advocates.

- Best For: MSMEs with a compelling social narrative.

- Avoid: Profit-only businesses or those without a genuine impact focus.

5. Milaap

Milaap offers donation-based crowdfunding to MSMEs with a strong regional or community focus.

- Funding Model: Donation-Based Crowdfunding

- Best For: Regional MSMEs, tier 2-3 city businesses

- Funding Range: ₹50,000 to ₹30 lakh

- Platform Fee: 0% fee, 2% processing fee

- Timeline: Flexible, until funding goal is achieved

- Why it matters: Strong community focus, especially for businesses serving local or regional needs.

- Strategic Advantage: Authentic connections with local audiences.

- Best For: Regional manufacturers or businesses addressing local issues.

- Avoid: Metro-focused or export-oriented businesses.

6. Fundable

Fundable offers equity and reward-based crowdfunding for MSMEs seeking international exposure and US-based investment.

- Funding Model: Equity + Reward-Based Crowdfunding

- Best For: MSMEs with US expansion or global plans

- Funding Range: $50,000 to $500,000

- Platform Fee: ₹15,000/month subscription

- Timeline: 60-90 days campaign

- Why it works: Gives access to US-based investors and international growth opportunities.

- Best For: MSMEs with proven India traction, ready to scale globally.

- Avoid: India-only businesses or early-stage ventures without international plans.

7. LetsVenture

LetsVenture connects early-stage MSMEs with a large network of angel investors and syndicates for scalable growth.

Funding Model: Equity Crowdfunding (Angel + Syndicate)

- Best For: Innovation-driven MSMEs, IP-rich manufacturers

- Funding Range: ₹25 lakh to ₹10 crore

- Platform Fee: 2-3% of funds raised

- Timeline: 45-90 days from listing to closure

- Why it works: Connects you with angel investors who could be long-term partners.

- Best For: Established businesses innovating or entering new spaces.

- Avoid: Businesses without an innovation angle or those seeking pure growth capital.

8. Fueladream

Fueladream specializes in helping businesses with design-driven products and creative ventures test market demand before full-scale production.

- Funding Model: Reward-Based Crowdfunding

- Best For: Design-driven products, creative ventures

- Funding Range: ₹2 lakh to ₹50 lakh

- Platform Fee: 5% fee + 3% processing

- Timeline: 30-60 days campaign

- Why it works: Excellent for testing product ideas and pre-order sales.

- Best For: Product-based businesses in design, lifestyle, or creative industries.

- Avoid: B2B products or complex enterprise solutions.

9. Indiegogo

Indiegogo offers a global platform for MSMEs with international ambitions, helping validate demand across borders.

- Funding Model: Reward-Based Crowdfunding

- Best For: Products with global appeal, NRI-targeted businesses

- Funding Range: $5,000 to $1M+

- Platform Fee: 5% + 3-5% processing

- Timeline: 30-60 days

- Global Reach: 235 countries, 10M+ backers

- Why it matters: Perfect for businesses with export potential and international appeal.

- Best For: MSMEs looking to expand into international markets.

- Avoid: India-specific solutions or businesses without global shipping capabilities.

10. ImpactGuru

ImpactGuru helps MSMEs with a social impact focus raise funds through donation-based crowdfunding, integrating with CSR initiatives.

- Funding Model: Donation-Based Crowdfunding

- Best For: Health-tech, education, and impact-driven service companies

- Funding Range: ₹5 lakh to ₹1 crore

- Platform Fee: 0% for most campaigns

- Timeline: Flexible, typically 60-90 days

- CSR Network: Direct partnerships with 100+ corporations

- Why it works: Leverages CSR connections for funding and future business partnerships.

- Impact Tools: Built-in tools for tracking and reporting social impact.

- International Payment: NRI funding for India-specific causes, especially in healthcare and education.

- The Catch: Requires a clear social impact thesis and transparent reporting.

- Best For: MSMEs with measurable social impact and a commitment to CSR.

- Avoid: Businesses without social impact or those unable to commit to reporting.

These platforms cater to a variety of business needs, whether you’re looking for equity, debt, or reward-based funding. Tailor your choice based on your growth stage, revenue model, and long-term vision. Read on to know how to do that.

Also Read: Top 8 Government Grants for Startups in India 2025

Which Platform Matches Your Business Stage?

The platform isn't the decision—it's the reflection of a decision you need to make about your business trajectory.

- If you're prioritizing ownership and control → Debt platforms (Recur Club) or reward-based (Catapooolt, Fueladream)

- If you're building for institutional investment → Equity platforms with SEBI compliance (Pepcorns, LetsVenture)

- If you're validating a new market or product → Reward-based with strong communities (Catapooolt, Indiegogo)

- If impact is core to your business model → Donation/impact platforms (Ketto, Milaap, ImpactGuru)

- If you're export-focused or targeting global markets → International platforms (Fundable, Indiegogo)

At S45, we've watched founders succeed and stumble through crowdfunding campaigns. The pattern is clear: Success correlates less with platform features and more with strategic clarity. Founders who know exactly why they're choosing equity over debt, or rewards over donations, execute better campaigns and build stronger stakeholder relationships.

Your Next Move: From Information to Action

You now understand the platforms, funding models, and strategic considerations. But knowledge without action is just procrastination.

- If You're in the Consideration Phase: Map your business goals for the next 24 months against this framework. Which funding model aligns with those goals? Which platforms are right for your business stage and sector?

- If You're Ready to Launch: Start with your story, not the platform. Why does your business deserve stakeholder capital? What are you building that’s worth others' time and money? Once you have the answers, the platform is just a distribution channel.

If you’re between these two, this is where partnership matters. At S45, we help MSME founders navigate crowdfunding and capital strategy, from your first raise to institutional funding and integrating capital with operations.

We don’t just fund businesses; we help founders build enduring, scalable companies. If that’s your vision, let’s talk about how crowdfunding fits into your plan.

Partner with S45 for capital guidance, expertise, and the support to turn your business into a category leader. Because the right funding isn’t just about money—it’s about building something that truly matters.