Key Takeaways

- Carried interest gives PE partners ~20% of profits only after beating an 8–12% hurdle, ensuring true performance-linked alignment.

- Waterfall structures protect founders by returning capital and hurdle payouts before any carry is distributed, supported by safeguards like clawback and high-water marks.

- India’s 2025 reforms make carried interest capital gains–friendly, resolve GST issues, and enforce SEBI-driven transparency, great news for MSME founders.

- Red flags to watch: carry above 25%, hurdle below 6%, missing clawbacks, or unclear waterfall terms. Always request detailed distribution models.

- S45 offers transparent, founder-first carry structures with long-term growth alignment plus operational and community support for MSMEs.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

If you're an MSME founder exploring private equity funding, you've probably heard the term "carried interest" thrown around in investor meetings. It sounds technical, maybe even intimidating. And if you nodded along without fully grasping what it means for your business, you're not alone.

Many MSME founders sign term sheets without realising how this clause drives investor behaviour. When structured well, it pushes your PE partner to focus on long-term value instead of a quick flip. This guide breaks it down in simple terms, highlights what really impacts your outcome, and shows you the red flags that matter before you close the deal.

This blog breaks down carried interest in plain language, shows you what to negotiate, and helps you spot red flags before signing anything.

What is Carried Interest?

Carried interest is the profit share your PE partner earns when they generate real value, not a fixed fee. They usually receive 20 percent of profits only after beating the 8 to 12 percent hurdle rate.

Their salary comes from the annual 2 percent management fee, but carried interest is their true upside. This structure pushes them to focus on the long-term outcome

Here's the distinction that matters:

- Management Fee: Fixed compensation paid annually, usually 2% of committed capital. Your PE partner gets this regardless of performance.

- Carried Interest: Variable profit share, typically 20%, earned only after crossing the hurdle rate. This is where the real money is for them.

Your PE partner takes on risk by investing time, expertise, and capital into your business. They only earn substantial returns when they successfully navigate market challenges and help you grow.

Key numbers every founder should know:

- Industry standard carried interest: 20% of profits above hurdle rate

- Typical hurdle rate in India: 8% to 12% annual returns

- Average PE holding period: 4 to 7 years before exit

- AIF structure adoption: Over 90% of Indian Alternative Investment Funds use this standard model

Now that you understand what carried interest is, let's look at exactly how your PE partner earns it and what the money flow looks like when your business hits an exit.

How Your PE Partner Earns Carried Interest

Understanding the concept is one thing. Seeing the actual money flow is another. Let's walk through a realistic MSME scenario, so you know exactly where every rupee goes when your business exits.

The Players in Your PE Deal

Before we dive into the numbers, you need to know who sits on which side of the table.

- You and co-investors (Limited Partners): Provide the capital and hold the majority stake

- PE Firm (General Partner): Manages the fund, makes strategic decisions, drives growth initiatives

- The Structure: In India, most PE investments flow through Alternative Investment Funds regulated by SEBI

These roles matter because the waterfall distribution follows a strict hierarchy based on who you are in this structure.

The Waterfall Distribution Explained

Imagine your manufacturing business raises ₹20 crores from a PE fund. The terms include a 12% hurdle rate and 20% carried interest. Five years later, you successfully exit by selling to a strategic buyer for ₹40 crores.

Here's how the ₹40 crores gets distributed:

- Step 1: Return of Capital Investors get their original ₹20 crores back first. No exceptions. Remaining amount: ₹20 crores.

- Step 2: Hurdle Rate Payment Investors receive their 12% annual return, which compounds to approximately ₹12.5 crores over five years. Remaining amount: ₹7.5 crores.

- Step 3: Carried Interest The PE firm earns 20% of the remaining ₹7.5 crores, which equals ₹1.5 crores. Remaining amount: ₹6 crores.

- Step 4: Final Distribution You and other investors split the remaining ₹6 crores based on ownership percentages.

This waterfall structure isn't arbitrary. Each step protects your downside while motivating your PE partner's upside. But the protection goes even deeper with specific contractual clauses.

Key Terms That Protect Your Interests

These four provisions ensure the waterfall actually works the way it's supposed to, even when things get complicated:

- Hurdle Rate: The minimum return threshold before carry activates. Think of it as your safety net. If the PE partner delivers only 10% returns when the hurdle is 12%, they get zero carried interest.

- Clawback Provision: If early investments perform well but later ones tank, the PE firm must return previously received carry. This prevents them from cashing out early and losing motivation.

- High Water Mark: Ensures you never pay carry twice on the same gains. If your business value drops and then recovers, carry is calculated only on new highs.

- Catch-up Clause: After the hurdle is met, the PE firm receives 100% of the next profits until its total carry reaches the agreed 20%. This accelerates their compensation once minimum returns are delivered.

These aren't just legal terms buried in contracts. They're built-in mechanisms that keep your PE partner accountable throughout the entire investment period. A well-structured carried interest agreement means your partner can't game the system or walk away after early wins.

At S45, we structure carry terms that align with sustainable growth timelines, not just exit pressures. Our partnerships include transparent waterfall provisions from day one, so founders know exactly how value gets distributed before signing.

The waterfall distribution shows you the mechanics, but here's what really matters: how does this structure actually benefit you as a founder?

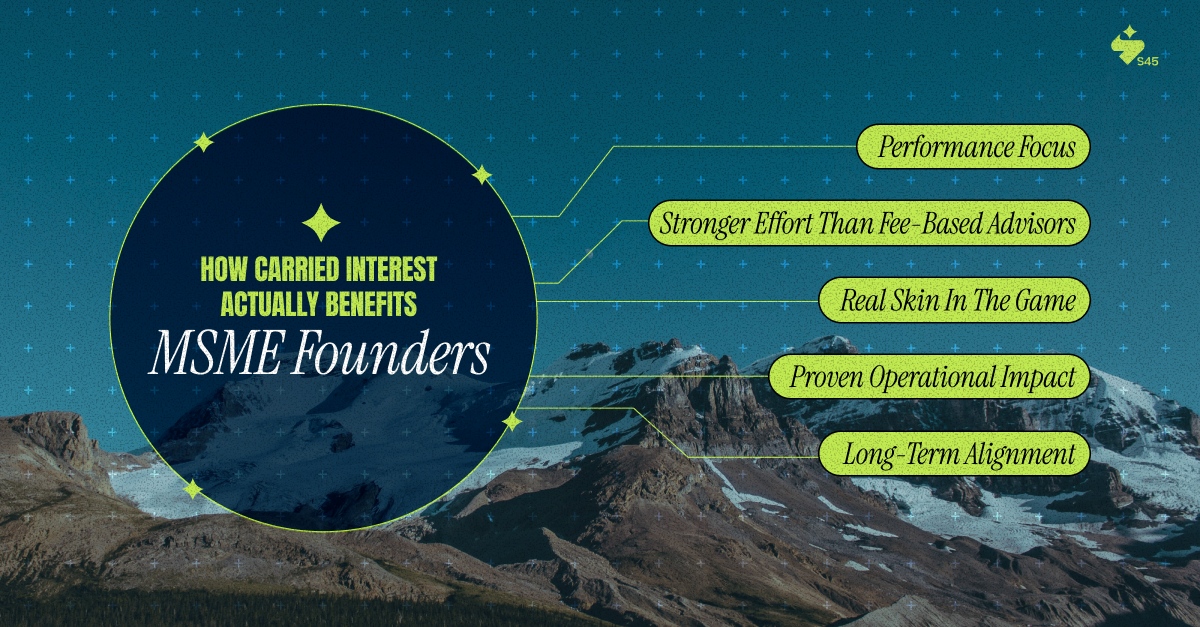

How Carried Interest Actually Benefits MSME Founders

Most founders see carried interest as something their PE partner earns. That's technically true, but it misses the bigger picture. The real question is what you get in return for structuring compensation this way.

- Performance Focus: Your PE partner earns meaningful money only when returns beat the 8 to 12 percent hurdle rate. The 2 percent fee is minor, so they concentrate on real growth that unlocks their 20 percent carry.

- Stronger Effort Than Fee-Based Advisors: Consultants get paid even when nothing changes. Carry pushes your partner to work harder because their upside depends entirely on improving your valuation.

- Real Skin in the Game: SEBI mandates a 2.5 to 5 percent sponsor commitment, so your partner invests personal capital. When they have crores at stake, they avoid risky shortcuts and stay accountable.

- Proven Operational Impact: About 70 percent of successful PE exits in India involve hands-on operational support. This happens only when incentives are aligned through carry rather than fixed fees.

- Long-Term Alignment: Carry typically vests over 4 to 7 years, which keeps your partner committed through market cycles. This supports founders who want stable systems, strong teams, and sustainable growth.

The carried interest model has worked for centuries because it solves a fundamental problem in partnerships: how do you ensure advisors care as much about your success as you do? The answer is simple. Tie their wealth to your outcomes, not their effort or time spent.

But understanding the benefits is only half the picture. India's regulatory environment has evolved significantly, especially with recent changes that directly impact how carried interest works for MSME founders.

Carried Interest in India: What the 2025 Regulatory Changes Mean for You

If you've been researching PE funding over the past few years, you've probably encountered confusion around how carried interest gets taxed in India. The good news is that 2025 brought much-needed clarity.

Current Tax Treatment Simplified

The Finance Bill 2025 made a decisive call. Carried interest is now officially treated as capital gains, not business income. This wasn't just semantic clarification. It resolved years of debate between tax authorities and the PE industry about whether carry should be taxed like salary or investment returns.

What this means in practical terms:

- PE partners pay lower tax rates on carried interest compared to ordinary income taxation

- This makes India more competitive for attracting quality fund managers compared to markets where carry faces higher tax burdens.

- For you as a founder, this creates a more vibrant PE ecosystem with experienced partners willing to set up shop in India rather than operating from Singapore or Mauritius

Why does their tax rate matter to you? Simple. When quality PE firms find India tax-efficient, you get access to better partners with deeper expertise.

GST Controversy Resolved

Here's where things got messy before 2024. Tax authorities argued that carried interest was essentially a service fee, which meant it should attract 18% GST on top of income tax. If that had stuck, the combined tax burden would have exceeded 40%, making India one of the least attractive PE markets globally.

The Supreme Court stepped in and upheld a Karnataka High Court ruling with a critical distinction. Since most AIFs operate as trusts, and trusts aren't considered separate taxable persons for service provision to themselves, GST doesn't apply to carried interest distributions.

The founder benefit here is direct:

- Lower overall fund costs mean more capital actually flows into your business instead of tax payments

- PE firms can offer more competitive terms when their effective costs decrease

- The regulatory certainty removes a major hesitation point for international PE players eyeing Indian MSMEs

This wasn't a minor technical fix. It fundamentally changed the economics of running PE funds in India, making the entire ecosystem more founder-friendly.

SEBI's Founder-Friendly Regulations

While tax clarity grabbed headlines, SEBI's ongoing regulatory framework deserves equal attention. These rules create transparency that protects you during negotiations:

- Mandatory PPM disclosure: Every Private Placement Memorandum must clearly detail all fee structures, including management fees, carried interest percentages, hurdle rates, and distribution waterfalls. You can't sign something and discover hidden terms later.

- Continuing interest requirements: PE sponsors must maintain their 2.5% to 5% capital commitment throughout the fund's life. They can't reduce their skin in the game after initial deployment.

- Transparent reporting standards: AIFs must provide regular performance updates and fee breakdowns to all investors, including founders who remain invested post-transaction.

Before any meeting with a PE firm, request their standard PPM template. SEBI requires them to provide this. But even in this improved environment, not all PE deals are created equal. You still need to watch for warning signs in how carried interest gets structured.

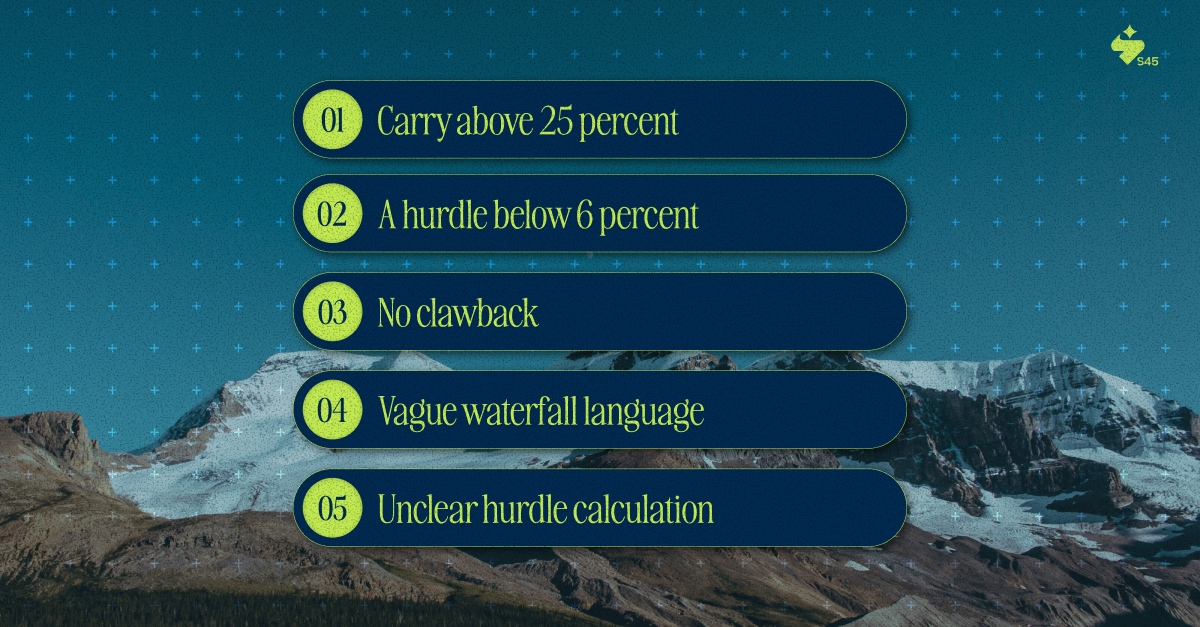

Red Flags and Negotiation Tips: What to Look for in Carried Interest Terms

Carried interest terms look simple, but small tweaks can shift millions. Watch for these issues during early discussions.

- Carry above 25 percent signals aggressive profit taking unless backed by strong sector results. Ask for deals where they earned this premium.

- A hurdle below 6 percent means you pay carry for average performance. Push for the standard 8 to 12 percent range.

- No clawback lets partners keep early carry even if later deals underperform. Ask for clauses that apply across the full fund life.

- Vague waterfall language creates disputes at exit. Request a clear waterfall with sample payouts at 1.5x, 2x, and 3x returns.

- Unclear hurdle calculation changes payouts. A 10 percent simple hurdle and a 10 percent compounded hurdle produce very different outcomes.

Understanding what to avoid is critical, but the real goal isn't just preventing bad deals. It's structuring partnerships where carried interest actually supports your vision for building a lasting business, not pressuring you into premature exits. At S45, we help founders catch these gaps early and negotiate terms that protect long-term value.

Conclusion

Carried interest isn't just a fee structure. It's the alignment mechanism that determines whether your PE partner wakes up thinking about your long-term success or their short-term exit.

The standard 20% carry with an 8-12% hurdle exists because it balances motivation with fairness. SEBI's regulations and 2025 tax clarity have made India's PE landscape more transparent than ever.

But transparency only helps if you know what you're looking at. Understanding waterfall distributions, clawback provisions, and red flags gives you the negotiation power to choose partners who genuinely walk beside you, not above you.

At S45, we help MSME founders navigate PE partnerships that align with their growth and legacy goals. Our approach goes beyond capital. We provide:

- Transparent carry structures designed for sustainable growth timelines

- Operational expertise to complement financial support

- Community access to fellow founders navigating similar journeys

- Long-term partnership focused on building, not just exiting

The right PE partner with clear carry terms can accelerate your path from MSME to market leader. Connect with our experts to evaluate your PE funding options with confidence and clarity.