Key Takeaways

- Corporate and investment banking serve different growth needs. Corporate banking supports operational stability, while investment banking enables strategic expansion and capital access.

- Corporate banking builds financial discipline. It strengthens liquidity, ensures working capital availability, and supports business continuity, forming the foundation for scale.

- Investment banking fuels transformation. It helps companies raise capital, execute mergers, and prepare for IPOs, turning strong operations into long-term market growth.

- Both are essential at different business stages. Corporate banking sustains; investment banking scales. The right mix depends on your company’s size, structure, and ambition.

- Guidance ensures capital readiness. With expert mentorship and strategic planning, founders can transition smoothly between corporate and investment banking partnerships.

When a business reaches a certain scale, managing capital becomes more than just keeping the books balanced. It’s about finding the right partners who can support your growth, whether through working capital, structured loans, or market access.

That’s where understanding the difference between corporate banking and investment banking becomes crucial. Though they both deal with business finance, their purposes, approaches, and outcomes are very different.

For India’s growth-ready enterprises, knowing how each works helps in choosing the right banking relationship at the right stage of scale. This article explores the two systems, how they function, and what sets them apart in driving sustainable growth for businesses.

What Is Corporate Banking

Corporate banking is the side of banking that focuses on serving businesses, institutions, and large organizations rather than individual consumers. It’s relationship-driven, long-term, and designed to support companies with their day-to-day and strategic financial needs.

Corporate banking refers to a range of banking services offered specifically to corporates, SMEs, and large enterprises. Its goal is to help companies manage liquidity, fund expansion, and maintain financial stability.

In simpler terms, it’s the financial backbone of a business’s operations — helping manage cash flow, credit, and growth financing.

Key Functions of Corporate Banking

Function | Purpose | Example in Practice |

Working Capital Loans | To meet short-term liquidity needs | Financing raw materials or payroll cycles |

Term Loans | For long-term investments | Purchasing new machinery or setting up a new plant |

Trade Finance | To facilitate import/export operations | Issuing letters of credit for overseas suppliers |

Treasury and Cash Management | To manage cash flow efficiently | Optimising collections and vendor payments |

Project Financing | For large-scale business expansion | Funding new factories or infrastructure projects |

Corporate Advisory | To improve financial structuring and planning | Advising on debt consolidation or capital restructuring |

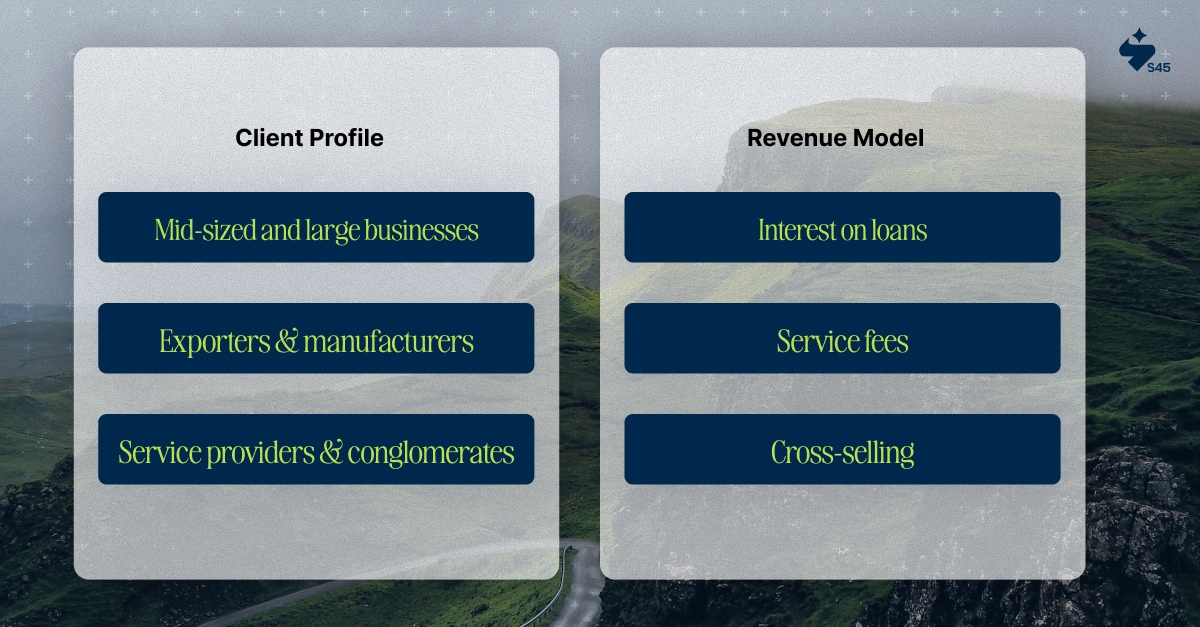

Client Profile

Corporate banks typically serve:

- Mid-sized and large businesses seeking ongoing financial partnerships.

- Exporters and manufacturers are managing complex transactions.

- Service providers and conglomerates with high working capital needs.

These relationships are continuous, built on trust, credit history, and performance, not just transactions.

Revenue Model

Corporate banks earn through:

- Interest on loans

- Service fees for cash management, trade finance, and treasury operations

- Cross-selling of treasury, forex, and structured banking solutions

Unlike retail banking, corporate banking is customized; every client relationship is tailored to their industry and financial rhythm.

Why Corporate Banking Matters

Corporate banking ensures that businesses have consistent access to the resources they need to operate and expand. It provides stability in uncertain times and fuels growth when opportunities arise.

For Indian SMEs scaling beyond ₹100 crore in annual turnover, these services become the financial infrastructure that supports working capital, growth funding, and credit discipline.

At S45 Club, we help founders strengthen governance and financial readiness — ensuring they build the banking relationships that prepare them for the next phase of scale and capital access.

Also Read: Growth Capital vs Venture Capital: Key Differences Explained

What Is Investment Banking

Investment banking is the arm of banking that helps businesses raise capital, manage mergers and acquisitions (M&A), and access capital markets. It focuses on strategy, structure, and scale, guiding companies through major financial milestones rather than everyday banking activities.

Definition

Investment banking provides advisory and execution services for complex financial transactions. This includes helping businesses:

- Raise funds through equity or debt issuance,

- Execute mergers, acquisitions, or divestitures,

- Manage IPOs, private placements, and restructuring.

While corporate banking supports daily financial operations, investment banking helps a business take its next strategic leap, whether that’s expansion, capital access, or transformation.

Key Functions of Investment Banking

Function | Purpose | Example in Practice |

Capital Raising | Helping companies raise funds from investors | Structuring an IPO or private equity round |

Mergers & Acquisitions (M&A) | Advising on buyouts, mergers, or partnerships | Assisting a manufacturing firm in acquiring a regional competitor |

Underwriting | Guaranteeing the sale of securities to investors | Ensuring the successful subscription of a company’s new share issue |

Corporate Advisory | Strategic consulting on valuation, restructuring, and capital structure | Reorganising debt and equity for better financial health |

Research and Market Analysis | Providing insights on markets, valuations, and investor sentiment | Guiding a company’s board on timing its market entry |

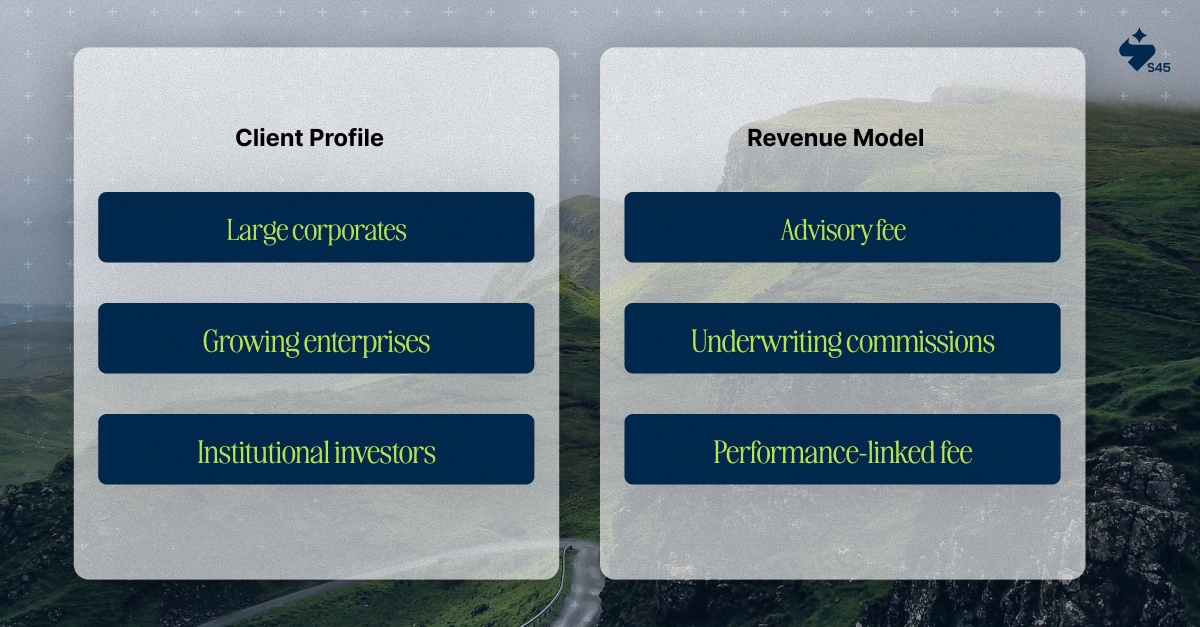

Client Profile

Investment banks usually work with:

- Large corporates looking to raise public or private capital.

- Growing enterprises preparing for an IPO or acquisition.

- Institutional investors seeking structured deals or advisory insights.

Their relationships are project-based, often centred on major transactions with defined timelines and outcomes.

Revenue Model

Investment banks earn through:

- Advisory fees (for M&A, fundraising, or valuation).

- Underwriting commissions (for IPOs and capital issuance).

- Performance-linked fees (success-based compensation for deal closure).

Their income depends on the complexity and success of the deals they manage, making it more variable than corporate banking.

Investment Banking in the Indian Context

India’s evolving economy has made investment banking increasingly important for mid-market enterprises and SMEs. With dedicated SME exchanges and growing investor interest, more businesses are exploring:

- IPO readiness,

- Strategic acquisitions, and

- Private equity partnerships.

Through its Capital Markets Platform and curated mentorship, S45 Club helps founders navigate this space, preparing them for IPOs, pre-IPO opportunities, and strategic capital partnerships that align with their vision.

Also Read: Private vs Public Equity: Key Differences Explained

Key Differences Between Corporate Banking and Investment Banking

Although both corporate banking and investment banking focus on helping businesses manage money, their goals, relationships, and risk profiles are entirely different.

Corporate banking supports day-to-day stability, while investment banking drives transformation and capital expansion.

Understanding this difference helps business leaders decide which partner fits their current stage of growth.

Detailed Comparison

Parameter | Corporate Banking | Investment Banking |

Primary Objective | Supports businesses with financial services for daily operations and long-term stability | Helps companies raise capital, manage mergers, and access capital markets |

Nature of Relationship | Relationship-driven and continuous | Transaction-based and time-bound |

Client Type | SMEs, large corporates, and institutions | Mid- to large-scale enterprises, institutional investors |

Service Focus | Loans, credit lines, trade, and treasury services | IPOs, fundraising, acquisitions, and advisory |

Revenue Model | Interest income and service fees | Advisory and success-based commissions |

Risk Profile | Lower and more predictable | Higher, tied to deal performance and market conditions |

Time Horizon | Ongoing, often multi-year relationships | Short-term, project-specific engagements |

Regulatory Oversight | Supervised by the RBI under traditional banking norms | Regulated by SEBI and other capital-market authorities |

Key Expertise | Credit analysis, relationship management, and liquidity control | Valuation, deal structuring, and capital-market strategy |

Example in Practice | A textile SME secures a ₹50-crore working-capital loan from a corporate bank | The same SME later partners with an investment bank to raise ₹100 crore through an IPO |

Interpreting the Differences

1. Purpose vs Vision

- Corporate banking focuses on sustaining the business.

- Investment banking focuses on scaling it.

- Both are vital, but they come into play at different stages of maturity.

2. Relationship Type

- Corporate banking is like a long-term business partnership.

- Investment banking is more like a strategic project, intense, specific, and outcome-driven.

3. Risk and Reward

- Corporate banks prioritize stable cash flow and credit management.

- Investment banks seek opportunity, higher returns, and higher stakes.

4. Client Journey

- SMEs often begin their journey with corporate banking relationships for liquidity and lending.

- As they grow and professionalize, they engage investment bankers to explore fundraising, acquisitions, or public listing.

At S45 Club, we help founders understand when to make this shift, from corporate-banking partnerships that sustain operations to investment-banking collaborations that unlock growth capital.

This awareness ensures that financial strategy evolves alongside business strategy.

Also Read: Difference Between Angel Investors and Venture Capitalists

The Role of Each in Business and Economic Growth

Both corporate banking and investment banking play critical, interconnected roles in driving India’s economic growth. While they operate differently, together they form the financial backbone that supports businesses from inception to institutional maturity.

Corporate Banking: Sustaining Daily Growth

Corporate banking keeps the economic engine running by ensuring liquidity and operational stability. It supports enterprises through:

- Working capital management: enabling businesses to meet daily cash needs.

- Credit and loan services: funding machinery, expansion, or trade operations.

- Risk management solutions: offering treasury and hedging services.

This layer of banking promotes financial discipline among businesses — particularly SMEs, ensuring that growth is stable and well-governed.

Example: A pharmaceutical company expanding its distribution network relies on corporate banking for credit lines and cash management to manage inventory and payments efficiently.

Investment Banking: Driving Strategic Expansion

Investment banking, in contrast, fuels large-scale growth and transformation. It empowers businesses to move beyond internal funding and tap into structured capital opportunities.

It contributes to economic progress by:

- Connecting enterprises with investors through IPOs and private placements.

- Facilitating mergers and acquisitions that build competitive strength.

- Encouraging innovation and market diversification through fundraising.

This layer of finance promotes institutional maturity, helping mid-sized businesses evolve into nationally and globally recognized organizations.

Example: A technology firm working with an investment bank to raise ₹200 crore for product development and global expansion creates not just shareholder value, but employment, innovation, and market dynamism.

Also Read: How to Achieve Sustainable Business Growth Strategies

Corporate Banking vs Investment Banking vs Corporate Finance

Many professionals use these terms interchangeably, but they represent three distinct functions within the financial ecosystem. Understanding how they differ helps founders align their financial strategies with the right expertise.

1. Corporate Banking: Managing Financial Operations

Corporate banking focuses on serving external clients, helping businesses manage liquidity, trade, and credit needs. It provides structured products like loans, treasury management, and project financing. Think of it as a financial partner that supports business operations.

2. Investment Banking: Enabling Capital and Transactions

Investment banking operates at a strategic and transactional level.It helps companies raise funds, manage deals, and access investors through the capital market. In other words, it helps businesses execute big financial decisions, acquisitions, IPOs, or restructuring.

3. Corporate Finance: Managing Internal Financial Strategy

Corporate finance, unlike the other two, is an internal business function. It involves planning, budgeting, capital structuring, and managing company assets to ensure profitability. This function is handled by a company’s finance team or CFO, not a bank.

Side-by-Side Comparison

Aspect | Corporate Banking | Investment Banking | Corporate Finance |

Definition | Banking services for businesses and institutions | Advisory and fundraising for strategic growth | Internal management of company finances |

Objective | Ensure liquidity and operational stability | Facilitate capital access and market transactions | Optimize capital use and profitability |

Who Performs It | Banks’ corporate divisions | Investment banks and advisory firms | Company’s finance or strategy team |

Time Horizon | Continuous relationship | Deal-specific and project-based | Long-term, strategic |

Focus Area | Loans, treasury, trade finance | IPOs, M&A, underwriting, valuation | Budgeting, planning, and capital allocation |

Revenue/Impact | Interest income and stability | Advisory fees and capital growth | Improved internal efficiency and ROI |

The most resilient businesses combine all three effectively, using corporate banking for liquidity, investment banking for scale, and corporate finance for disciplined internal decision-making.

At S45 Club, we help founders integrate these layers seamlessly, building a financial ecosystem that supports both sustainability and scale.

Conclusion – Knowing the Right Partner for the Right Stage

Every growing business reaches a point where its financial needs evolve. Early on, stability matters most, managing cash flow, securing loans, and maintaining strong banking relationships. As the business matures, the focus shifts to expansion, strategic investment, and institutional visibility.

That’s when the role of investment banking becomes more prominent. It helps translate years of operational strength into structured capital, acquisitions, or even public listings.

Both corporate and investment banking serve vital purposes, but their relevance depends on a company’s stage, goals, and financial discipline.

Stage of Business | Ideal Banking Focus |

Emerging SME (₹50–100 crore) | Corporate banking for working capital, loans, and treasury support |

Growth-Stage Enterprise (₹100–300 crore) | A blend of corporate banking and early investment advisory |

IPO-Ready or Expanding Business (₹300 crore+) | Investment banking for fundraising, mergers, and market access |

At S45 Club, we help founders recognize this transition, from corporate banking partnerships that sustain growth to investment banking collaborations that amplify it.

Through mentorship, structured playbooks, and capital access, we guide entrepreneurs toward sustainable scale, combining stability, governance, and ambition.