Key Takeaways

- Enterprise Value (EV) shows the total firm's worth. EV captures what the entire business is worth, including debt and cash, and reflects the total cost to acquire or evaluate a company.

- Equity Value (EqV) reveals shareholder wealth. It isolates the portion of business value belonging to owners or shareholders, after debts and obligations are deducted.

- The bridge between EV and EqV matters. Understanding how to move from one to the other (via net debt) helps founders interpret valuations accurately during fundraising or buyouts.

- The right metric depends on purpose. Use EV for acquisitions, debt analysis, or performance benchmarking. Use EqV for IPOs, ownership planning, or equity raises.

- Valuation clarity drives investor confidence. At S45, we help founders move from valuation confusion to valuation readiness, turning financial understanding into strategic strength.

Growing a business often involves more than sales and profit; it requires understanding what the business is actually worth. For founders and investors, that means knowing the difference between Enterprise Value (EV) and Equity Value.

In a 2025 report, funds backing mid-market and large firms accounted for over half of total private equity deal value in India. That makes value metrics like EV and Equity Value more important than ever, whether you are raising growth capital, exploring acquisition interest, or preparing for institutional investment.

This article explains what EV and Equity Value mean, how to calculate each, when to use one over the other, and what the numbers reveal about the health and potential of a business.

What is Enterprise Value (EV)

Enterprise Value represents the total value of a company to all providers of capital: debt-holders, shareholders, and others. It reflects what a buyer would pay to acquire the entire business, including its operations, debts, and assets.

In effect, EV shows the value of the business as a whole, independent of how it is financed.

Key Components of Enterprise Value

EV typically includes:

- Market value of equity (for public firms: share price × total shares)

- Total debt (short-term + long-term)

- Preferred equity (if any)

- Minority interests (if applicable)

- Less: cash and cash equivalents (or surplus cash)

This ensures both assets and liabilities, across debt or equity, are considered, providing a full picture of company value.

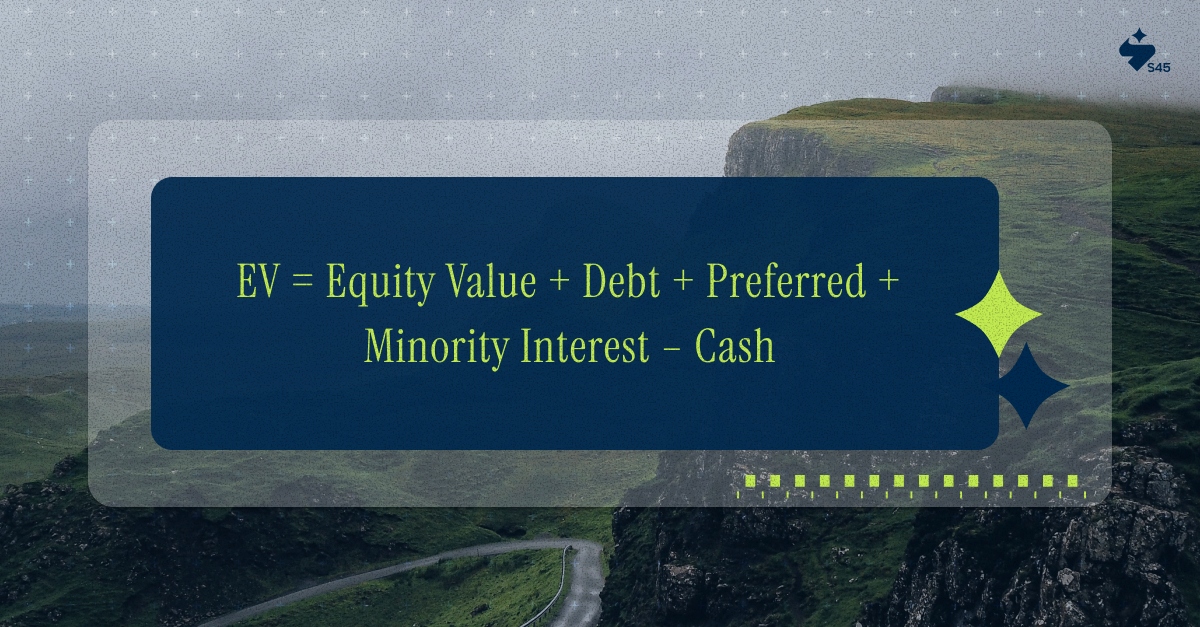

A widely used formula for EV is:

For firms with preferred equity or minority interest, the comprehensive formula expands accordingly:

Why EV Matters: Especially for Growth-Stage Businesses

- Capital-Structure Neutrality: EV gives a valuation that is independent of whether a business is debt-heavy or equity-heavy. This makes it useful to compare different companies, regardless of their financing mix.

- Acquisition and M&A Relevance: Buyers consider the full enterprise cost, debt, and assets when evaluating acquisition targets. EV reflects what it costs to buy the entire business.

- Valuation Consistency: For companies with high debt, simply using equity value can mislead the valuation. EV accounts for liabilities, giving a more balanced view.

For Indian SMEs aiming to scale, EV provides a clear lens to evaluate true business worth beyond just shareholder value. Understanding EV helps founders judge investments, acquisitions, and fundraising with clarity.

Also Read: Understanding Fair Value: Meaning, Formula, and Examples

What is Equity Value

Equity Value represents the portion of a company’s total value attributable to its shareholders. It reflects what the owners of the company (the equity holders) actually own after accounting for debts and other obligations.

In public markets, Equity Value is often referred to as market capitalisation, calculated by multiplying the company’s share price by its total number of outstanding shares.

For private companies, where shares aren’t traded on exchanges, Equity Value is estimated using comparable valuation methods or discounted cash flow (DCF) models.

Core Components of Equity Value

Component | Explanation |

Market Value of Equity | Share price × number of outstanding shares (for listed firms) |

Preferred Shares | Include if they carry ownership claims similar to equity |

Minority Interest | Applicable in consolidated group structures |

Cash Adjustments | Cash may increase Equity Value if considered in excess of operational needs |

Debt Adjustments | Deducted when converting from EV to equity terms |

Formula for Equity Value

The most common relationship between the two is:

Where:

- Net Debt = Total Debt – Cash and Cash Equivalent

A more complete form (used in detailed valuations):

This calculation helps investors or founders determine the true ownership value after accounting for liabilities.

Why Equity Value Matters

- Shareholder Perspective Equity Value represents the wealth of shareholders, the portion that remains after repaying debt and other obligations. For founders, this is their ownership value, the part that grows as the company performs better.

- Fundraising and IPO Readiness: Investors evaluate a company’s potential return based on equity value. Understanding how enterprise value translates into equity value helps founders set realistic expectations during funding rounds or public offerings.

- Benchmarking Ownership Dilution: In private rounds or equity raises, founders must know how the new capital affects total equity value, and what share of the business they continue to own.

At S45, we guide founders to interpret their equity value not as a static number, but as a reflection of governance, growth, and balance sheet health.

Knowing how equity value connects to enterprise value helps entrepreneurs negotiate with confidence, whether they’re raising capital or planning exits.

Also Read: Private vs Public Equity: Key Differences Explained

Key Differences Between Enterprise Value and Equity Value

While both Enterprise Value and Equity Value measure “worth,” they serve different purposes and apply to different stakeholders.

- Enterprise Value gives a complete picture of a company’s total value, including debt, equity, and cash.

- Equity Value focuses on the ownership portion that belongs solely to shareholders.

This distinction is crucial because an increase in Enterprise Value doesn’t always mean an equal rise in Equity Value, especially if debt or other liabilities increase alongside.

Comparative Table: Enterprise Value vs Equity Value

Parameter | Enterprise Value (EV) | Equity Value (EqV) |

Definition | Total value of the business to all capital providers | Value attributable only to shareholders |

Includes Debt? | Yes, adds debt to capture full firm value | No, debt is subtracted to isolate shareholder value |

Includes Cash? | Deducted (reduces EV) | Added back (increases EqV) |

Capital Providers Covered | Debt holders + Equity holders + Preferred/Minority | Equity holders only |

Relevance | Useful for M&A, firm valuation, comparisons | Useful for IPO pricing, fundraising, and share valuations |

Risk Focus | Reflects financial obligations and risk profile | Reflects market perception and ownership worth |

Influenced By | Debt levels, cash reserves, capital structure | Share price, market sentiment, and ownership dilution |

Key Users | Acquirers, financial analysts, and institutional investors | Founders, shareholders, equity investors |

Scope of Valuation

EV answers: “What is the business worth as a whole?”

Equity Value answers: “What portion belongs to the owners?”

For example, if a company’s Enterprise Value is ₹500 crore with ₹100 crore debt and ₹50 crore cash,

Equity Value = 500 – (100 – 50) = ₹450 crore.

Stakeholder Relevance

EV matters most to buyers or investors who want to understand what it costs to acquire the entire business (including debt).

Equity Value matters most to shareholders and founders, who care about their ownership value after debt repayment.

Sensitivity to Debt and Cash

High debt inflates Enterprise Value (since the buyer assumes obligations), but reduces Equity Value.

Similarly, high cash reserves increase Equity Value but lower Enterprise Value.

When Indian SMEs prepare for capital raises or exits, understanding this bridge helps founders interpret investor valuations accurately, avoiding confusion between “what the company is worth” and “what the founders take home.”

Why These Differences Matter in Valuation

- Investors: Use EV to compare across firms with different financing structures.

- Founders: Use EqV to track how much their ownership is truly worth.

- Analysts: Use both — EV for firm metrics (like EV/EBITDA) and EqV for per-share metrics (like P/E ratio).

When used together, EV and Equity Value form the backbone of financial valuation, connecting operational performance to market perception.

Also Read: Private Equity vs. Venture Capital: Key Differences

How to Convert Between Enterprise Value and Equity Value: The Bridge

Understanding the bridge between EV and Equity Value is essential. This conversion helps investors, founders, and analysts move from a company’s total value (EV) to its shareholder value (EqV), or vice versa.

The Basic Relationship

or conversely,

Where,

Net Debt = Total Debt – Cash and Cash Equivalents.

This bridge ensures both sides of a company’s capital structure are captured accurately.

Step-by-Step Example

Let’s look at an example for clarity:

Component | Amount (₹ crore) |

Enterprise Value | 600 |

Total Debt | 150 |

Cash and Cash Equivalents | 30 |

Net Debt (Debt – Cash) | 120 |

Equity Value (EV – Net Debt) | 480 |

So, if a business has an Enterprise Value of ₹600 crore, ₹150 crore in debt, and ₹30 crore cash, its Equity Value = ₹480 crore.

What Happens When Capital Structure Changes

Scenario | Effect on EV | Effect on EqV |

Company repays ₹50 crore debt | EV unchanged | EqV increases (as debt reduces) |

The company raises ₹50 crore in equity | EV increases (fresh capital) | EqV increases (ownership expands) |

The company accumulates ₹40 crore in cash | EV decreases (cash deducted) | EqV increases (cash adds to shareholder value) |

This shows why EV remains stable in operational comparisons, while EqV fluctuates with financing decisions.

Why Founders Should Understand the Bridge

- It reveals how leverage impacts value distribution between lenders and shareholders.

- It helps founders read investor term sheets more intelligently, especially during fundraising or buyouts.

- It avoids confusion in valuation negotiations, where one party quotes EV while the other refers to EqV.

At S45, we help founders interpret valuation bridges transparently, ensuring both parties speak the same language when discussing business worth, debt impact, and equity share.

When to Use Enterprise Value vs When to Use Equity Value: Use Cases

Both EV and EqV are vital, but they serve different purposes depending on the situation. Here’s how to decide which one to use, and when.

1. For Mergers and Acquisitions (M&A)

- Use Enterprise Value. Buyers pay the total firm value, including debt. EV captures what it costs to acquire the whole business.

- During an M&A, the acquirer settles the target’s debt obligations; hence, EV reflects the true economic cost.

Example: If Company A buys Company B with an EV of ₹800 crore and ₹200 crore debt, the actual purchase price (equity value) will be ₹600 crore after accounting for debt.

2. For Equity Funding or IPO Valuation

- Use Equity Value. Investors and founders focus on ownership stakes. EqV defines how much the business’s equity is worth and how much dilution occurs during a raise.

Example: A company with a ₹400 crore Equity Value raising ₹100 crore for 20% equity implies a pre-money valuation of ₹400 crore and a post-money valuation of ₹500 crore.

3. For Performance Comparison Between Companies

- Use Enterprise Value. Metrics like EV/EBITDA or EV/Revenue compare company performance independent of financing methods. This helps compare two firms even if one uses debt financing and the other relies purely on equity.

Example: Two logistics firms, one debt-heavy, one debt-light, may have similar EV/EBITDA multiples, even if their equity values differ significantly.

4. For Internal Ownership Planning (ESOPs or Partner Buyouts)

- Use Equity Value. Founders, shareholders, or employees care about ownership value, not total firm cost. Equity Value helps structure ESOPs, partner exits, or shareholder buybacks fairly.

5. For Debt Negotiation or Refinancing

- Use Enterprise Value. Banks and lenders rely on EV-based metrics to assess total business strength, including its capacity to service debt. It provides a full picture of firm value as collateral or a creditworthiness measure.

Also Read: Debt vs Equity Financing: Key Differences Explained

Common Misconceptions and Pitfalls (and How to Avoid Them)

Even experienced business leaders and investors sometimes blur the line between Enterprise Value and Equity Value. Misinterpreting one for the other can lead to inaccurate valuations, flawed negotiations, and missed growth opportunities.

Here are common mistakes and how to avoid them.

1. Confusing Market Capitalisation with Enterprise Value

Misconception: Many assume that a company’s market capitalisation (share price × number of shares) equals its total business value.

Reality: Market capitalisation reflects only equity value, not total firm value.It excludes debt and cash adjustments, which significantly affect Enterprise Value.

Example: A company with ₹800 crore market cap and ₹200 crore debt has an Enterprise Value closer to ₹1,000 crore (minus any cash balance).

How to Avoid It: Always check the balance sheet for net debt and adjust accordingly when assessing the full firm value.

2. Ignoring Cash Reserves in Valuation

Misconception: Analysts sometimes assume that holding excess cash doesn’t impact value.

Reality: Cash increases Equity Value (as shareholders benefit) but reduces Enterprise Value (as buyers pay net of cash).

How to Avoid It: Always subtract cash when calculating EV. If a company holds significant surplus cash, ensure that it’s properly adjusted to reflect operational and non-operational reserves.

3. Misreading Debt’s Impact on Ownership Value

Misconception: More debt means higher valuation because it fuels expansion.

Reality: While leverage can amplify growth, it also increases risk. High debt inflates EV but reduces EqV, since shareholders owe more to lenders.

How to Avoid It: Focus on sustainable leverage. Investors value companies with healthy debt–equity ratios and predictable repayment schedules.

4. Overlooking Preferred and Minority Interests

Misconception: Only common equity matters in valuation.

Reality: Preferred shareholders and minority interests carry value claims that affect both EV and EqV. Ignoring them distorts true ownership value.

How to Avoid It: When calculating EV, always add back preferred equity and minority interests. These represent claims outside the controlling shareholders’ stake.

5. Treating Both Metrics as Interchangeable

Misconception: Some founders use EV and EqV interchangeably in pitches or valuation decks.

Reality: They reflect two distinct perspectives, one holistic (EV), one ownership-specific (EqV). Mixing them creates confusion during negotiations.

How to Avoid It: Decide which value aligns with your audience, investors care about EqV, acquirers about EV, and communicate accordingly.

At S45, we help founders demystify financial language. When you understand what investors truly mean by “valuation,” you negotiate not just confidently, but fairly.

Also Read: Understanding Equity Warrants: Definition and Types

Practical Takeaways for Founders and Investors (Especially Indian SMEs)

Private and mid-market businesses often underestimate how much clarity on valuation metrics influences growth. For Indian SMEs, especially those eyeing structured capital or institutional partnerships, understanding EV vs EqV is a strategic advantage.

1. Use the Right Metric for the Right Decision

Business Decision | Metric to Prioritise | Why It Matters |

Raising equity capital | Equity Value | Reflects shareholding and dilution |

Evaluating acquisition offers | Enterprise Value | Shows total worth, including debt |

Internal partner buyouts | Equity Value | Indicates ownership transfer value |

Debt restructuring | Enterprise Value | Captures full business value, incl. obligations |

IPO readiness | Both | EV for firm valuation, EqV for share pricing |

When founders align valuation discussions with the right metric, they project financial maturity, a key signal for institutional investors.

2. Build Governance and Transparency Around Numbers

- Maintain clean, audited financial statements that clearly show debt, cash, and capital structure.

- Regularly update valuation models to reflect real-time performance.

- Communicate valuation context consistently across board reports, investor decks, and term sheets.

Strong governance makes valuation less subjective and helps founders move seamlessly from private equity interest to IPO preparedness.

3. Don’t Treat Valuation as Static

Valuation changes with market conditions, debt levels, and investor sentiment. A rising EV can coincide with a flat or even falling EqV if debt or external obligations increase.

Regularly recalibrating valuation builds strategic awareness and prepares businesses for capital events.

4. Treat Valuation Literacy as a Leadership Skill

Understanding EV vs EqV isn’t just finance; it’s leadership. It helps founders make smarter funding, acquisition, and partnership decisions that balance growth with long-term value creation.

At S45, we guide founders to treat valuation metrics as navigation tools, not just financial numbers, helping them build scalable, transparent, and investment-ready enterprises.

Conclusion

Understanding Enterprise Value and Equity Value isn’t just about formulas; it’s about perspective. These two metrics represent different lenses through which a business’s worth can be viewed: one from the market’s standpoint, and the other from the owner’s seat.

For founders, this clarity transforms how capital, partnerships, and growth decisions are made. When you understand the bridge between EV and EqV, you can:

- Negotiate confidently during funding or acquisition talks.

- Evaluate offers beyond the headline numbers.

- Build governance systems that reflect investor expectations.

For investors, these metrics ensure decisions are grounded in fact, balancing growth potential with financial discipline.

At S45, we help founders and business leaders navigate valuation with precision and confidence. Through mentorship, capital market access, and structured playbooks, we guide SMEs in transforming valuation awareness into sustainable business growth.