Key takeaways

- Venture debt is a strategic, non-equity financing option for growth companies that already have investor backing and measurable revenue traction.

- It reliably extends runway and funds targeted growth initiatives, while introducing scheduled repayments and lender-imposed constraints.

- Eligibility and pricing depend on investor pedigree, revenue predictability, and covenant design, so total cost should be modeled.

- Treat venture debt as part of a blended capital plan that balances dilution, control, and cash flow rather than as a stand-alone fix.

Disclaimer: This content is for informational purposes only and should not be construed as financial advice. Please consult with qualified financial advisors before making investment decisions.

Growth-stage companies face a recurring challenge: how to fuel expansion without constantly diluting ownership.

Every equity round chips away at founder control. Every new investor brings fresh expectations and board dynamics. For many startups in India, this tradeoff becomes increasingly painful as they scale.

The alternative often overlooked is venture debt, a financing instrument that has gained significant momentum in India's startup ecosystem. India's venture debt market reached $1.23 billion in 2024 and continues to expand rapidly, reflecting growing confidence in debt-backed growth strategies.

Unlike traditional bank loans, which require collateral and demonstrate profitability, venture debt operates on a different basis. It fills the space between equity rounds, offering capital to companies that have already proven their model to institutional investors.

This guide provides a comprehensive overview of everything you need to know about venture debt funds in India. From understanding how the mechanism works to determining when it makes strategic sense, you'll gain clarity on whether this financing route aligns with your growth trajectory.

What is Venture Debt?

Venture debt is a loan extended to early-stage and growth-stage companies that have already raised institutional venture capital. Unlike traditional bank loans that require tangible collateral and profitability, venture debt is underwritten based on your equity backing, growth metrics, and cash runway.

Core Structure

The typical venture debt arrangement includes three components:

- Principal loan amount with interest payments (10-18% per annum in India)

- Warrant coverage giving lenders small equity upside (5-20% of loan value)

- Covenants that protect the lender's downside through financial and operational guardrails.

Most arrangements are structured as term loans with 24-36 month tenures. You make interest-only payments for an initial period (often 6-12 months), followed by principal plus interest repayments. The warrants give lenders the option to purchase equity at a predetermined price, usually set at your last funding round valuation.

What makes venture debt particularly useful is timing. It's designed to extend your runway between equity rounds by 12-18 months, giving you more time to hit milestones that justify higher valuations in your next raise. This reduces dilution pressure and keeps you from raising equity at unfavorable terms.

Top Venture Debt Funds in India

The venture debt landscape in India has matured significantly over the past decade. There are now over hundreds of startups annually and dozens of active debt funds, for 2024–25 in India.

Let’s look at the top ones:

Stride Ventures

India's leading venture debt fund with over 100 investments across 15+ sectors.

Key Highlights:

- Portfolio includes 14 unicorns: MediBuddy, Zepto, BluSmart.

- Notable investments: CredAvenue (Yubi), MyGlamm, Upstox, WayCool.

- Typical investment: $3-10 million per deal.

- Focus: Late-stage startups with technology-driven models.

- Approach: Founder-friendly structures designed to minimize dilution.

Founded in 2019, Stride has launched three funds, emphasizing support for startups beyond capital deployment through strategic guidance and network access.

Alteria Capital

India's leading venture debt fund dedicated to supporting innovative startups backed by top-tier VC sponsors.

Key Highlights:

- Specialization: Customized financial solutions for tech and B2B companies.

- Differentiation: Flexible structuring with tailored repayment schedules.

- Focus: Companies demonstrating strong unit economics.

- Approach: Strike a balance between growth acceleration and founder ownership preservation.

Alteria works closely with portfolio companies to align covenant structures with business cycles and growth phases, making them particularly suited for companies with seasonal or lumpy revenue patterns.

InnoVen Capital

One of the largest venture debt providers in India, claiming to be both the first and largest in the country.

Key Highlights:

- Backing: Joint venture between Singapore's United Overseas Bank and Temasek Holdings.

- Portfolio: Myntra, OYO, BYJU'S.

- Focus: Tech and high-growth startups.

- Deployment: Several hundred million dollars since market entry.

InnoVen has been instrumental in normalizing venture debt as a legitimate financing option for Indian founders, bringing institutional credibility and deep capital reserves to the space.

Trifecta Capital

Founded in 2015, Trifecta provides both equity and debt funding along with financial advisory services.

Key Highlights:

- Founders: Nilesh Kothari and Rahul Khanna.

- Portfolio: HomeLane, MyGlamm, Spinny, Infra.Market, BluSmart Mobility.

- Model: Hybrid equity and debt approach with advisory services.

- Advantage: Unique insights into capital structure optimization.

This hybrid model provides Trifecta with a strategic perspective on how debt and equity interact at various growth stages, making them valuable thought partners beyond just capital providers.

Several newer funds have entered the market to meet growing demand. Beyond the established names, a host of emerging funds are focusing on specific sectors or geographies. These include regional players and industry-specific funds catering to particular business models or stages.

As venture debt in India continues to expand, choosing the right fund requires a clear understanding of your capital needs, repayment capacity, and growth priorities. To make an informed decision, it’s valuable to seek expert guidance.

Reach out to platforms like S45 Club that act as a strategic advisor to founders, helping evaluate funding options, structure deals effectively, and connect with credible venture debt providers that align with long-term business goals.

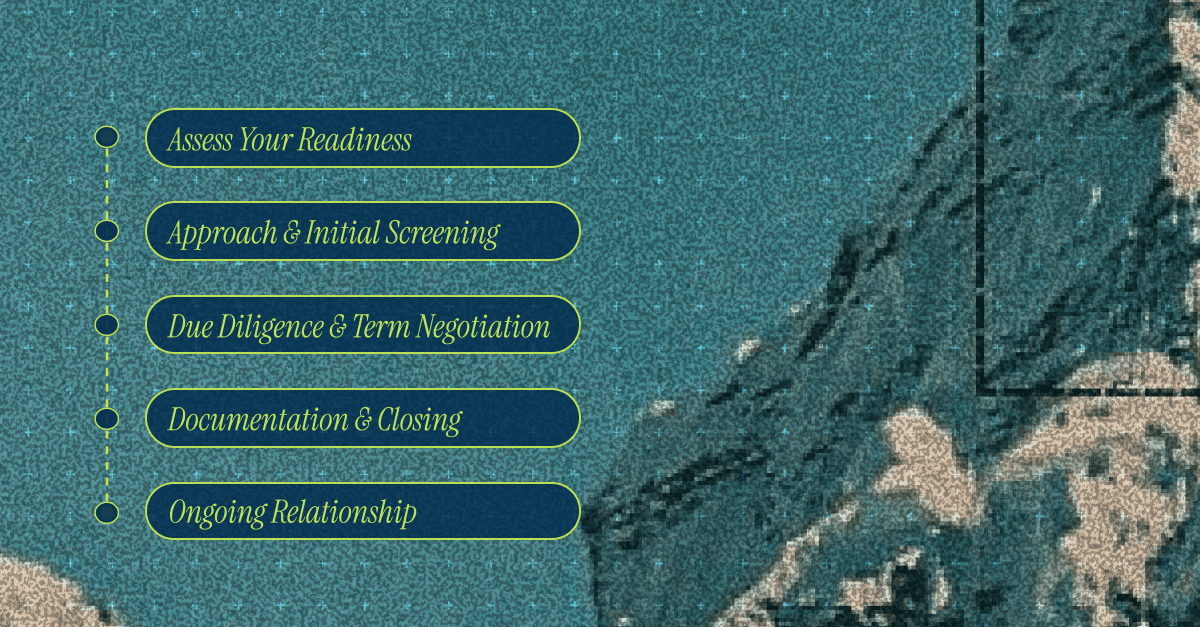

How Venture Debt Works (Step-by-Step Guide)

Understanding the venture debt process helps you approach it strategically rather than reactively. The journey from consideration to deployment follows a fairly standard pattern across most funds.

Step 1: Assess Your Readiness and Requirements

Before approaching venture debt providers, evaluate whether you meet the baseline criteria.

Readiness Checklist:

- At least one institutional equity round closed.

- 9-12 months of cash runway remaining.

- Consistent month-over-month revenue growth.

- Clear deployment plan for the capital.

Determine Your Needs:

- Calculate how much capital you need (typically 20-40% of the last equity raise).

- Define specific use cases: runway extension, working capital, strategic hires, and equipment.

- Time it right: 3-6 months after closing an equity round is optimal.

The best time to secure venture debt is when your runway is longest and your valuation is fresh. Approaching debt providers when you're desperate for capital weakens your negotiating position significantly.

Step 2: Approach and Initial Screening

Once you've identified potential funds, initiate conversations strategically.

Outreach Strategy:

- Use warm introductions through existing investors or advisors when possible

- Prepare a concise deck: business model, financial metrics, cap table, debt use case

- Target funds matching your sector focus, stage, and check size

What Lenders Evaluate:

- Market traction and revenue growth trajectory

- Quality of your investor base

- Burn rate and unit economics

- Path to next equity round

This phase typically progresses rapidly, usually within 1-2 weeks. If there's mutual interest, you'll receive a term sheet outlining the proposed structure.

Step 3: Due Diligence and Term Negotiation

The due diligence process mirrors equity fundraising but focuses more heavily on financial sustainability.

What Gets Scrutinized:

- Cash flow projections and debt servicing capacity.

- Customer concentration and churn rates.

- Path to next equity round and required milestones.

- Cap table structure and founder commitment.

Key Terms to Negotiate:

- Interest rates (push for the lower end of the 10-18% range).

- Warrant coverage (typically 5-20% of loan value).

- Interest-only period (longer is better for businesses with seasonal cash flows).

- Covenants (minimum cash balance, revenue thresholds, spending limits).

Pay close attention to covenants. These protect the lender but can constrain your operational flexibility if they are too restrictive. Negotiate for breathing room that aligns with your business realities.

Step 4: Documentation and Closing

Once terms are agreed upon, legal documentation begins.

Documentation Includes:

- Loan agreement with detailed terms and conditions.

- Warrant agreement specifying equity purchase rights.

- Security documents (often IP, receivables, equity pledges).

- Board resolutions authorizing the transaction.

Timeline: Typically 3-4 weeks, depending on corporate structure complexity

Security Considerations:

- Understand exactly what you're pledging as collateral.

- Review the circumstances under which security can be enforced.

- Personal guarantees are becoming less common with established funds.

After documentation is complete and legal conditions are satisfied, funds are disbursed. Most arrangements allow for a single drawdown, though some permit multiple tranches tied to milestone achievement.

Step 5: Ongoing Relationship and Reporting

Post-closing, you'll have regular reporting obligations that keep your lender informed.

Reporting Requirements:

- Monthly or quarterly financial statements.

- Variance analyses comparing actuals to projections.

- Covenant compliance certificates.

- Material changes in business strategy or operations.

Best Practices:

- Treat reporting seriously, even when everything is going well.

- Communicate proactively if strategy shifts or challenges emerge.

- Use capital as planned (if plans change, inform lender before pivoting).

- Build trust through transparency, creating flexibility for any necessary amendments later.

Most funds are founder-friendly and will work with you on reasonable adjustments, but unexpected changes can quickly erode goodwill.

Once you understand the mechanics of venture debt, the natural question becomes: Is it the right fit for your business compared to equity funding? Let’s explore how the two stack up side by side.

Venture Debt vs Equity: How to Choose the Right Capital at the Right Time

Choosing between venture debt and equity isn't a binary decision. Most high-growth startups use a mix of both at different stages. The key is knowing when each option makes the most sense based on your current runway, growth stage, and capital goals.

Dilution vs. Interest: Understanding the Tradeoff

Factor | Equity | Venture Debt |

Cost | Permanent ownership dilution. | Interest payments plus a small equity kicker (warrants). |

Dilution | Typically, 10–25% per round. | Usually 0.5–1% through warrants. |

Repayment | No repayment obligation. | Regular interest and principal repayments. |

Cash Flow Required | No | Yes, must support repayment schedule |

Example:

If you raise $2 million in equity at a $20 million valuation, you may give up around 10% ownership.

With venture debt, the same $2 million might carry a 15% warrant coverage, translating to only about 0.5–1% dilution, depending on conversion terms. The tradeoff is regular interest payments, typically in the 12–18% range in India.

For companies with strong gross margins and stable revenue, the interest burden is manageable. As a general rule, monthly debt service should remain below 20% of monthly revenue.

When to Use Equity vs Venture Debt

You Can Use Equity When:

- You are pre-product-market fit and need flexibility to iterate.

- You are entering a new market or developing a product that requires long-term investment.

- Your revenue is inconsistent, or your burn rate is high relative to income.

- You need patient capital that doesn't demand predictable cash flow.

Equity works well in the discovery and early growth stages, where risk is high and returns are uncertain.

Use Venture Debt When:

- You have recently closed an equity round and want to extend your runway without additional dilution.

- You are between rounds and need 6 to 12 months to hit key valuation milestones.

- You need capital for high-ROI, near-term investments such as equipment, inventory, or strategic hires.

- Your revenue is growing steadily, and you can service debt without straining cash flow.

Venture debt is most effective when your business fundamentals are strong, and the capital is being used to accelerate specific outcomes.

Control, Cost of Capital, and Runway Considerations

Aspect | Equity | Venture Debt |

Control | Investors often take board seats and voting rights. | Lenders typically have observer roles, not control. |

Cost of Capital | High in the long term due to ownership dilution. | Lower if debt is repaid from cash flows. |

Runway Impact | Extends cash without repayment. | Adds repayment obligations that require careful planning. |

Smart capital structuring doesn't rely on just one type of funding. Use equity to support long-term, uncertain, or high-risk initiatives. Utilize venture debt to extend your runway, bridge funding gaps between rounds, or support measurable, short-term growth drivers.

A blended capital approach allows you to maximize growth while preserving ownership and control. This is the foundation of capital-efficient scaling.

Knowing when to use venture debt is only half the equation. To actually secure it, startups must meet specific eligibility and financial benchmarks. Let’s break down what determines access and how lenders assess your readiness.

What Determines Access to Venture Debt in India?

Before you explore venture debt as a funding option, it's essential to understand how lenders evaluate startups. Unlike equity investors who take long-term ownership risk, debt providers need repayment within a fixed period. That means they assess risk differently, and they’re selective about who qualifies.

This section covers three interconnected factors that influence both access to venture debt and the terms you receive:

- Eligibility criteria

- Interest rate structure

- Warrant coverage

Each of these factors influences how lenders perceive your business, enabling you to structure a deal that supports growth without compromising cash flow or founder control.

1. Eligibility: Are You a Fit for Venture Debt?

Venture debt is typically available to startups that already have momentum. It is not designed for early-stage companies still figuring out product-market fit. Most funds want to see institutional backing, revenue traction, and sound financial planning.

Key requirements lenders look for:

- Institutional VC backing: Lenders expect startups to have raised at least one equity round from recognized investors. A strong investor profile signals lower risk to debt providers.

- Revenue traction: Startups with annual recurring revenue of at least $1–2 million and consistent monthly growth are more likely to qualify. Lenders often look for 10–15 percent month-over-month revenue growth.

- Cash runway: The ideal time to raise venture debt is when you have 9 to 12 months of cash remaining. Too little runway increases lender risk, while too much can reduce urgency and negotiation leverage.

- Cap table structure: Lenders assess founder commitment and ownership. Founders holding at least 40 percent of the company collectively is generally seen as a positive indicator.

Meeting these criteria doesn’t guarantee funding, but it positions you to negotiate better terms and access a wider pool of lenders.

2. Interest Rate: What Will Venture Debt Cost You?

Once you're considered eligible, the next factor is pricing. Venture debt is more expensive than traditional loans, but less dilutive than equity. Interest rates reflect the startup’s risk profile and repayment capacity.

Key factors affecting your interest rate:

- Typical range: In India, rates generally fall between 10 and 18 percent per annum. The exact rate depends on your stage, metrics, sector, and investor profile.

- Business performance: Startups with stable revenue, strong margins, and tier-1 backers can negotiate lower rates. Early-stage companies or those in volatile sectors may fall on the higher end of the range.

- Fixed vs variable rates: Some funds offer fixed interest rates for predictability, while others offer variable rates linked to benchmarks like the repo rate. Each has trade-offs in terms of risk and cost.

- Additional costs: Most lenders charge an upfront fee of 1 to 3 percent of the loan amount. This impacts your effective interest rate and should be included in total cost calculations.

3. Warrants: The Equity Component in Venture Debt

Venture debt often includes warrants, which are rights for the lender to purchase equity in your company at a predetermined price. While the debt itself is non-dilutive, warrants create a potential for future dilution.

Key considerations around warrants:

- Warrant coverage: This typically ranges from 5 to 20 percent of the loan amount. For example, a ₹10 crore loan with 10 percent warrant coverage gives the lender the option to buy ₹1 crore worth of equity at a pre-agreed price.

- Strike price: Warrants are usually priced based on your last equity round valuation. If your valuation doubles in the next round, the lender benefits from the upside without taking full equity risk.

- Dilution and tax impact: Upon exercise, existing shareholders will be diluted. Gains on sale or conversion are typically taxed as capital gains, which affects how both parties evaluate the warrant's value.

- Negotiation flexibility: Some funds offer trade-offs between warrant coverage and interest rate. A deal with lower interest may include higher warrant coverage, while a higher interest could reduce the equity component.

Warrants are a key part of venture debt structuring and should be evaluated with the same scrutiny as valuation in an equity round.

A clear understanding of these levers allows you to approach venture debt strategically. Instead of just asking “Can I raise debt?”, you can evaluate: “Am I ready to raise on the right terms, and do those terms support long-term value creation?”

Understanding eligibility and cost gives you the ‘what’, but not the ‘how.’ It's essential to examine how startups utilize venture debt in real-world growth scenarios.

Common Use Cases of Venture Debt

Startups turn to venture debt as a strategic tool to support growth, reduce dilution, and increase flexibility. The key is using it where the capital drives measurable outcomes, without waiting for a full equity round.

Below are the most common and effective ways startups deploy venture debt.

1. Strategic Growth Applications

Use venture debt to accelerate traction or unlock valuation milestones.

- Extend Runway Between Equity Rounds: Gain 6–12 extra months to hit product, revenue, or expansion targets before raising the next round.

- Finance Large Contracts: Fund production or fulfillment costs tied to enterprise deals where repayment is backed by revenue.

- Asset-Backed Purchases: Invest in machinery, infrastructure, or equipment that generates return and can serve as collateral.

- Pre-Revenue Strategic Hiring: Bring on senior leadership or scale sales teams to support projected growth before it materializes.

- Test Markets or Products: Enter a new geography or build a product line without immediately committing to a significant equity raise.

- Fund Acquisitions or Acqui-Hires: Move quickly on M&A opportunities without diluting or slowing down.

2. Tactical Financial Uses

Utilize debt to manage operations efficiently and maintain control during uncertain periods.

- Smooth Out Cash Flow Cycles: Manage delayed receivables and seasonality without increasing idle equity capital.

- Maintain Fundraising Flexibility: Avoid raising equity during market downturns or when you're between milestones.

If the capital you raise has a clear, short-to-mid-term ROI or helps you unlock a stronger valuation later, venture debt may be the right fit. If you're using it to buy time, prove value, or avoid dilution, you're on the right track.

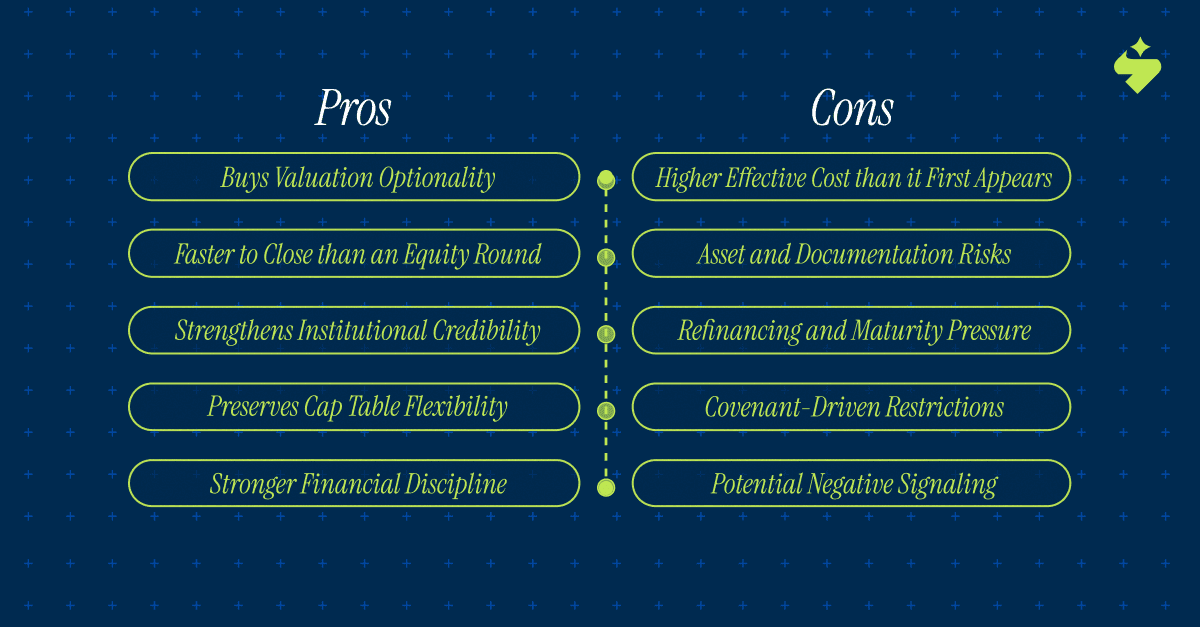

Pros & Cons of Venture Debt

Venture debt creates opportunities but also introduces constraints. Evaluating both sides honestly helps you make informed decisions.

Pros

- Buys valuation optionality, not just runway: It allows you to hit key milestones that can meaningfully increase your next-round valuation, making the small warrant component a worthwhile trade-off.

- Faster to close than an equity round: The diligence and documentation process is typically shorter, which helps when opportunities or market timing are critical.

- Strengthens institutional credibility: Securing venture debt from a reputable fund signals to future investors that your unit economics and business model have been vetted.

- Preserves cap table flexibility: By avoiding additional equity dilution now, you retain more ownership for future strategic investors or key hires.

- Encourages stronger financial discipline: Regular reporting and forecasting requirements from lenders help sharpen internal controls and improve readiness for later rounds.

Cons

- Higher effective cost than it first appears: Beyond the stated interest rate, factors like fees, warrants, and potential variable rates can make the total cost similar to equity over time if not carefully modeled.

- Asset and documentation risks: Some agreements require pledging assets such as IP or receivables, which can limit flexibility or create enforcement risk if terms aren’t fully understood.

- Refinancing and maturity pressure: Debt has fixed repayment timelines. If your next funding round is delayed or markets tighten, you may face liquidity pressure or need to refinance at unfavorable terms.

- Covenant-driven restrictions: Lenders often impose covenants on cash flow, hiring, or spending, which can limit agility when business conditions change.

- Potential negative signaling: If debt is raised under tight terms or at a time of distress, future investors may interpret it as a red flag about financial health or runway.

While understanding theory is essential, executing a sound venture debt strategy requires experience and connections. That’s where expert partners like S45 Club come in, guiding businesses through every stage of the capital journey.

How S45 Club Can Help?

Navigating the capital markets as a growth-stage SME requires more than just access to funding. It demands strategic thinking about capital structure, governance readiness, and market positioning.

S45 Club serves as a bridge between ambitious businesses and the institutional capital required to scale. For companies evaluating venture debt, S45 provides the strategic frameworks and market access that make the difference between capital that constrains and capital that accelerates.

Here's how S45 Club supports SMEs through their capital journey:

- Strategic capital planning to help you determine the optimal mix of debt and equity at each growth stage.

- Access to institutional debt providers and pre-IPO investors through a curated network of capital partners.

- Governance playbooks that prepare your company for institutional funding requirements and covenant compliance.

- Financial modeling and scenario planning to ensure debt obligations align with your growth trajectory and cash flow profile.

- Market intelligence on current debt market conditions, competitive terms, and negotiation strategies.

- Post-fundraise support, including investor reporting frameworks and covenant management systems.

Beyond capital access, S45 Club brings expertise in preparing companies for the institutional scrutiny that comes with venture debt. This includes tightening financial operations, implementing strong reporting systems, and establishing the governance structures that debt providers expect.

Conclusion

Venture debt has progressed from a niche financing option to a mainstream capital strategy for growth-stage companies in India. The market's maturation reflects growing sophistication among both founders and lenders about when and how debt creates value without introducing undue risk.

The decision to pursue venture debt shouldn't be reactive, driven by cash crunches or complex equity markets. Used strategically between equity rounds, it extends runway, minimizes dilution, and gives you the time and resources to achieve milestones that justify premium valuations.

The best capital structures blend equity's flexibility with debt's efficiency, optimizing for both growth and founder outcomes. As you evaluate whether venture debt fits your situation, focus on fundamentals: adequate runway to service debt comfortably, capital funding initiatives with measurable ROI, and ability to meet eligibility criteria and secure reasonable terms.

S45 Club helps businesses navigate these decisions with clarity and confidence. If you’re ready to explore whether venture debt aligns with your funding roadmap, book a consultation call with S45 Club to discuss how a tailored capital strategy can accelerate your next stage of growth.