Key Takeaways

1. Fund structure defines your investment journey. Open-ended and closed-ended funds differ not just in liquidity, but in how capital behaves, how long it stays invested, and how value is realised.

2. Open-ended funds offer flexibility and access. They allow continuous investment and redemption, making them suitable for investors seeking liquidity and regular market participation.

3. Closed-ended funds enable long-term value creation. Fixed capital and locked timelines allow fund managers to focus on operational improvement, patient capital deployment, and higher exit multiples.

4. The right choice depends on liquidity needs and risk appetite. Investors prioritising liquidity prefer open-ended funds; those focused on long-term, illiquid opportunities favour closed-ended structures.

5. Strategic capital selection leads to sustainable scale. At S45 Club, we help founders and investors evaluate fund structures not just for returns, but for alignment, ensuring every capital decision builds discipline and enduring growth.

The structure of a fund can influence how capital flows, how long it stays invested, and how returns are generated.

For investors and business owners exploring private equity, knowing whether a fund is open-ended or closed-ended is critical to aligning investment goals with liquidity needs.

In India, alternative investment funds (AIFs) have grown rapidly, with total commitments surpassing ₹8.3 lakh crore by mid-2025, according to SEBI data.

This growth is driven by investors and entrepreneurs seeking long-term, structured capital, the kind that can accelerate scale without short-term pressures. Understanding how open-ended and closed-ended funds differ helps both investors and founders choose the right path for their capital journey.

What is an Open-Ended Fund?

An open-ended fund is designed for continuous investment and redemption. Investors can enter or exit at any time, and the fund’s assets under management (AUM) fluctuate based on these movements.

Unlike fixed-term vehicles, open-ended funds remain operational indefinitely, creating flexibility for both fund managers and investors.

Key Characteristics

- Perpetual Structure: Open-ended funds do not have a fixed maturity. New units can be issued and existing ones redeemed on an ongoing basis.

- Liquidity: Investors can buy or redeem units based on the fund’s Net Asset Value (NAV), providing high liquidity.

- Valuation: The NAV is typically calculated daily for mutual funds or periodically for private market funds, depending on underlying asset liquidity.

- Accessibility: Open-ended funds can suit both institutional and retail investors, offering easier entry and exit.

Application in Private Equity

In private equity, open-ended structures are less common but increasingly used in evergreen funds or core capital vehicles. These funds continuously raise and recycle capital, investing in portfolio companies while allowing periodic redemptions.

For instance, some infrastructure or real estate funds operate as open-ended, investing in long-term assets yet offering liquidity through secondary transactions or partial redemptions.

Advantages

- Flexibility in subscribing and redeeming investments

- Access to diversified portfolios

- Transparency through regular NAV disclosures

- Potential for steady compounding through reinvestment

Limitations

- Fund managers must maintain liquidity buffers, which can limit investment in long-term illiquid assets.

- Frequent redemptions can force premature exits or reduce fund efficiency.

- NAV volatility can increase during market fluctuations due to daily valuation adjustments.

At S45 Club, we often guide founders exploring open-ended structures to evaluate how liquidity and flexibility fit into their long-term objectives. The key question is not just “Can I access capital anytime?” but “Does this structure support disciplined growth?”

Also Read: What Is Equity Fund: Meaning and Types

What is a Closed-Ended Fund?

A closed-ended fund operates with fixed capital and a defined tenure. The fund raises money once, usually during its launch phase, and invests that capital over a predetermined period, often 7 to 10 years.

Investors cannot freely enter or exit the fund after this period, making it a long-term commitment.

Key Characteristics

- Fixed Capital Base: Once the fund closes to new investors, its capital remains constant throughout its term.

- Limited Liquidity: Investors can typically exit only when the fund reaches maturity or through secondary transfers.

- Valuation: NAV is calculated periodically, but fund units may trade at premiums or discounts if listed on an exchange.

- Investment Focus: Ideal for illiquid assets such as private equity, real estate, or infrastructure, where capital lock-in supports patient growth.

Application in Private Equity

Closed-ended structures dominate the private equity and venture capital landscape. They give fund managers the freedom to invest with a long-term horizon without redemption pressure.

This structure supports strategies like buyouts, expansion funding, and operational transformation, all of which require time to mature.

In India, most Category II AIFs operate as closed-ended funds, aligning with the long gestation cycles of SMEs and mid-market companies.

Advantages

- A stable capital base ensures managers can invest without liquidity constraints

- Better suited for illiquid or long-term investments

- Allows managers to focus on performance rather than short-term redemptions

- Aligns investor interests with fund success through performance-linked exits

Limitations

- Limited liquidity, investors must remain invested until the fund matures

- Units may trade below NAV if listed on exchanges

- Investors need higher patience and risk tolerance

- Returns are realised only at fund maturity or exit events

For founders, closed-ended funds represent long-term partnership capital. not just funding but structured guidance.

At S45 Club, we often encourage entrepreneurs to see such capital as a stabiliser that allows strategic decisions without short-term withdrawal risks.

Also Read: Categories of Alternative Investment Funds Explained

Key Differences Between Open-Ended and Closed-Ended Funds

Open-ended and closed-ended funds serve distinct investor needs. While open-ended funds focus on liquidity and flexibility, closed-ended funds emphasise long-term stability and performance over time.

Understanding their differences helps investors and business leaders choose the right structure for their goals.

Comparison Table: Open-Ended vs Closed-Ended Funds

Parameter | Open-Ended Funds | Closed-Ended Funds |

Structure | Perpetual – accepts continuous inflows and outflows | Fixed capital – raised once during launch |

Investment Period | Continuous – investors can enter or exit anytime | Locked – investment made during fund launch only |

Liquidity | High – redemptions allowed based on NAV | Low – redemptions restricted until maturity |

Valuation Basis | Based on Net Asset Value (NAV) | Based on market price or periodic NAV |

Pricing | Units issued and redeemed at NAV | Units may trade at a premium or a discount to NAV |

Fund Manager Focus | Managing liquidity and daily NAV | Long-term value creation and exit timing |

Suitable For | Investors seeking flexibility and easy access | Investors with a longer horizon and a higher risk appetite |

Best Used For | Liquid asset classes and hybrid portfolios | Private equity, real estate, infrastructure |

Risk Profile | Lower volatility, frequent price changes | Higher long-term risk, potential for higher returns |

The key difference lies in time and liquidity. Open-ended funds suit investors needing regular access to capital or shorter-term exposure.

Closed-ended funds align with investors or founders looking for stable, long-term partnerships, where capital stays committed through the business growth cycle.

For private equity and venture capital, closed-ended structures are preferred. They allow managers to focus on long-term operational improvement and exit readiness rather than daily redemptions.

Conversely, open-ended funds appeal to investors prioritising liquidity and portfolio flexibility over extended timeframes.

At S45 Club, we often advise business leaders to consider not only how easily capital can flow in or out, but also whether the chosen structure strengthens long-term value creation. The right fund design should complement business growth stages, not conflict with them.

What This Means for Indian SME Founders, Investors, and Growth-Stage Businesses

For Indian SMEs, fund structure is not just a technical detail; it defines how capital behaves once it enters the business, and whether a company partners with an open-ended or closed-ended fund can shape everything from growth timelines to governance expectations.

For Founders: Building with the Right Capital Horizon

Closed-ended private equity funds are often a better fit for Indian SMEs seeking to scale sustainably. These funds bring structured, patient capital that aligns with long-term goals such as capacity expansion, market entry, or IPO readiness.

Because the capital is locked in for several years, founders can focus on strategy, execution, and operational efficiency without worrying about investor withdrawals.

Open-ended funds, while more flexible, may not always suit businesses with long gestation cycles or heavy capital expenditure. The liquidity pressure inherent in open-ended structures can make it harder for investors to stay committed to long-term transformation projects.

Key Takeaway for Founders:

Select a fund structure that matches your business lifecycle. A manufacturing or infrastructure firm benefits from a closed-ended partnership, while asset-light models with shorter capital cycles can consider open-ended arrangements.

For Investors: Balancing Liquidity with Long-Term Vision

Investors face a trade-off between liquidity and return potential. Open-ended funds allow periodic entry and exit, offering flexibility and easier access to capital. They suit investors who value liquidity or want to diversify across multiple asset classes.

Closed-ended funds, in contrast, restrict liquidity but offer higher potential returns through concentrated, long-term investments.

They are best suited for investors willing to commit to longer horizons, typically seven to ten years, in exchange for greater performance potential.

Key Takeaway for Investors:

Liquidity preference should never override long-term alignment. The most successful investors match their liquidity horizon with the fund’s strategy, ensuring capital remains patient enough to realise true value creation.

For Businesses Seeking Institutional Partnerships

When SMEs raise capital from private equity, the fund structure influences governance expectations.

- Closed-ended funds often bring institutional oversight, performance reporting, and exit-driven discipline, which helps companies mature operationally.

- Open-ended structures may prioritise steady income or liquidity, leading to shorter-term performance tracking but less operational involvement.

For scale-ready Indian SMEs, partnering with a closed-ended fund can help build financial discipline, board governance, and investor confidence, all prerequisites for eventual IPO or global expansion.

Also Read: Category II Alternative Investment Funds: Overview and Benefits

How to Evaluate a Fund: Checklist for Founders and Investors

Selecting between open-ended and closed-ended funds requires evaluating more than just return expectations. It involves aligning business goals, liquidity needs, and governance preferences with the fund’s design.

Key Evaluation Criteria

Factor | Why It Matters | How to Evaluate |

Investment Horizon | Determines how long capital remains locked | Match fund life with business goals (e.g. 7–10 years for expansion) |

Liquidity Requirements | Impacts investor flexibility | Assess how soon you may need access to invested capital |

Asset Class Fit | Different funds suit different asset types | Closed-ended for illiquid assets; open-ended for liquid or hybrid |

Fund Manager Track Record | Indicates experience and reliability | Review prior fund performance and exit history |

Governance and Reporting | Ensures transparency and accountability | Check disclosure frequency and investor communication standards |

Fee and Incentive Structure | Affects net returns and alignment | Compare management fees and performance incentives |

Exit Strategy | Determines how returns are realised | Ensure clarity on redemption terms or exit mechanisms |

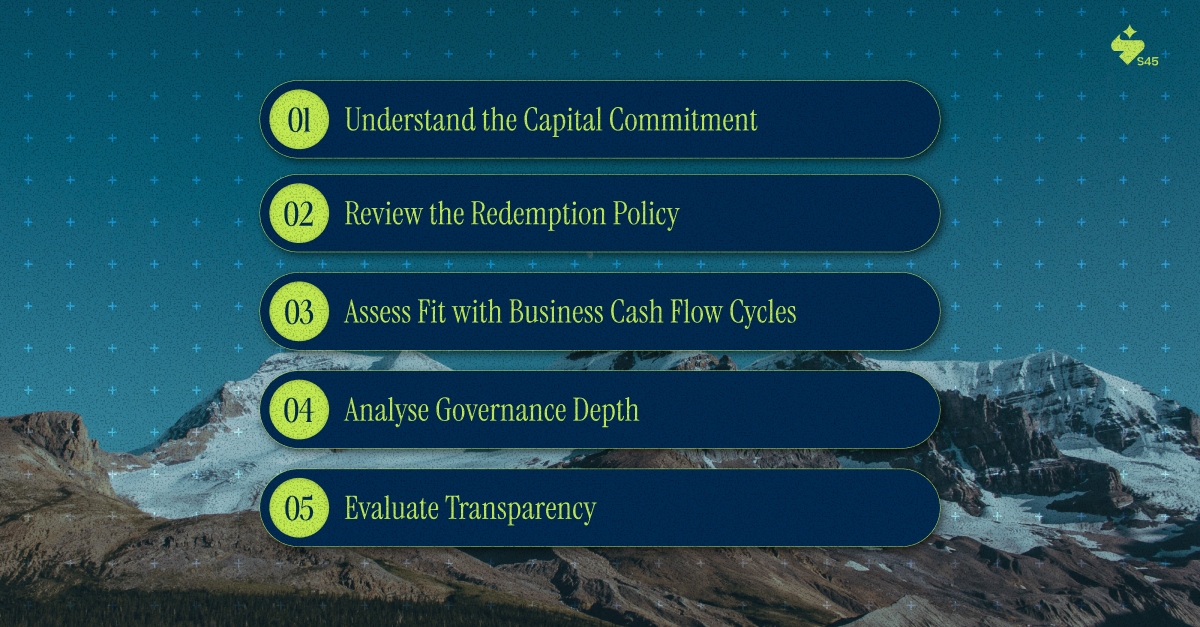

Practical Steps for Founders and Investors

- Understand the Capital Commitment: Closed-ended funds often require capital to be called over time rather than up front. Ensure clarity on commitment schedules and drawdown timelines.

- Review the Redemption Policy: Open-ended funds may allow partial exits, but with notice periods or redemption gates during market stress. Always verify liquidity terms.

- Assess Fit with Business Cash Flow Cycles: Align your fund participation or capital intake with your company’s operational cash flow, especially for sectors with long working capital loops.

- Analyse Governance Depth: Choose fund partners who bring strategic value, not just capital. Their oversight should add credibility, not complexity.

- Evaluate Transparency: Prioritise funds with regular audits, performance reporting, and valuation clarity. This builds investor trust and operational accountability.

At S45 Club, we guide both founders and investors through fund evaluation frameworks that balance capital access with sustainability. The goal is simple: find structures that support disciplined growth without compromising flexibility or governance.

Also Read: How to Raise Funds for Your Startup in India

Conclusion

Fund structures define more than how investments are managed; they shape how growth unfolds.

Open-ended funds provide accessibility and flexibility, ideal for investors who value liquidity and continuous entry or exit. Closed-ended funds, in contrast, enable depth, stable capital, patient timelines, and long-term operational transformation.

Both serve distinct purposes, but the right choice depends on the investor’s vision and the business’s growth cycle.

For founders, clarity about fund structure can prevent future strain. A closed-ended partner may bring institutional rigour and strategic discipline, while an open-ended approach may keep capital accessible for shorter-term goals. The key lies in choosing what complements the company’s stage and ambition.

At S45 Club, we guide entrepreneurs and investors to view capital as more than funding. The right structure is a partnership, one that builds governance, stability, and scale on the path to sustainable growth.