Key Takeaways

- Many MSMEs struggle with funding due to documentation gaps, low credit history, collateral demands, and inconsistent financial records.

- Clean books, diversified funding sources, strong credit behaviour, and clear growth projections significantly improve approval chances.

- Building lender relationships early and presenting funding as a growth opportunity creates a more confident funding narrative.

- Avoid red flags like conflicting numbers, personal fund usage, vague capital asks, and ignoring loan terms.

- Partnering with experts like S45 can accelerate funding readiness through capital support, documentation guidance, and strategic growth mentorship.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

If you are an Indian MSME founder, you have likely felt that gap between where you want your business to go and the capital you need to get there. The plans are clear, the market is ready, but the funding conversation moves slow, and it can feel like progress depends on approvals rather than ideas. Every founder knows that uncomfortable pause when growth is possible, but cash flow says wait.

The challenge is widespread. Indian MSMEs face a ₹25 lakh crore credit gap, even though most have strong products and long-term potential. Funding struggles are rarely about capability alone. They usually come from documents, credit history, perception, or timing.

In this blog, we will decode why funding becomes difficult and learn clear ways to overcome it with strategies that help you approach lenders with confidence.

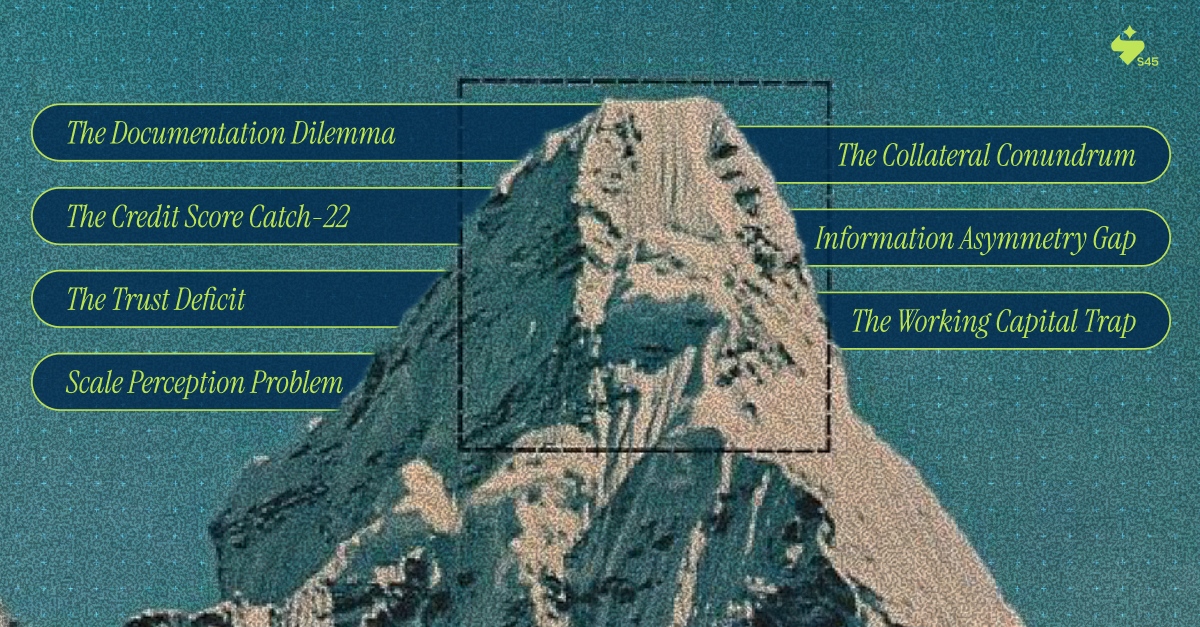

Common Funding Issues Indian MSMEs Face

Every founder reaches a point where growth depends less on ideas and more on access to the right capital. It is not that businesses lack potential; it is often the system that feels layered, slow, and demanding.

Here are the most prevalent funding challenges that Indian MSMEs encounter:

1. The Documentation Dilemma

Many MSMEs run operations well but do not maintain formal records that lenders trust. When audited statements, GST records, or bank trails are missing, lenders hesitate because numbers on paper matter as much as real business activity.

2. The Collateral Conundrum

Traditional banks require collateral worth 100-150% of the loan amount. For service-based businesses, tech startups, or asset-light MSMEs, this creates an impossible barrier. The assets they do have, intellectual property, customer contracts, or brand value, aren't recognized by conventional lenders.

3. The Credit Score Catch-22

To build credit, you need credit. MSMEs relying on personal savings or informal borrowing never build an institutional credit history. When they finally approach formal lenders, their lack of a credit track record works against them, even if they've never defaulted.

4. The Information Asymmetry Gap

Government schemes like MUDRA, CGTMSE, and Stand-Up India exist, but awareness remains low. Many MSME founders don't know which scheme fits their business stage, how to apply, or what documentation is required. This knowledge gap costs them access to affordable capital.

5. The Trust Deficit

Banks view MSMEs as high-risk borrowers due to higher failure rates. This perception leads to stricter eligibility criteria, longer processing times (often 45-90 days), and higher interest rates compared to larger corporations. The 38% interest rate some NBFCs charge reflects this risk premium.

6. The Working Capital Trap

Even successful MSMEs face cash flow crunches due to delayed payments from clients. With 30-90 day payment cycles common in B2B transactions, businesses need working capital to bridge the gap. However, securing short-term funding at reasonable rates remains difficult.

7. The Scale Perception Problem

Lenders prefer businesses with proven scale and consistent revenue growth. Early-stage MSMEs or those in traditional sectors struggle to demonstrate the "hockey stick growth" that excites institutional investors, leaving them stuck in a funding valley.

These challenges are real, but they're not insurmountable. If you want quicker access to capital without the usual friction, then guidance and structured funding preparation can change the game. This is where working with a strategic growth partner like S45 helps you move from funding uncertainty to funding readiness.

Up next, let us look at practical ways to overcome these funding issues with clear, repeatable strategies that help you secure capital faster.

8 Proven Ways MSMEs Can Overcome Their Funding Challenges

Funding does not unlock by chance. It opens when the business looks predictable, credible, and investment-ready. The objective is not just to get money approved, but to build a structure that makes lenders comfortable and confident about your growth path.

Below are practical, field-tested approaches that help MSMEs move from funding obstacles to funding access:

1. Build a Bulletproof Business Plan That Speaks Numbers

A strong business plan is more than a story. Lenders want clarity on numbers, growth potential, and revenue logic. A plan backed by data earns trust faster.

How to approach it:

- Add 3-year projections with realistic and optimistic scenarios

- Highlight unit economics clearly

- Show customer proof like LOIs, testimonials, or pilot results

- Connect growth milestones with revenue outcomes

Quick win: Start with a simple financial model and refine it as data grows.

2. Transform Your Financial Records from Liability to Asset

Clean records tell lenders your business is disciplined. It reduces back and forth during due diligence and speeds up approvals.

Action points for founders:

- Shift to digital accounting tools like Zoho Books or Tally

- Maintain monthly reconciliations instead of a quarterly rush

- Keep ITR, GST returns, and bank statements organized

- Get books audited even if not mandatory

Quick win: Begin by cleaning the last three months of books to show financial hygiene.

3. Actively Build and Repair Your Credit Profile

Creditworthiness develops over time. The earlier you start building it, the easier fund access becomes.

Practical steps:

- Check CIBIL or Experian score quarterly

- Start with a small credit line, repay early

- Keep utilization under 30 percent

- Correct report discrepancies quickly

Quick win: Become an authorized user on a partner's or director’s good credit account.

4. Diversify Your Funding Sources

Different needs require different capital structures. A single-source approach limits eligibility and increases dependency.

Ways to layer funding smartly:

- Use savings for initial capital

- NBFCs or banks for machinery and equipment

- Invoice discounting for working capital

- Government schemes for scale-based support

Quick win: Apply to multiple lenders to create negotiation leverage.

5. Leverage Technology to Show Real-Time Business Health

Modern lenders value data visibility. Integrated systems reduce paperwork and build trust instantly.

Tools you can start with:

- Accounting sync with bank transactions

- Cash flow forecasting apps

- MIS dashboards for monthly reporting

- GST portal integration for quick checks

Quick win: Connect your accounting platform with a digital lending app for faster evaluation.

6. Position Your Ask for Growth, Not Rescue

Money flows into vision, not survival. Frame capital as fuel for expansion and opportunity capture.

Strong positioning looks like:

- Funding to enter new markets or increase capacity

- Revenue uplift clearly mapped to investment

- Milestones with measurable KPIs

- A crisp one-page investment highlight sheet

Quick win: Reword your pitch from need to opportunity.

7. Build Relationships Before You Need Funding

Warm relationships convert into quicker approvals. When lenders know you, trust builds long before paperwork begins.

Founders can do this by:

- Quarterly check-ins with bank managers

- Being visible at MSME finance events

- Joining industry groups and chambers

- Maintaining two or more active banking relationships

Quick win: Share a quarterly performance update even when you are not applying.

8. Seek Strategic Guidance Instead of Navigating Alone

Funding is a technical process. Expert support reduces trial and error and helps you present your business professionally.

Where guidance truly helps:

- Structuring proposals that lenders understand

- Identifying the right funding type for your stage

- Preparing documentation and compliance

- Improving the fundability score before the application

Quick win: Get a funding readiness evaluation to know what is blocking approval.

When these strategies come together, funding becomes smoother, faster, and more predictable. Instead of knocking on multiple doors, you approach the right ones with clarity and confidence.

In the next section, we will look at red flags that silently kill funding approvals and how to avoid them before they become costly mistakes.

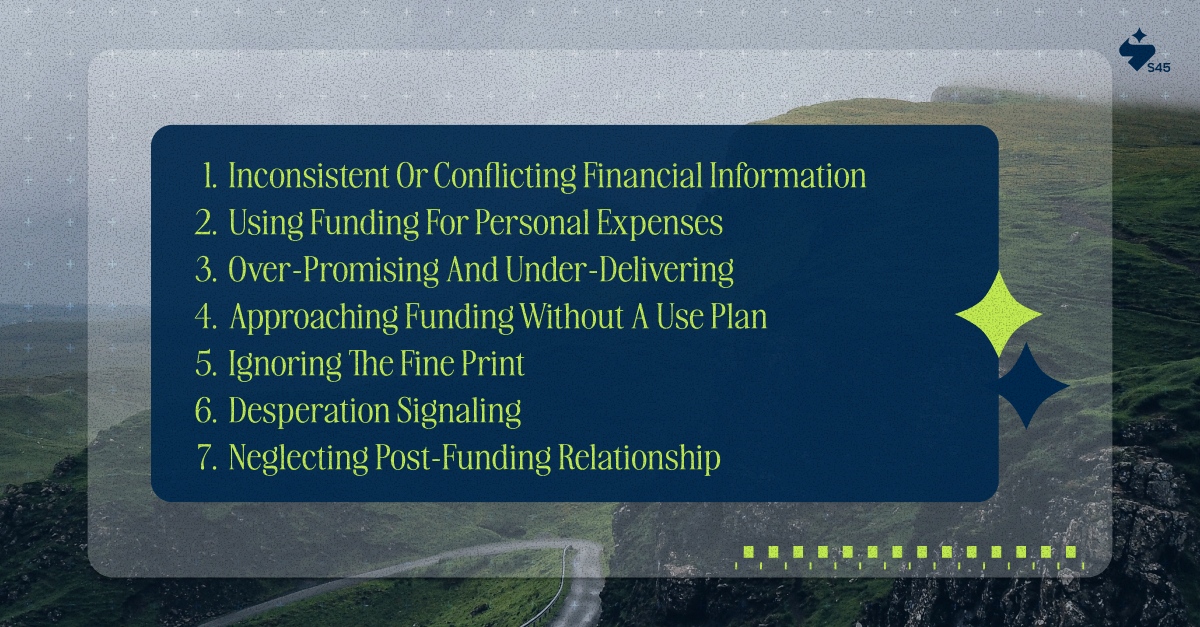

Red Flags That Can Derail Your Funding Journey

Lenders do not just fund numbers. They observe discipline, clarity, and intent. A business may have potential, but one red flag can slow down approval or reduce the amount sanctioned. Knowing what to avoid is as important as knowing what to do.

1. Inconsistent or Conflicting Financial Information

Mixed numbers in different documents raise doubt instantly.

Avoid this by:

- Keeping financials consistent across GST, ITR, and P&L

- Aligning verbal statements with submitted reports

- Double-checking figures before sending them

2. Using Funding for Personal Expenses

Blurring business and personal accounts is an instant trust breaker.

Better approach:

- Maintain separate accounts for business

- Track fund usage with simple MIS reports

- Never pull funds for personal needs

3. Over-Promising and Under-Delivering

Lenders remember history. Missed commitments reduce future chances.

Keep it healthy with:

- Clear repayment plans

- Transparent communication during delays

- Measured projections instead of inflated ones

4. Approaching Funding Without a Use Plan

A vague ask, like working capital, signals a lack of clarity.

Strengthen your pitch with:

- Allocation breakup for marketing, inventory, or equipment

- Revenue and ROI timelines

- Milestones tied to fund usage

5. Ignoring the Fine Print

Sometimes loans look attractive until hidden terms surface.

Be cautious and check for:

- Processing fees and penalties

- Personal guarantee clauses

- The difference between flat and reducing interest rates

6. Desperation Signaling

Urgency makes lenders cautious. Calm confidence works better.

Maintain control by:

- Exploring 2 or 3 offers before finalizing

- Avoiding unregulated lenders in panic

- Negotiating instead of accepting the first quote

7. Neglecting Post-Funding Relationship

Capital is not the end. Relationships must continue.

Keep lenders updated with:

- Quarterly financial reports

- Compliance submissions on time

- Early communication during expected cash dips

When you sidestep these red flags, you stand out as a founder who is prepared, structured, and bank-ready.

If you feel your business is close to being fund-ready but needs structure, documentation clarity, or guidance on the right funding route, working with a partner like S45 can help you move faster. S45 collaborates with MSME founders to streamline books, strengthen investor alignment, and prepare businesses for growth-focused capital.

Conclusion

Funding success comes from readiness and clarity, not luck. When your numbers make sense, records are clean, and your growth story is structured, lenders respond faster. Even if you have faced rejections earlier, you can still turn things around with consistent improvements and measurable progress.

If you are planning to raise funds soon or want to prepare your business for investment readiness, partnering with S45 can save months of trial and error.

How S45 supports MSMEs:

- Growth capital with structured funding pathways

- Financial and operational guidance for scale readiness

- Support in documentation and funding preparation

- Strategic mentorship for long-term business growth

- Access to an exclusive founder network for strategic peer insights

Ready to move forward with more confidence? Connect with us today!