Key Takeaways

- PIPE Definition: Private Investment in Public Equity (PIPE) allows listed companies to raise quick capital from private investors without going through the lengthy IPO process.

- Process Simplicity: PIPE deals involve direct negotiation, regulatory compliance under SEBI norms, and faster fund infusion compared to public offerings.

- Types of PIPEs: Common variations include Traditional, Structured, Convertible, Registered Direct Offerings (RDO), and Equity Line of Credit (ELOC), each suited to different funding goals.

- Benefits and Risks: PIPEs offer flexibility, speed, and investor access but may lead to dilution, pricing discounts, and governance challenges.

- Investor Insight: Successful PIPE deals depend on fair valuation, transparent governance, regulatory adherence, and strategic alignment between companies and investors.

Do you know how listed companies raise capital quickly without the lengthy IPO route?

Private Investment in Public Equity (PIPE) deals are now gaining traction in India and globally. These deals allow public firms to issue shares or convertible securities directly to select investors, offering speed, flexibility, and strategic access.

In 2023, PIPE deals in India surged 110% year-on-year, reaching about $8.4 billion across 111 deals.

In this guide, you will learn how PIPE functions, how it compares with IPOs, its types, advantages, and risks. You will also understand the key investor considerations and notable Indian examples.

What is Private Investment in Public Equity?

Private Investment in Public Equity (PIPE) refers to the purchase of shares or convertible securities of a publicly listed company by private or institutional investors, often at a small discount to the current market price. It’s a quicker and more flexible fundraising route than public offerings.

The main parties involved are the issuing company seeking funds, institutional or high-net-worth investors providing capital, and advisors or investment banks managing valuation, compliance, and structuring.

Key terms in PIPE deals include share price discounts, lock-in periods that restrict immediate resale, and disclosure norms under SEBI (in India) that ensure transparency. SEBI also specifies investor eligibility, minimum pricing, and approval timelines to maintain fairness in such transactions.

Companies often prefer PIPE deals when they need capital quickly, whether to repay debt, fund expansion, or strengthen their balance sheet without facing IPO delays or market volatility. Next, let’s discuss how PIPE differs from IPOs and private placements.

How is PIPE Different from IPO and Private Placement?

Every company raising capital faces a trade-off between speed, control, and compliance. Private Investment in Public Equity sits in the middle; faster than an IPO yet more structured than a private placement.

Here’s a clear comparison of how PIPE differs from both routes:

Parameter | PIPE | IPO | Private Placement |

Time to Raise Funds | Usually completed within weeks | Takes several months | Can take weeks to months |

Regulatory Requirements | Moderate SEBI compliance | Heavy SEBI and exchange scrutiny | Lower, but with investor restrictions |

Investor Access | Limited to qualified or institutional investors | Open to the public | Select group of investors |

Pricing Flexibility | Shares issued at a negotiated discount | Market-driven pricing | Negotiated between parties |

Dilution Risk | Moderate | Higher due to larger share issuance | Lower, depending on deal size |

Transparency/Disclosures | Publicly disclosed but less detailed than IPO | Full prospectus and disclosures required | Minimal disclosure, often private |

Market Impact | Mild short-term effect on stock price | High visibility and potential volatility | Minimal market reaction |

PIPE deals combine the flexibility and confidentiality of private placements with the accountability of public markets. This balance makes PIPEs an efficient route for companies needing quick, regulated capital without the lengthy IPO process. But, how does a PIPE deal actually work from start to finish?

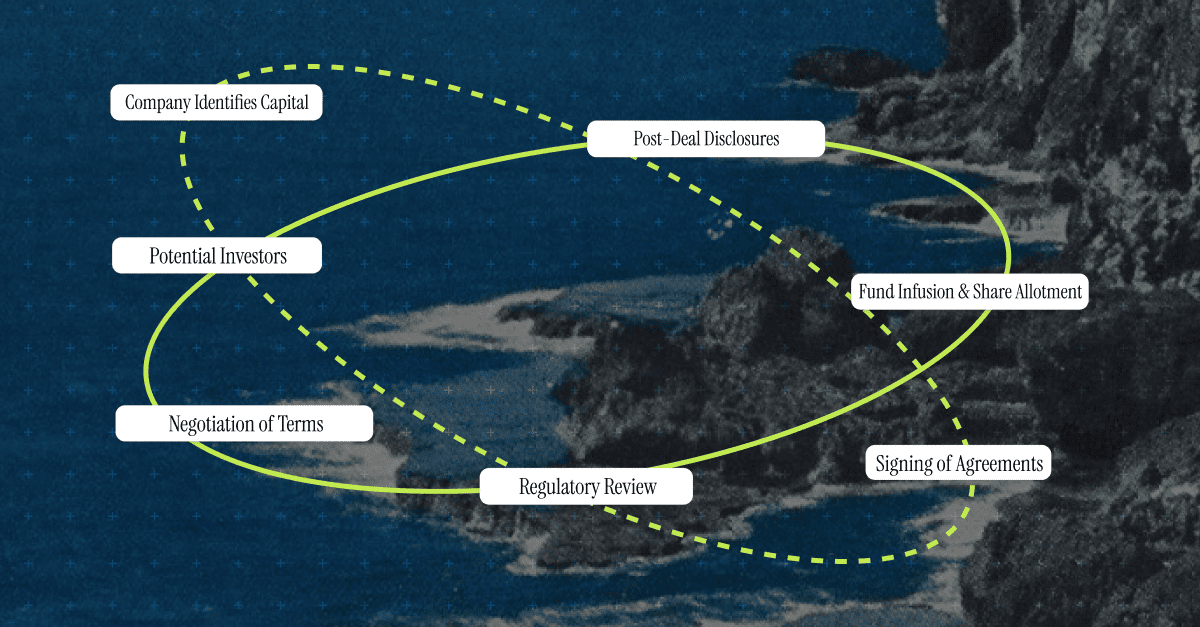

Step-by-Step Process on How Private Investment in Public Equity Works?

PIPE deals are known for their structured speed; they move fast but within clear compliance limits. Each stage involves coordination between the company, investors, and regulators to ensure transparency and fairness.

Here’s how a typical Private Investment in Public Equity works in practice:

1. Company Identifies Capital Need

The process starts when a listed company needs quick funding, often for expansion, debt reduction, or acquisitions. Management assesses the amount, timing, and preferred investor profile before initiating discussions.

2. Selection of Potential Investors

Investment banks or advisors help shortlist institutional or private investors with a history of PIPE participation. These investors bring both capital and strategic value, often through private negotiations.

3. Negotiation of Terms

Both parties agree on the investment size, pricing (usually at a discount), and rights such as board observation or conversion privileges. This stage defines the balance between funding urgency and ownership control.

4. Regulatory Review and Compliance Checks

In India, SEBI regulations mandate company board approval, shareholder consent, and filing of relevant disclosures. Compliance ensures transparency and investor eligibility before the deal can proceed.

5. Signing of Agreements

Once terms are cleared, a subscription agreement is signed. It formalizes pricing, timelines, lock-in periods, and investor commitments. Legal advisors oversee documentation to minimize post-deal disputes.

6. Fund Infusion and Share Allotment

Investors transfer funds, and the company issues shares at the agreed terms. These shares are typically listed within a defined period, making the investment visible in public markets.

7. Post-Deal Disclosures and Monitoring

The company announces the Private Investment in Public Equity details to exchanges and investors, ensuring regulatory transparency. Periodic updates maintain market trust and demonstrate effective fund use.

PIPE transactions combine the flexibility of private deals with the discipline of public investment. This efficiency has given rise to multiple deal structures customized to different funding goals, which you will see next.

Types of Private Investment in Public Equity

PIPE deals are not one-size-fits-all. Companies choose from several structures depending on funding urgency, investor profile, and dilution tolerance. Each type balances speed, control, and investor protection differently.

Here are the major types of Private Investment in Public Equity and how they work:

- Traditional PIPE

In a traditional PIPE, investors buy common equity, often at a small discount to the current market price. It’s the simplest and quickest form of PIPE, ideal for companies seeking capital without complex deal structures or additional instruments like warrants.

- Structured PIPE

A structured PIPE combines equity with instruments like preferred shares or warrants. These additions protect investors from price declines or postponed returns, drawing in those seeking longer commitments. While structured PIPEs can attract capital for extended periods, they may also increase dilution and constrain the company’s flexibility in raising funds later.

- Convertible PIPE

These investments use instruments that convert into equity later, often at a pre-agreed conversion price. It lets companies raise funds today while delaying share issuance. Investors benefit from potential price appreciation, while businesses manage short-term dilution.

- Registered Direct Offering (RDO)

An RDO is a PIPE registered with regulators, allowing resale of securities in public markets. It offers faster access to capital with greater transparency than private placements. Companies often use RDOs when they need visibility but can’t afford IPO-level timelines.

- Equity Line of Credit (ELOC)

An ELOC provides a flexible funding line from investors, enabling companies to draw capital in phases. It staged funding reduces immediate market impact and helps manage share dilution effectively. It’s especially useful for firms with predictable, recurring capital needs.

Choosing the right PIPE type can be confusing, especially when balancing speed, pricing, and investor expectations. Founders often struggle to assess which structure best supports growth without creating dilution or compliance risks. Platforms like S45 help SMEs evaluate options, align deal terms with strategy, and structure PIPEs that maintain long-term stability and flexibility.

This variety of structures makes PIPEs both flexible and complex, offering benefits and trade-offs worth considering carefully.

Advantages and Disadvantages of PIPE

Like any financing method, Private Investment in Public Equity transactions offer advantages and drawbacks. Understanding these helps companies decide whether this route aligns with their long-term goals and investor expectations.

Here’s a clear view of the key pros and cons:

Advantages of PIPE | Disadvantages of PIPE |

|

|

|

|

|

|

|

|

|

|

While PIPEs offer agility and customization, they also carry dilution and control risks that need careful management. Success lies in structuring a deal that protects shareholder value while securing timely capital, something that depends heavily on understanding the key considerations before proceeding.

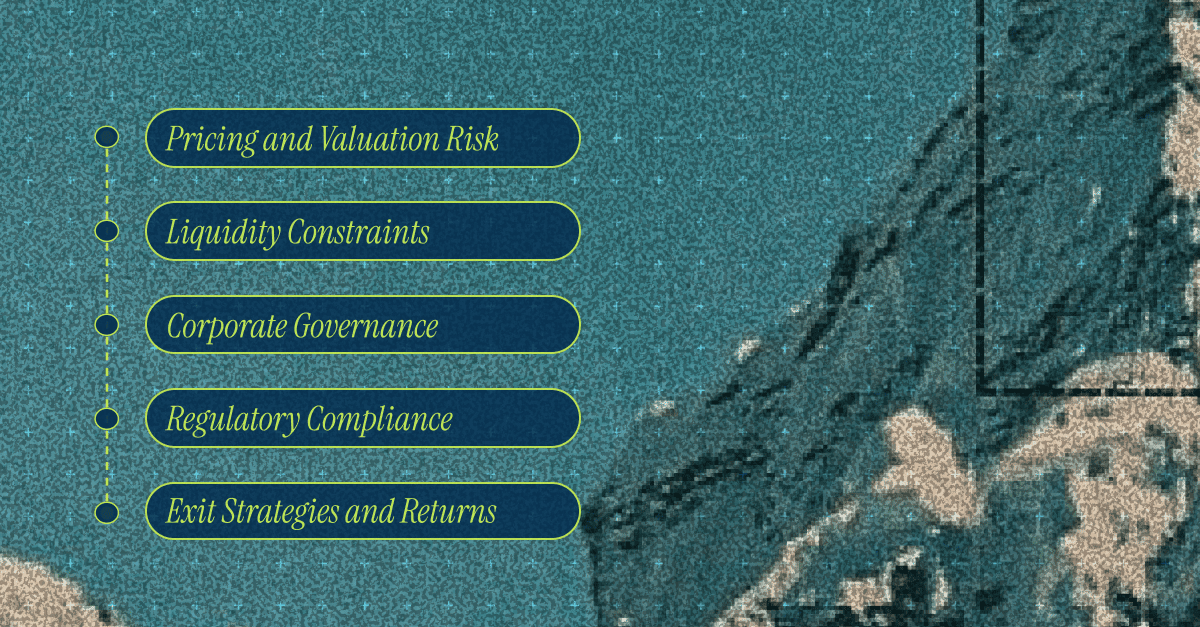

Key Considerations for Investors in PIPE Deals

Investing in Private Investment in Public Equity deals can be rewarding, but it requires a sharp eye for detail and risk management. Investors must weigh the potential for outsized returns against the challenges of illiquidity and governance.

Below are the essential factors to assess before committing capital.

- Pricing and Valuation Risk

Private Investment in Public Equity shares are often issued at a discount to the market price. While this benefits entry, it can signal a company’s urgent need for funds or market weakness. Investors must assess whether the discount justifies the risk and ensure valuations are backed by fundamentals, not short-term stock fluctuations.

- Liquidity Constraints

PIPE shares are not immediately tradable. Lock-in periods can range from months to years, depending on regulations and deal terms. It limits investors’ ability to exit quickly, making it crucial to evaluate liquidity needs and ensure the holding period aligns with portfolio goals.

- Corporate Governance

Governance quality directly impacts investment outcomes. Investors should assess board independence, management credibility, and shareholder rights before entering a Private Investment in Public Equity deal. Weak oversight or poor transparency can erode value, even if the company’s market prospects look strong on paper.

- Regulatory Compliance and Disclosures

Private Investment in Public Equity transactions must comply with securities laws, insider trading rules, and stock exchange guidelines. Investors must confirm that the issuing company follows all disclosure norms to avoid regulatory scrutiny or post-deal complications. Due diligence here ensures long-term credibility and legal safety.

- Exit Strategies and Returns

Unlike open-market investments, PIPE exits depend on resale restrictions, market conditions, and conversion timelines. Investors should map out potential exit routes, such as stock sales post-lock-in or conversion events, and estimate realistic returns under varying market scenarios.

Sophisticated investors must balance high-return opportunities with the inherent risks of illiquidity, valuation, and governance. Now, let’s discuss some real-world examples of PIPE deals.

Notable Examples of PIPE-style Deals in India

Private placements into listed companies in India often take forms such as rescue capital injections, preferential allotments, or QIPs. These PIPE-style deals move fast and bring large private investors into public firms.

The following verified Indian examples illustrate key structures and outcomes.

1. Yes Bank — 2020 capital injection (recapitalization)

In March 2020, a consortium led by the State Bank of India, along with ICICI Bank, HDFC, Axis Bank and other private lenders, took part in a structured capital plan for Yes Bank following its near-collapse. The RBI-backed restructuring package raised about $1.34 billion in fresh capital from the consortium and other investors.

2. Adani portfolio primary equity transactions (2022–2023) — large private placements

Between 2022 and 2023, Adani group companies completed several large private/strategic equity transactions with global institutional investors.

For example, in early 2022, International Holding Company (IHC) invested roughly $2 billion into the Adani green portfolio, and in 2023, GQG Partners and other institutions participated in primary equity transactions that together raised billions of rupees across Adani listed entities.

3. RBL Bank / other institutional placements (2024 example of private placement / QIP activity)

In mid-2024, RBL Bank announced plans to raise up to $779 million through institutional placements (a mix of QIP and private debt placement). While this uses the QIP/private placement route, it follows the same practical purpose as PIPE deals: quick capital from institutional backers without an open public offering.

India’s market often uses instruments labelled QIP, preferential allotment, or institutional placement to achieve the same objective that U.S. markets call a PIPE. Now, let’s discuss how platforms like S45 can help SMEs with PIPE deals.

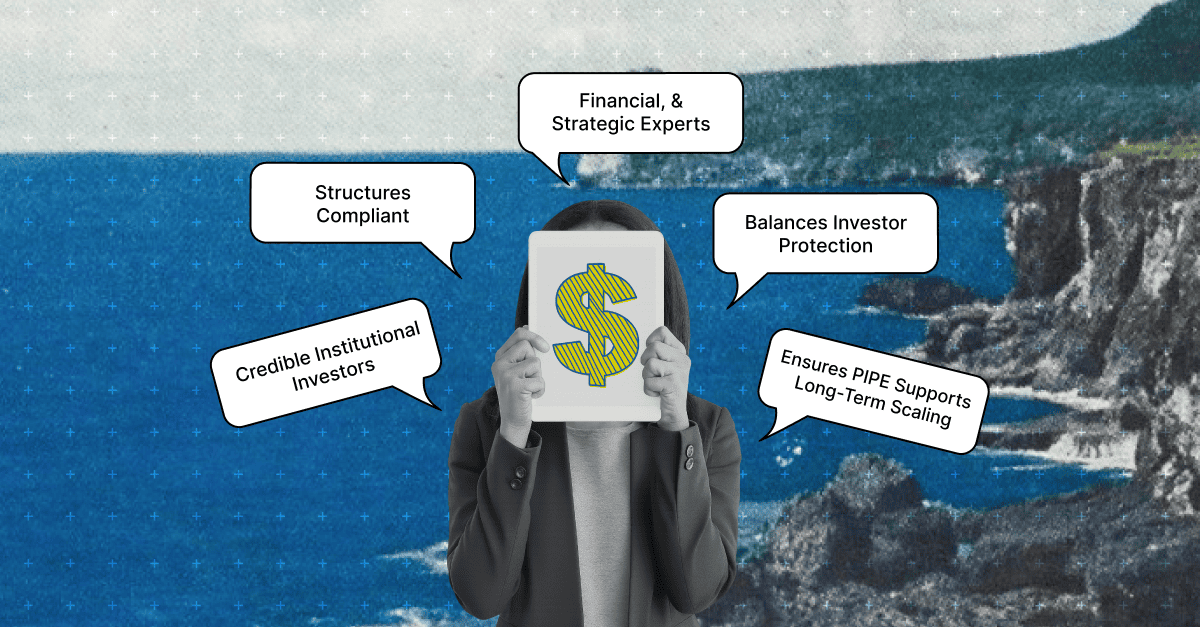

How S45 Supports Businesses with PIPE Deals?

For high-performing SMEs with ₹100 Cr+ revenue or ₹10 Cr+ profit, S45 acts as a strategic growth partner. We connect ambitious founders with institutional investors, advisors, and industry experts to structure smarter funding deals, including Private Investment in Public Equity (PIPE).

Here’s what S45 brings to your table:

- Connects companies with credible institutional investors: Cover the gap between growing businesses and vetted institutional investors through our curated network, ensuring access to high-quality capital partners aligned with long-term vision.

- Structures compliant, transparent PIPE deals: Get expert-led support to design SEBI-compliant deal structures, manage disclosures, and simplify documentation, thereby reducing regulatory complexity for founders.

- Provides access to legal, financial, and strategic experts: SMEs can connect to top-tier advisors who handle valuation, due diligence, and negotiations, ensuring deals are both fair and future-ready.

- Balances investor protection with company growth needs: Through balanced term sheets and structured agreements, S45 helps founders retain strategic control while building investor confidence.

- Ensures PIPE supports long-term scaling, not short-term fixes: Our experts encourage capital deployment that strengthens business fundamentals, helping companies achieve sustainable growth beyond immediate funding rounds.

Raising capital is complex, but you don’t have to do it alone. Join the S45 Club for Founders, connect with like-minded leaders, and learn how strategic Private Investment in Public Equity investments can accelerate your next growth phase.

Conclusion

Private Investment in Public Equity (PIPE) offers listed companies and growing SMEs a faster, more flexible way to raise funds without the delays of public offerings. It involves direct investment from institutional or accredited investors, structured through negotiated terms and regulatory compliance.

When used wisely, PIPE combines the advantages of liquidity, strategic partnerships, and rapid capital infusion, though it carries risks like dilution and pricing pressure.

The true strength of a PIPE deal lies in thoughtful planning, transparency, and collaboration with experienced investors and advisors. When structured around long-term goals, it covers short-term funding gaps and strengthens market credibility and growth potential.

For ambitious founders aiming to scale responsibly, the question isn’t whether to consider PIPE, but how to execute it effectively. Is your business ready for that level of structured growth? Connect with our experts at S45 Club and receive smart capital solutions personalized for India’s top-performing SMEs.