At a glance

- Finding private investors for traditional MSMEs isn’t as hard as it seems; you just need to know where to look.

- Beyond VCs, firms like ChrysCapital and Aavishkaar actively back manufacturing and service-based businesses.

- Clean financials, steady cash flow, and clear growth stories attract serious investors.

- The right partner brings not just capital, but expertise, networks, and long-term alignment.

- Want to scale without losing control? s45 helps MSME founders connect with these investors and secure capital without losing control.

Important Disclaimer: This content is for educational and informational purposes only and does not constitute financial, investment, tax, or legal advice.

You've built a profitable manufacturing, trading, or service business that’s been generating steady revenue for years. You know your market, have weathered economic cycles, and created something sustainable. But now, you’ve hit a ceiling.

Your machinery needs upgrading. Competitors are automating. Export opportunities are knocking, but working capital is tight. You need capital to scale, and more importantly, the right investors who understand businesses like yours.

But when you search for "private investors in India," you're flooded with articles about venture capitalists funding tech startups. But how do you know which one is best for you? The truth is, there’s a whole world of private investors actively seeking traditional MSMEs; they’re just harder to find.

In this guide, we will help you find your suitable investors.

10 Private Investors in India for Traditional MSMEs

Below is a strategic mix of both institutional PE firms and individual investors who genuinely understand traditional businesses. These investors work with companies that have real assets, cash flows, and multi-decade track records.

1. ChrysCapital

It is a Private Equity Firm.

- Investment Focus: Mid-market companies across consumer, financial services, healthcare, infrastructure, manufacturing, and pharmaceuticals

- Why They Matter for MSMEs: One of India's most established PE firms with over $4 billion under management, ChrysCapital has a proven track record with traditional businesses. They invested in Mankind Pharma and Hero FinCorp, companies with strong fundamentals rather than tech buzz.

- Typical Deal Size: ₹100-500 crore

- Investment Stage: Growth and expansion stage

- What They Bring: Operational expertise, M&A support, and access to institutional management practices

- Best Fit For: Profitable businesses with ₹50+ crore revenue looking to scale regionally or nationally, especially in pharma, manufacturing, and financial services.

2. Kunal Shah (CRED Founder)

He is an individual angel investor

- Investment Focus: Fintech, consumer behavior-driven businesses, SaaS

- Why He Matters for MSMEs: While primarily known for tech investments, Kunal Shah's deep understanding of consumer behavior and business model innovation makes him valuable for MSMEs digitizing or reimagining customer experiences.

- Typical Investment Size: ₹50 lakh - ₹5 crore

- Investment Stage: Seed to early growth

- What He Brings: Consumer psychology expertise, product thinking, and access to fintech/payment infrastructure through CRED

- Best Fit For: MSMEs building direct consumer relationships, businesses with unique loyalty models, or traditional businesses adding innovative fintech elements.

3. Everstone Capital

This is a private Equity Firm

- Investment Focus: Consumer, healthcare, industrials, logistics, and financial services

- Why They Matter for MSMEs: Everstone has over $5 billion in assets and a specific focus on India and Southeast Asia. They've backed Burger King India and manufacturing companies, showing an appetite for both consumer brands and industrial businesses

- Typical Deal Size: ₹150-600 crore

- Investment Stage: Growth capital and buyouts

- What They Bring: Strong consumer sector expertise, supply chain optimization, and exit execution capabilities

- Best Fit For: Consumer-facing businesses, food processing units, logistics companies, and manufacturing firms with potential for regional expansion.

4. Ascent Capital

This is a private equity firm.

- Investment Focus: Small and medium enterprises, agribusiness, manufacturing

- Why They Matter for MSMEs: Ascent specifically targets the ₹20-150 crore revenue segment, exactly where most MSMEs sit. They typically take controlling or significant minority stakes and work hands-on with management.

- Typical Deal Size: ₹25-150 crore

- Investment Stage: Growth and expansion

- What They Bring: Board-level strategic guidance, operational improvements, and access to debt financing

- Best Fit For: Family-owned businesses ready for professionalization, agri-processing units, and manufacturing companies needing capacity expansion.

5. Kunal Bahl (Snapdeal Co-founder)

He is an individual angel investor

- Investment Focus: E-commerce, consumer brands, supply chain, logistics

- Why He Matters for MSMEs: Co-founder of Titan Capital and an active angel with 150+ investments, including Ola, Razorpay, and Urban Company. He understands scaling businesses in Indian market conditions and supply chain complexities.

- Typical Investment Size: ₹1-8 crore

- Investment Stage: Seed to Series A

- What He Brings: E-commerce expertise, supply chain optimization knowledge, and an extensive founder network

- Best Fit For: D2C brands, manufacturing businesses going direct-to-consumer, logistics and supply chain businesses, and companies leveraging digital channels for traditional products.

6. Aavishkaar Capital

This is an impact-focused private equity firm.

Investment Focus: Businesses serving rural and semi-urban markets; social enterprises

- Why They Matter for MSMEs: Unlike conventional PE firms, Aavishkaar specifically targets businesses that benefit underserved communities. If your MSME provides rural employment or serves Tier 3+ markets, they're worth approaching.

- Typical Deal Size: ₹10-100 crore

- Investment Stage: Early growth to the expansion stage

- What They Bring: Patient capital, impact measurement frameworks, and networks in rural market development

- Best Fit For: Agri-businesses, rural distribution networks, affordable products/services, and companies with strong social impact alongside profitability.

7. Anupam Mittal (Shaadi.com Founder)

He is an individual angel investor

- Investment Focus: Consumer internet, D2C, services marketplaces

- Why He Matters for MSMEs: Founder of People Group and Shark Tank India judge, Anupam, has invested in 50+ startups, including Ola and Bigbasket. He understands building profitable, sustainable businesses in India's unique market dynamics.

- Typical Investment Size: ₹50 lakh - ₹5 crore

- Investment Stage: Seed to early growth

- What He Brings: Brand-building expertise, consumer market insights, media visibility, and digital marketing knowledge

- Best Fit For: Consumer-facing businesses, service aggregators, D2C brands, and MSMEs building strong brand equity in competitive markets.

8. TVS Capital Funds

This is a corporate-backed private equity firm.

- Investment Focus: Consumer brands, healthcare, financial services

- Why They Matter for MSMEs: Backed by the respected TVS Group, this firm brings both capital and decades of business-building experience. They invested in MedPlus and Nykaa, showing patience with businesses building sustainable models.

- Typical Deal Size: ₹50-300 crore

- Investment Stage: Growth stage

- What They Bring: TVS Group's operational expertise, regional market knowledge (especially South India), and strategic networks

- Best Fit For: Consumer brands with regional strongholds, healthcare businesses, and companies looking for strategic investors who think long-term.

9. InvAscent

This is a private Equity Firm

- Investment Focus: Healthcare, life sciences, specialized manufacturing

- Why They Matter for MSMEs: InvAscent focuses specifically on healthcare and specialized manufacturing sectors, where MSMEs often have deep technical expertise but need capital for scaling.

- Typical Deal Size: ₹30-200 crore

- Investment Stage: Growth and expansion

- What They Bring: Healthcare sector expertise, regulatory navigation support, and connections with larger healthcare networks

- Best Fit For: Medical device manufacturers, pharmaceutical companies, diagnostic services, and healthcare IT businesses.

10. Sanjay Mehta (100X.VC Founder)

He is an individual angel investor & micro VC

- Investment Focus: Early-stage startups across sectors, including traditional business models with tech integration

- Why He Matters for MSMEs: Founder of 100X.VC and member of Indian Angel Network, Mumbai Angel Network, and Venture Nursery. He has invested in 17+ companies, including OYO Rooms and CoinDCX, and typically spends 5-7 years with portfolio companies.

- Typical Investment Size: ₹50 lakh - ₹3 crore

- Investment Stage: Seed to Pre-Series A

- What He Brings: Hands-on mentorship, technology advisory, and connections with CIOs/CTOs for B2B businesses

- Best Fit For: MSMEs integrating technology into operations, B2B service businesses, and companies needing technical advisory alongside capital.

You've seen the list of investors. You know who they are and what they focus on. At s45, we help founders assess which type of investor makes sense for their specific stage, sector, and growth objectives, then facilitate warm introductions based on strategic fit.

But here's the uncomfortable truth most articles skip: knowing which investors to approach matters far less than being genuinely ready for their scrutiny.

What Investors Really Evaluate in MSMEs

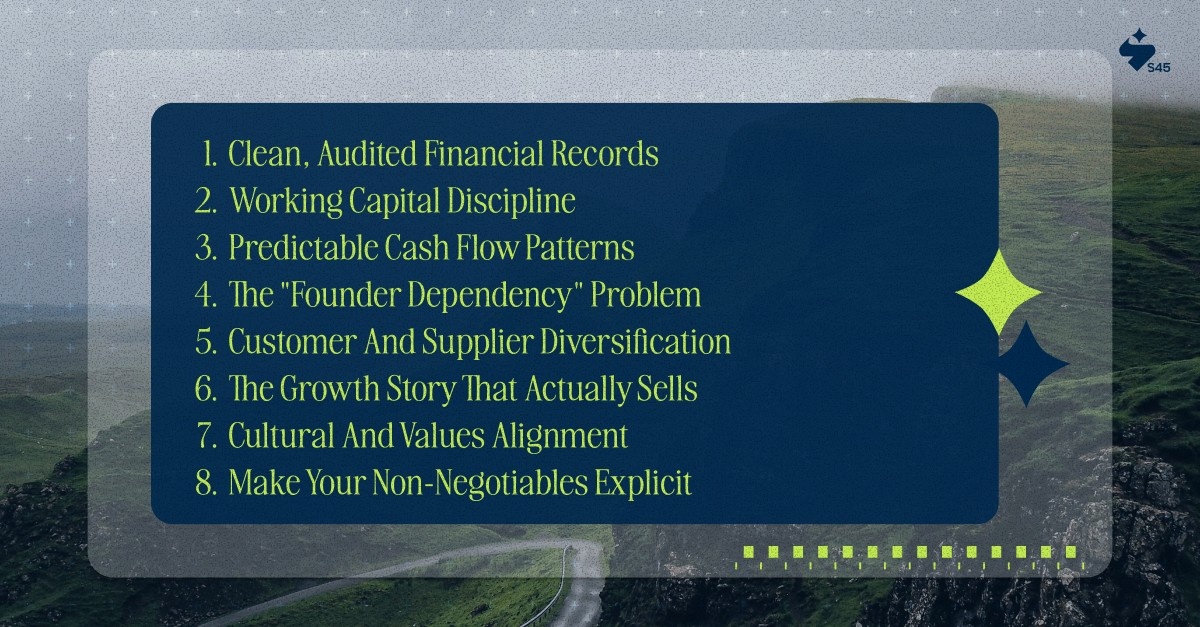

Every week, profitable MSMEs with strong fundamentals get rejected—not because their businesses aren't good, but because they haven't prepared for what investors actually evaluate. Here's what investors actually look for:

1. Clean, Audited Financial Records

Audited statements for the last three years are a must. Investors look for consistency, trends, and potential red flags. Your financials must be clear, with separate personal and business finances.

If your CA has been hiding real economics to minimize tax liability, it’s time to adjust. Aggressive tax planning is acceptable, but opaque financials aren’t.

2. Working Capital Discipline

Investors closely monitor three key metrics:

- Days Sales Outstanding (DSO): Time taken to collect payments

- Days Inventory Outstanding (DIO): The Time inventory stays before being sold

- Days Payable Outstanding (DPO): Time taken to pay suppliers

Messy working capital, where you're funding your customers while suppliers tighten their terms, is a red flag. It signals cash flow issues, making growth risky.

3. Predictable Cash Flow Patterns

Unpredictability is a deal-breaker. If your cash flow is seasonal or project-based, you must explain the pattern. Demonstrate why certain periods are stronger, e.g., "Q4 always performs well" or "Government contracts pay out in month 6."

4. The "Founder Dependency" Problem

If you, the founder, are central to all key customer relationships and operational decisions, investors will be concerned about "key person risk." They need to see:

- SOPs for Critical Functions: Document key processes so others can follow without you.

- Second-Line Leadership: Have managers who can run the business without you.

5. Customer and Supplier Diversification

A handful of clients shouldn’t account for the bulk of your revenue. Similarly, relying on one supplier makes you vulnerable. Investors want to see diversity in both customers and suppliers.

6. The Growth Story That Actually Sells

Investors want a credible growth plan. Be specific:

- Weak growth story: "We’ll expand nationally and hit ₹200 crore in 3 years."

- Strong growth story: "We’re at ₹50 crore with 65% market share in Karnataka. We’ll replicate this in Tamil Nadu and Maharashtra, where we’ve secured distributors and tested the market."

Your story needs to show specific actions, expansion, product extension, and operational improvements that lead to measurable growth.

7. Cultural and Values Alignment

Aligning with the right investor is crucial. If your business values employee welfare, environmental responsibility, or quality, ensure your investor respects these values. Misalignment can lead to friction post-investment.

8. Make Your Non-Negotiables Explicit

Be clear about what you won’t compromise on:

- "We maintain a no-layoff policy."

- "Our quality standards come with higher COGS, but they’re key to customer loyalty."

Good investors will respect your values. Bad ones will try to "fix" them.

The right investor respects your non-negotiables. If certain employment practices, community ties, or quality standards are central to your business, make them clear in the investment agreement. The wrong investor may prioritize short-term gains over long-term sustainability, which is why aligning values from the start is essential.

Who Actually Invests in Traditional Businesses?

Not all private investors are the same, and this is where many MSME founders go wrong. The term "private investor" covers a range of entities with different investment goals, timeframes, and value propositions.

Here’s who actually invests in traditional businesses:

1. Private Equity Firms with MSME/Manufacturing Focus

These institutional investors target established, profitable businesses with:

- ₹10-100 crore in annual revenue

- Positive EBITDA and proven profitability

- Opportunities for operational improvements

- Potential for 2-3x growth in 3-5 years

What they bring: Capital, operational expertise, process optimization, market access, and professionalization support.

The catch: They usually seek significant ownership (26-51%) and board representation.

2. Impact Investors and ESG-Focused Funds

These investors focus on businesses that deliver financial returns and social or environmental impact. They are ideal if your MSME:

- Provides rural or semi-urban employment

- Practices sustainable manufacturing

- Serves underserved customers

- Contributes to local economic growth

What they bring: Patient capital with longer investment horizons (7-10 years), often at slightly lower returns in exchange for impact.

3. Family Offices

Ultra-high-net-worth families managing their wealth may invest directly in businesses. They tend to be more patient, flexible with governance, and can act quickly.

- The advantage: They think generationally, making them great partners for succession or legacy preservation.

- Finding them: They prefer privacy and typically invest through networks, referrals, and intermediaries. This is where organizations like s45 become valuable, connecting founders with the right investor profiles based on sector, scale, and strategic fit.

4. Strategic Investors (Corporations)

Larger companies within your industry or supply chain may invest in complementary businesses.

- What they bring: Immediate market access, technical expertise, and often guaranteed off-take agreements.

- The consideration: Evaluate potential lock-in clauses and exclusivity agreements that may limit relationships with competitors.

Understanding these investor types is key. But to effectively engage them, you’ll need to understand what they look for when evaluating MSMEs.

Once you're ready, the next step is to identify who to approach. Let’s explore the specific investors who actively work with traditional MSMEs.

Your Next Move: Turning Insight into Action

Private investors aren’t just for tech startups. There’s significant capital available for profitable, established MSMEs in sectors like manufacturing, trading, and services, the backbone of India’s economy.

The key is finding investors who understand your business, respect your vision, and offer not just funding, but operational expertise and access to valuable networks to help you scale.

s45 partners with MSME founders like you, guiding them through the investment journey, from assessing investment readiness to connecting with the right investor profiles and structuring deals that preserve your vision while fueling growth. We work specifically with founders in traditional businesses who need capital and expertise, not just funding.

If you're building something meaningful and ready to scale to the next level, connect with s45 to explore how strategic private investment could accelerate your journey while preserving your legacy.