Startups drive innovation and growth, but securing funding can be a major challenge. Traditional methods like bank loans or venture capital often come with rigid terms, high-interest rates, or equity loss. For many young companies, these barriers can hinder access to necessary capital.

Enter Revenue-Based Financing (RBF), an alternative that provides flexibility and control. Unlike traditional funding, RBF allows startups to secure capital based on future revenue projections, without giving up equity or adhering to rigid repayment schedules. It’s quickly becoming a popular choice for startups seeking non-dilutive, performance-based financing.

Key Takeaways

- Revenue-based finance gives startups fast, flexible capital without giving up equity or control—ideal for growth-ready businesses like SaaS and e-commerce.

- Repayments align with revenue performance, so you pay more when you earn more and less during lean months—protecting cash flow and ensuring repayment comfort.

- No collateral, quick approvals, and capped repayments make RBF founder-friendly, offering predictable costs and financial peace of mind.

- Best suited for startups with consistent revenue streams, RBF helps fuel marketing, hiring, and product expansion without dilution or complex investor negotiations.

- With partners like S45 Club, startups gain more than funding—access to strategic capital, expert mentorship, and a roadmap to sustainable, scalable growth.

What is Revenue-Based Financing?

Revenue-Based Financing (RBF) is a modern funding option that allows businesses to secure capital based on their future revenue. Instead of relying on traditional debt or equity financing, RBF offers an alternative that aligns with the company’s performance. Essentially, a business receives capital upfront and agrees to repay the funding through a percentage of its monthly revenue until a specified multiple of the original funding amount is paid back.

Comparison with Traditional Debt and Equity Financing

Feature | Traditional Debt Financing | Equity Financing | Revenue-Based Financing (RBF) |

Repayment Structure | Fixed monthly payments, regardless of revenue | No repayment, equity holders get returns based on business performance | Percentage of revenue, varying with business performance |

Ownership Impact | No loss of ownership, but may require collateral | Equity is sold, giving up ownership | No loss of ownership; non-dilutive |

Flexibility | Rigid, fixed payments | Flexible, but control is relinquished | Flexible payments based on revenue |

Access to Capital | Slow approval process | Often lengthy due to investor negotiations | Quick approval and access to funds |

Eligibility Requirements | Requires a strong credit history and collateral | Requires high growth potential and willingness to give up control | Requires predictable revenue streams, not based on credit or collateral |

Risk to Business | Fixed payments regardless of performance | Loss of control and decision-making power | Lower financial strain due to variable repayments |

Key Features of Revenue-Based Financing

Revenue-Based Financing (RBF) stands out for its startup-friendly structure, offering funding without forcing founders to give up ownership or face rigid repayment terms. Here’s a closer look at its key features:

- Non-Dilutive: With RBF, startups do not have to give up equity or ownership of their company. This ensures the entrepreneurs retain full control over their business decisions, unlike equity financing, which requires giving up a portion of ownership.

- Flexible Repayments: Repayment terms in RBF are tied to the business’s revenue. A fixed percentage of the company’s monthly revenue is used for repayments, which means payments are higher when revenue is strong and lower when revenue decreases.

- Quick Access to Capital: RBF typically offers a faster, more streamlined process compared to traditional loans or venture capital. Startups can access the funds they need quickly, enabling them to seize opportunities or address challenges without lengthy delays.

How Does Revenue-Based Financing Work?

Revenue-Based Financing (RBF) is a unique and flexible approach to funding that links repayments to a business’s revenue performance. This method offers startups a way to secure capital without the constraints of traditional debt or equity financing.

Let’s explore the step-by-step process of how RBF works, the repayment structure, and key elements like repayment caps and duration.

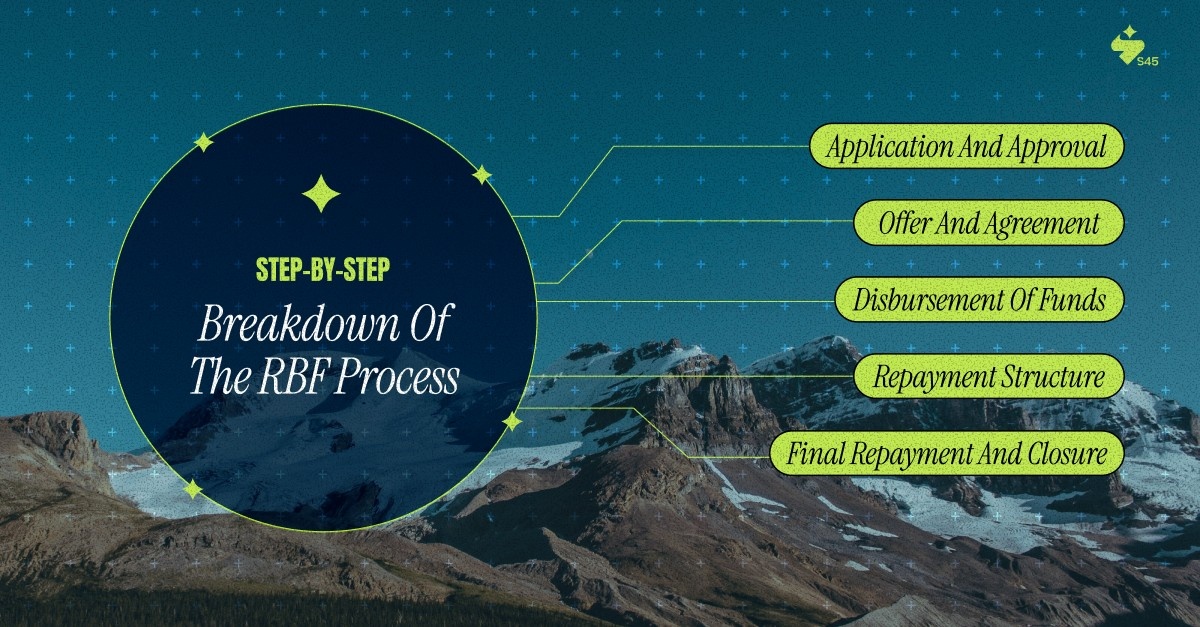

Step-by-Step Breakdown of the RBF Process

Understanding the RBF process is crucial for any startup considering this form of financing. Here's a breakdown of each step, from application to repayment, to give you a clear idea of how it works in practice.

- Application and Approval: The process begins when a business applies for funding. RBF lenders evaluate the company’s historical revenue data, typically over the last 6–12 months, to assess the business's revenue potential. Based on this data, the lender determines the amount of capital that can be provided.

- Offer and Agreement: Once the business is approved, the lender presents an offer detailing the amount of capital available and the repayment terms. These terms include the percentage of monthly revenue that will be used to repay the loan and the total repayment cap, which is usually a multiple of the original loan. Both parties agree on these terms before disbursal.

- Disbursement of Funds: After the agreement, the funds are disbursed in a lump sum to the business. This capital can be used for various operational needs, such as product development, marketing campaigns, or hiring new staff.

- Repayment Structure: Repayments are made monthly, based on a fixed percentage of the business’s revenue. This percentage, known as the “repayment percentage,” is agreed upon during the contract. If the business generates more revenue, repayments increase, and if revenue drops, repayments decrease accordingly.

- Final Repayment and Closure: Once the business has repaid the total amount due, the RBF agreement ends. The repayment amount is capped, so the business will never pay more than the agreed-upon multiple of the original loan, even if it repays more quickly due to strong revenue months.

Example Illustrating Repayment Structure Based on Revenue Percentages

To make the RBF repayment structure easier to understand, let's go through a real-life example. This will help you visualize how repayments fluctuate with monthly revenue and how the loan term varies based on performance.

- Initial Capital Provided: $100,000

- Repayment Cap (Amount to be repaid): $120,000 (1.2x the original loan amount)

- Revenue Percentage for Repayment: 5%

Monthly Revenue:

- If the business generates $50,000 in revenue for the month, it would pay 5% of this amount towards the loan:

Repayment for the month = $50,000 * 5% = $2,500

Duration of Repayment:

- At this rate, it would take approximately 48 months (4 years) to repay the loan, assuming the monthly revenue remains constant at $50,000.

- If the business experiences higher-than-expected revenue (e.g., $100,000), the repayment would increase to $5,000 per month, shortening the repayment period.

- If the business has a down month with lower revenue (e.g., $30,000), the repayment would drop to $1,500, extending the repayment period.

Early Repayment Scenario:

- If, after 18 months, the business has generated higher-than-expected revenue and repaid $60,000 of the loan, the remaining balance would be $60,000. The business would continue repaying based on its revenue until the remaining amount is paid off.

How Repayment Caps and Duration Work in RBF?

Understanding the concept of repayment caps and duration is essential to grasping the full benefits of RBF. These elements give startups both flexibility and assurance, knowing that the total amount to be repaid is capped and the repayment duration is based on their ability to pay.

Repayment Cap:

- The repayment cap refers to the total amount the business agrees to pay back, which is typically a multiple of the original loan. For instance, if the business borrows $100,000, the repayment cap might be $120,000, meaning the company would repay $120,000 in total over the course of the loan.

- This cap is a key feature of RBF because it provides a predictable limit to how much the company will owe, regardless of the duration or how quickly it repays.

Duration:

- The duration of repayment in RBF is flexible and tied directly to the business's revenue. The repayment period can range from several months to a few years, depending on the company's performance.

- When revenue is higher, the business can pay off the loan more quickly, whereas slower periods extend the repayment schedule. The loan is paid off as soon as the repayment cap is met, regardless of how long it takes.

RBF’s flexibility makes it especially appealing for businesses with seasonal or fluctuating revenue, as it reduces the financial burden during slower periods while allowing for quicker repayment when the business is doing well.

Advantages of Revenue-Based Financing for Startups

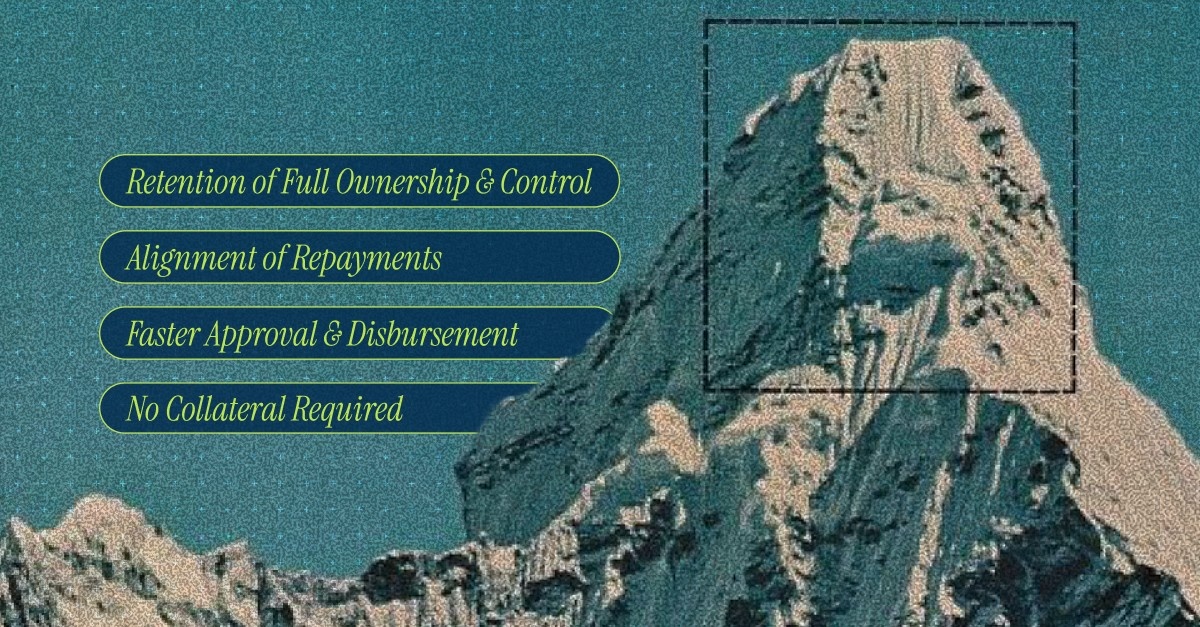

Revenue-Based Financing (RBF) offers several benefits that make it an attractive funding option for startups. Below are the key advantages that can help businesses grow without sacrificing ownership or facing rigid financial constraints.

- Retention of Full Ownership and Control: With RBF, founders keep 100% ownership of their company, unlike equity financing, which dilutes shares. This ensures entrepreneurs maintain full control over decisions and the direction of their business.

- Alignment of Repayments with Business Performance: Repayments are tied to monthly revenue, allowing flexibility. Businesses pay more during high-revenue months and less during slower periods, making cash flow management much easier.

- Faster Approval and Disbursement Compared to Traditional Loans: RBF offers a quicker and simpler approval process, often providing funds within days. This speed helps startups act swiftly on growth opportunities or urgent challenges.

- No Collateral Required: RBF funding is based on future revenue, not physical assets. This makes it ideal for startups that lack significant collateral but have strong growth potential.

Potential Drawbacks to Consider

While Revenue-Based Financing (RBF) offers numerous advantages, there are also some potential drawbacks that startups should carefully consider before opting for this type of funding. Here are a few challenges associated with RBF:

- Higher Cost of Capital Compared to Traditional Loans: RBF often carries a higher overall cost than traditional loans or credit lines. Since repayments are capped at a multiple of the initial funding amount, the total borrowing cost can be greater than standard debt financing.

- Requirement for Consistent and Predictable Revenue Streams: RBF works best for companies with steady, predictable revenues. Startups with fluctuating or uncertain income may find it harder to qualify, as lenders base terms on reliable future revenue projections.

- Impact on Cash Flow During Periods of Low Revenue: Even though repayments adjust with revenue, a percentage is still due each month. During slower periods, this can pressure cash flow, as even smaller payments may affect a company’s ability to manage other operational expenses.

Leading Revenue-Based Financing Platforms in India

Revenue-Based Financing (RBF) is gaining momentum as an effective funding model for startups. Here are some leading platforms offering RBF solutions, both globally and in India.

1. S45 Club

S45 Club helps MSMEs in India access growth capital and strategic guidance.

- S45 Club focuses on empowering MSMEs in India by providing structured capital and strategic guidance.

- They offer non-dilutive, flexible funding options, including Revenue-Based Financing, tailored for businesses poised for high growth.

- S45 Club supports companies aiming to scale into India's next blue-chip giants, offering both capital and expert strategic direction to foster long-term succes

2. Klub

Klub provides businesses with adaptable, founder-friendly funding solutions.

- Provides non-dilutive funding to businesses across sectors.

- Offers customized repayment structures based on cash flow patterns.

3. Velocity

Velocity specializes in quick funding solutions for e-commerce businesses.

- Targets e-commerce businesses with quick capital disbursement.

- Known for fast funding approval within 7–10 days.

4. Recur Club

Recur Club supports companies with recurring revenue models to scale efficiently.

- Focuses on businesses with recurring revenue models.

- Partners with banks to provide reliable, non-dilutive funding.

5. Clearco

Clearco leverages data to provide capital to high-growth digital businesses.

- Focuses on e-commerce and SaaS businesses.

- Uses a data-driven approach to offer capital based on business performance.

Also Read: Business Advisory Council: Key Functions and Benefits

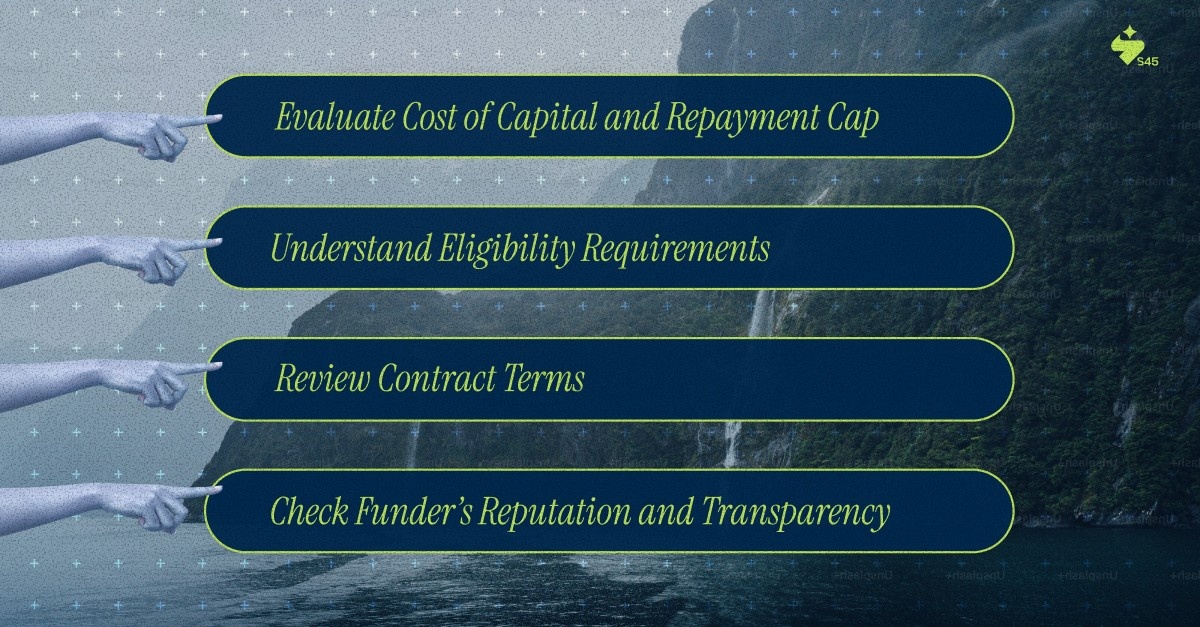

Key Considerations Before Choosing Revenue-Based Financing (RBF)

Revenue-Based Financing (RBF) can be an excellent option for startups, but it’s important to carefully evaluate several key factors before committing. Here are the most important considerations to keep in mind:

1. Evaluate Cost of Capital and Repayment Cap

Before diving into RBF, it’s essential to understand the financial implications. The cost of capital and the repayment cap can significantly impact your overall financial health, so it’s important to assess these aspects carefully.

- Cost of Capital: RBF generally comes with a higher cost compared to traditional loans, so it's crucial to evaluate the total cost of borrowing, including the repayment cap, which is usually a multiple of the loan amount.

- Repayment Cap: Ensure that the repayment cap aligns with your business projections and doesn’t result in an overwhelming financial burden in the long term.

2. Understand Eligibility Requirements

Each RBF provider has different criteria for eligibility, so it’s important to understand what is required to qualify. Meeting these requirements will help you decide if RBF is a viable option for your business.

- Revenue Streams: RBF typically requires a business to have consistent and predictable revenue, often from subscription-based or recurring models.

- Growth Potential: Many providers also assess a business’s growth trajectory to determine if it’s a good fit for RBF, so ensure your business meets these criteria before applying.

3. Review Contract Terms (e.g., Revenue Share %, Repayment Multiple)

The contract terms can vary widely between providers, so it’s critical to review the specific conditions that will affect your repayments. Understanding these terms upfront will prevent any surprises down the road.

- Revenue Share Percentage: This is the percentage of your monthly revenue that will go towards repaying the loan. Ensure this percentage is manageable within your cash flow.

- Repayment Multiple: Understand how much you will repay in total, as the repayment cap is typically a multiple of the original loan amount, which can significantly impact your financial plans.

4. Check Funder’s Reputation and Transparency

Choosing the right provider is key to a smooth RBF experience. Make sure to thoroughly research the provider’s reputation and ensure they operate with transparency.

- Reputation: Look for reviews and testimonials from other businesses to gauge the provider's reliability and service quality.

- Transparency: Ensure the provider is transparent about all fees, terms, and conditions. A trustworthy provider should have no hidden charges and should clearly explain all aspects of the agreement.

By considering these factors, you’ll be in a stronger position to make an informed decision and choose the right Revenue-Based Financing option for your business.

Take Your Startup to the Next Level with S45 Club’s Strategic Support

As a startup, finding the right support to scale efficiently can be challenging. That's where S45 Club comes in. They provide not only Revenue-Based Financing (RBF) but also the strategic capital and expert guidance that can accelerate your business growth. Watch this video to see how S45 Club can empower your startup:

Watch the video: S45 Club OverviewIn this video, you’ll discover how S45 Club helps startups leverage capital for sustainable growth.

S45 Club's Role in Your Startup’s SuccessS45 Club helps startups access the right capital and guidance to scale efficiently, combining financial support with expert strategic advice.

- Strategic Capital Access: Provides tailored financing solutions to fuel high-growth startups.

- Expert Guidance: Offers industry insights from experts in investment banking, private equity, and fintech to ensure smart growth.

- Empowering MSMEs: Supports MSMEs in scaling into India’s next-generation blue-chip companies.

- Personalized Support: Combines technology and dedicated advisors to deliver customized guidance for sustainable growth.

For more information on how S45 Club can fuel your startup's growth and provide strategic support, visit S45 Club.

Conclusion

Revenue-Based Financing (RBF) offers startups a flexible, non-dilutive funding option that aligns with their revenue performance, allowing businesses to grow without giving up ownership or taking on heavy debt. While RBF provides key benefits such as flexible repayments, quick access to capital, and retention of full control, it's important to carefully evaluate the cost of capital, eligibility requirements, and contract terms before moving forward.

At S45 Club, we go beyond funding, offering strategic capital, expert guidance, and personalized growth support to help your startup scale sustainably and confidently.

Ready to unlock your growth potential? Book your consultation with S45 Club today and discover how revenue-based finance can power your next stage of success.