You’ve spent months refining your pitch deck, endured tough due diligence, and finally received the term sheet; capital is on the way. But here’s the question most MSME founders never ask: Is your venture capital fund compliant with SEBI regulations?

It may sound bureaucratic, even unnecessary, but in 2025, this question can define your startup’s future. SEBI now requires all legacy Venture Capital Funds (VCFs) to shift to the Alternative Investment Fund (AIF) framework, yet nearly 130 of 179 registered VCFs remain non-compliant or inactive.

Understanding SEBI’s rules helps ensure your investor can legally deploy funds, prevent compliance delays, and align with credible partners. This blog explains the key SEBI requirements every founder must know to protect funding and future growth.

At a Glance

- SEBI mandates all VCs to migrate to the AIF framework by March 31, 2025, or surrender registration.

- Non-compliant funds risk penalties that can disrupt ongoing and future investments.

- The 66.67% rule for Category I AIFs ensures more capital flows into unlisted MSMEs.

- Always verify your VC’s SEBI registration before signing—compliance now directly impacts your funding security.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

How SEBI Makes the Shift from VCF to AIF?

SEBI’s latest changes mark India’s shift from a scattered regulatory framework to a unified, transparent system that protects both investors and entrepreneurs.

The Old Guard: VCF Regulations (1996–2012)

SEBI introduced the Venture Capital Funds (VCF) Regulations, 1996, as India’s first official rulebook for venture capital.

- Funds had to register with SEBI.

- At least 66.67% of investable capital had to go into unlisted equity.

- A single company could receive no more than 25% of the fund’s corpus.

Over time, these rules became outdated. As private equity, hedge, and angel funds emerged under separate rules, confusion and loopholes appeared in the system.

The New Reality: AIF Regulations (2012–Present)

SEBI replaced the old framework on May 21, 2012, with the Alternative Investment Funds (AIF) Regulations.

- Venture capital funds now fall under Category I AIFs, which invest in startups and early-stage businesses.

- These funds receive tax benefits under Section 10(23FB) of the Income Tax Act.

- They are also treated as Qualified Institutional Buyers (QIBs), improving their credibility in capital markets.

- Older VCFs can manage their existing investments but cannot start new schemes unless they migrate to the AIF framework. They must choose between transitioning and winding down operations.

For founders, this means your investor is now part of a regulated and structured ecosystem, offering greater security and accountability.

At S45, we view capital as more than money; it’s a foundation for long-term growth. We help founders connect with compliant, stable investors who value transparency and play by the rules, ensuring funding remains reliable through every growth stage. Now, let’s find out what SEBI identifies as Category I AIFs.

What You Need to Know About Category I AIFs

Understanding the Category I AIF structure is crucial for founders. It reveals what your investor can and cannot do, how their fund operates, and the timelines that govern your relationship.

The Corpus and Investor Requirements

Category I AIFs must have a corpus of at least ₹20 crore, with each investor contributing a minimum of ₹1 crore. The fund can have up to 1,000 investors.

- Committed Capital: The ₹20 crore minimum ensures your investor has substantial capital to deploy, avoiding funds built on informal or unstable commitments.

- Institutional Discipline: The ₹1 crore per investor requirement filters for sophisticated investors like family offices and institutions who understand long-term, patient capital.

- Fund Economics: Understanding the fund size helps calibrate your expectations. If you’re raising ₹5 crore from a ₹50 crore fund, you’re a significant player. In a ₹500 crore fund, you’re a smaller part of the portfolio—adjust expectations for attention and support.

- Minimum Tenure: Category I AIFs are close-ended with a minimum tenure of three years. Most venture funds have a 7-10 year lifecycle with 5-year investment periods and 2-5 year liquidation windows.

But with the two-thirds rule, you need to be more conscious.

The Two-Thirds Rule: Why It Supports Startups

SEBI mandates that at least two-thirds of the fund’s corpus be invested in unlisted equity shares or equity-linked instruments. This ensures the fund is genuinely focused on venture capital, not just low-risk investments.

- Alignment with Founders: Your investor must deploy capital in early-stage, unlisted companies, like yours. This creates incentives to actively support your growth.

- Remaining One-Third Flexibility: The other one-third can be used for IPO subscriptions, debt investments, or special purpose vehicles. This gives your investor flexibility to support your growth at various stages.

- MVCF Extensions: The 2024 amendments introduced Migrated Venture Capital Funds (MVCFs) to help legacy funds complete their exits. MVCFs get extensions to finish exits, but with strict deadlines.

- Understand Their Timeline: If your investor is an MVCF, their liquidation timeline will affect your funding runway and exit strategy.

Therefore, you need partners like S45 who can commit to the long haul, not investors who are counting down to their exit. Next, let’s find out the impact of the migration on your business.

Why This Migration Matters to Your Business

By now, you might be wondering: why should I care about my VC's regulatory status? Here's the reality: non-compliant funds face escalating consequences:

- Active Surveillance: Funds that don't migrate to the Migrated Venture Capital Fund (MVCF) category face enhanced reporting obligations and SEBI scrutiny. This means more time spent on compliance, less time supporting portfolio companies.

- Liquidation Pressure: Expired schemes operating beyond their tenure without migrating must liquidate by July 19, 2025. If your investor is forced into rushed liquidation, your follow-on rounds could evaporate, and your board could lose continuity.

- Penalties and Sanctions: SEBI has already imposed penalties on non-compliant VCFs, including ₹21 lakh in aggregate penalties for 17 entities. Funds facing sanctions may struggle to attract limited partners, constraining their ability to support your growth.

- Investment Restrictions: Non-compliant funds may face restrictions on making new investments or following on in existing portfolio companies, directly impacting your access to committed capital.

When your investor is distracted by existential compliance issues, your business pays the price in lost strategic guidance, delayed capital deployment, and weakened networks.

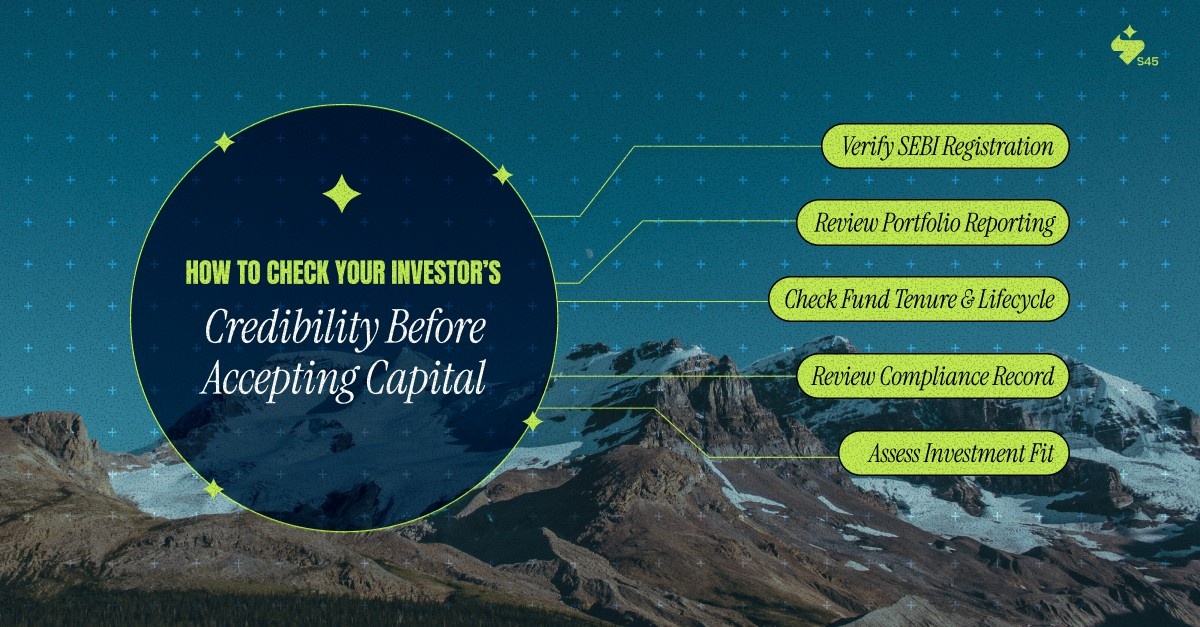

How to Check Your Investor’s Credibility Before Accepting Capital

You wouldn’t hire an executive without checking their background. The same rule applies to investors. Before taking their money, verify their compliance, track record, and alignment with your goals.

Step 1: Verify SEBI Registration

Go to the SEBI website and open the “Intermediaries” section.

- Check if the investor or fund is listed under registered Alternative Investment Funds (AIFs) with an active Category I registration.

- If they claim legacy VCF (Venture Capital Fund) status, ask:

- Have you migrated to the new MVCF structure?

- What’s your liquidation deadline?

- What happens to portfolio companies if liquidation isn’t completed on time?

Step 2: Review Portfolio Reporting

Request the fund’s latest quarterly investment reports submitted to SEBI.

- Missing or skipped reports signal non-compliance or internal issues.

- While reviewing, look for:

- Number of active portfolio companies

- Sector diversification

- Follow-on investment history

A well-diversified fund with consistent reporting usually indicates sound governance.

Step 3: Check Fund Tenure and Lifecycle

Ask for the Private Placement Memorandum (PPM) or Limited Partnership Agreement (LPA) to understand:

- When the fund was launched (vintage year)

- Whether it’s still investing or winding down

- The exit timeline and any extension provisions

If the fund is in its final years, the investor may focus more on exits than new follow-ons. Know where your deal fits in their timeline.

Step 4: Review Compliance Record

Search for SEBI enforcement actions or penalty orders against the fund or sponsor. This information is public under the “Enforcement Actions” section of SEBI’s site. A clean record shows discipline, while frequent disputes can indicate governance or operational problems.

Step 5: Assess Investment Fit

Review the fund's investment mandate.

- Confirm if your company fits its sector, stage, and cheque size.

- Clarify which vehicle they’re investing from, Category I, Category II, or proprietary capital, and what restrictions come with it.

- Funds investing outside their stated mandate may face regulatory scrutiny or limited partner disputes—both of which reduce their ability to support you.

When structure, compliance, and strategy align, you’re not just taking capital, you’re choosing a stable long-term partner.

Understand Term Sheets: What You Can Negotiate and What You Can’t

Not every clause in your term sheet is up for discussion. Some terms come directly from SEBI’s AIF rules and can’t be changed. Knowing which ones are fixed helps you save time and focus on points that truly impact your deal.

Non-Negotiable Regulatory Terms

These are SEBI-mandated and apply to all Category I AIFs:

- Investment Limits: Category I AIFs cannot invest in sectors or instruments restricted by SEBI. Your investor must follow these rules, even if they limit your preferred capital structure.

- Borrowing Restrictions: AIFs can only borrow for short-term needs—up to 30 days at a time, four times a year, and only up to 10% of the fund’s corpus. If your investor seems low on liquidity, this rule is usually the reason.

- Associate Company Investments: To invest in an associate company, the fund needs approval from 75% of investors by value. If your founder group has multiple linked entities, this approval may delay your deal.

- Reporting Duties: AIFs must file quarterly reports with SEBI listing portfolio companies, valuations, and investment activity. You’ll need to share data for these reports. So, plan for this in your quarterly close process.

Negotiable Commercial Terms

Everything else can be discussed. These include:

- Valuation and ownership percentage

- Liquidation preference

- Board representation

- Anti-dilution clauses

- Drag-along and tag-along rights

- Founder vesting

Push where you have leverage, and verify any claim that “SEBI doesn’t allow this.” That statement often hides a commercial preference, not a rule. Strategic partners like S45 often can help you here so that you can avoid wasting time and focus on terms that shape your long-term control and alignment.

What Happens if Your VC Doesn’t Migrate

Now, let’s explore the scenario where your VC fails to migrate by the March 2025 deadline. Here's what happens.

Immediate Consequences for the Fund

Non-migrated VCFs with active schemes face enhanced reporting and surveillance. Expired schemes operating beyond their liquidation period face penalties, including potential loss of registration. SEBI can mandate asset distribution and investor repayments.

Impact on Portfolio Companies

- If Capital Already Received: Don’t worry, the capital you’ve already received remains unaffected. The fund still owns shares in your company, and those stakes won’t disappear due to the fund’s compliance issues.

- Follow-On Capital May Disappear: The real risk lies in follow-on funding. Non-compliant funds may not be able to make new investments, so if you rely on Series A+ capital from them, that may not materialize.

- Board Changes: If the fund is forced into liquidation, they might have to exit board seats or sell their stake to another buyer. This could lead to strategic shifts and misalignment with your original vision.

Your Rights and Options

As a portfolio company, you have limited formal rights to force your investor's compliance. However, you can:

- Request Updates: Ask your investor directly about migration status. Professional funds will be transparent. Evasive answers are red flags.

- Engage Other Investors: If you have multiple investors, including compliant Category I AIFs, leverage those relationships. Compliant investors may be able to provide bridge capital or facilitate secondary purchases.

- Plan for Contingencies: Model your growth assuming your VCF investor cannot follow on. Build relationships with alternative capital sources proactively.

- Consider Legal Counsel: If you suspect your investor's non-compliance could trigger material adverse consequences, such as forced liquidation of board seats or emergency exits—consult corporate counsel to understand your options.

By understanding these risks and preparing early, you can protect your company from potential fallout. But what if you can have a partner who would do that for you?

Partner with S45: Capital + Expertise for Sustainable Growth

At S45, we don't just facilitate capital connections; we architect sustainable growth pathways for MSME founders. Our approach combines:

- Curated Investor Relationships: We partner with Category I AIFs and compliant institutional investors who share our commitment to long-term value creation and founder-friendly capital.

- Regulatory Intelligence: Our ecosystem partners understand the evolving regulatory landscape and help founders navigate capital structures that support scaling, not just short-term valuations.

- Operational Leverage: Beyond capital, we provide strategic guidance on manufacturing excellence, innovation implementation, and building businesses designed for legacy, not just exits.

If you're an Indian entrepreneur building an MSME designed to last, then the regulatory landscape might be complex, but the path forward doesn't have to be. Connect with S45 to explore how we support founders navigating growth capital, operational scaling, and legacy building.