Key Takeaways

- Self-funding gives founders full control, lean discipline, and stronger product-market alignment, but growth may be slower without external support.

- It works best for capital-efficient models with early revenue potential, while heavy capex industries may require funding sooner.

- A structured approach to cash flow, MVP building, networking, and government schemes can make self-funding sustainable.

- Founders who want ownership plus growth support can consider S45 as a partner that offers capital, mentorship, and networks while respecting the founder’s vision.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

Indian MSME founders often begin their journey with one big question: Should I fund my business myself or look for external capital? For many of you building legacy-driven, innovation-minded businesses, the appeal of self-funding is strong. No investors questioning your decisions. No dilution. Complete freedom to build the business your way.

But here is the other side. Personal capital is limited, growth can feel slow, and the risk sits squarely on your shoulders. With over 6.3 crore MSMEs in India, most begin with self-funding, yet many struggle when cash flow tightens or scale demands increase.

This guide walks you through what self-funding really means, its benefits, the risks involved, and when this path makes sense for you as a founder.

What is Self-Funding?

Self-funding simply means starting and growing your business using your personal financial resources instead of raising equity or debt from external investors. Many Indian founders call it bootstrapping. The idea is straightforward. You launch lean, reinvest early profits back into the business, and scale gradually with discipline.

Common forms of self-funding in India:

- Personal savings kept aside for the business launch

- Support from family, which is very common in traditional business setups

- Reinvesting revenue instead of taking early withdrawals

- Credit cards or personal loans for short-term needs, used carefully

How is it different from traditional funding?

- You use your own money, not investor capital

- No equity dilution or external board pressure

- Growth depends on cash flow, not funding rounds

If you are someone who values control and wants to build patiently, self-funding can be a solid start. Yet as growth demands increase, a partner who walks beside you can make a difference. S45 helps founders retain ownership while still accessing capital and expert guidance.

The Compelling Benefits of Self-Funding Your MSME

Self-funding often becomes the first milestone in a founder’s journey. You start small, make decisions fast, and build based on customer needs rather than investor expectations. For many Indian MSMEs, this approach creates a strong foundation before thinking about outside capital.

1. Complete Ownership and Control

When you self-fund, 100 percent equity stays with you. No board approvals. No dilution. You decide how fast to grow, what to build next, and when to pivot. This freedom is powerful for founders who think long term. Zoho, a global SaaS leader from India, operated this way and built patiently over decades. Even when partnering for growth later, you still stay in the driver's seat.

2. Financial Discipline and Lean Operations

Every rupee matters, which creates sharp business thinking. Bootstrapped startups have 21% higher profitability than VC-backed startups. You hire only what is essential, watch cash flow closely, and avoid spending on vanity activities. This habit builds strong financial judgment and helps you run an efficient operation that can survive market swings.

3. Customer Centric Business Model

When funding does not come from investors, it must come from customers. This forces real product validation. You solve real problems, build based on feedback, and grow through genuine demand instead of hype. Strong customer loyalty becomes your fuel.

4. Flexibility and Agility

You can act fast. No waiting for approvals. If a new opportunity arises, you can test it next week. Growth happens at your pace, aligned with relationships and trust, which matter deeply in Indian markets.

5. Better Future Valuation

Traction first, funding later, often leads to better terms. Once the business proves itself, you hold negotiation power. Many founders bootstrap initially, then raise funds for scale at a much higher valuation. Funding becomes a choice, not a survival need.

6. Building Sustainable Legacy

Self-funded businesses grow slowly but steadily. They create assets that can be passed on to future generations. Profits stay within the business and the community. This kind of growth aligns with founders who value longevity over shortcuts.

If you ever reach a stage where growth needs capital or specialized direction, you do not need to give up ownership to move forward. S45 works with founder-led businesses by offering capital plus operational support without overshadowing the founder’s vision.

In short, self-funding gives you control, clarity, and sustainable growth. But it is not without tradeoffs, which we will explore next.

The Real Risks and Challenges You Need to Consider

Self-funding is rewarding, but it demands patience and resilience. Many MSME founders start strong, only to feel the pinch when funds get tight or competition accelerates. Knowing the risks early helps you prepare rather than react later.

1. Limited Capital and Slower Growth

With personal funds, growth follows available cash. Marketing budgets are tight. Hiring is selective. Expansion takes time. You might spot a market opportunity but lack the capital to capture it quickly. Capital-heavy models like manufacturing or infrastructure feel this more strongly. Self-funded growth usually compounds over years, not months, so expectations must be realistic.

2. Personal Financial Risk

Your money is on the line, be it savings, gold, or family contributions. There is no external safety cushion if revenue dips. Lifestyle adjustments become real decisions. Many founders feel pressure when family members ask about progress, especially in joint family setups. The key is simple. Never put in money you cannot afford to lose. Create buffers, not blind bets.

3. Founder Burnout and Stress

You wear every hat. Sales in the morning. Accounting in the afternoon. Strategy at night. Decisions carry weight because every rupee is personal. This can lead to fatigue and isolation when there is no experienced advisor to guide you. Momentum slows if the founder burns out early.

4. Competitive Disadvantage

Well-funded competitors move fast. They scale marketing, hire aggressively, and build product at speed. Brand recall becomes tough to match. You might be better, but visibility wins markets. Talent also prefers growth opportunities and pay security that funded companies can offer.

5. Limited Scalability Without External Capital

Without capital, expansion needs careful timing. Inventory slows cash flow. Tech upgrades get delayed. You might have demand, but not the resources to serve it. At some point, self-funding shifts from a strategy to a constraint.

6. Missed Expert Guidance and Networks

Investors bring more than money. They bring knowledge, playbooks, and networks. Without this, blind spots remain, decisions take longer, and market access becomes harder.

However, these risks do not mean self-funding is wrong. They mean you need clarity and a plan.

Is Self-Funding Right for Your MSME?

Self-funding works beautifully for some founders and feels limiting for others. The right choice depends on your business model, financial readiness, and growth vision. Instead of guessing, evaluate your position with clarity.

Consider self-funding if:

- Your business is capital-light, such as SaaS, consulting, or services

- You have personal savings to support 12 to 18 months of operations

- Ownership matters more than rapid scale

- You are comfortable building gradually and learning as you go

- Cash flow can start early through paying customers

- You are building for the long run, not chasing quick exits

Consider external funding if:

- Your business demands heavy upfront capital, like manufacturing or biotech

- You have a time-sensitive market opportunity

- Scale is essential for survival, such as network effect models

- Personal funds cannot sustain the foundation stage

- R&D or tech development needs consistent investment.

- You require strong industry access or partnerships from day one

A hybrid route also works well for many MSMEs:

- Bootstrap initially for product validation

- Use government schemes like MUDRA or CGTMSE for early finance

- Partner with growth-focused organisations like S45 when you want capital plus operational expertise without losing control

If you feel ready to self-fund, the next step is learning how to use money wisely. Let us move to practical strategies that help founders self-fund without burning out or running dry.

Practical Strategies for Successful Self-Funding

If you have chosen the self-funding route, the goal is simple: stretch every rupee, generate revenue early, and build momentum without overextending. Many founders start with enthusiasm, but struggle when expenses grow faster than income. A structured approach prevents that struggle.

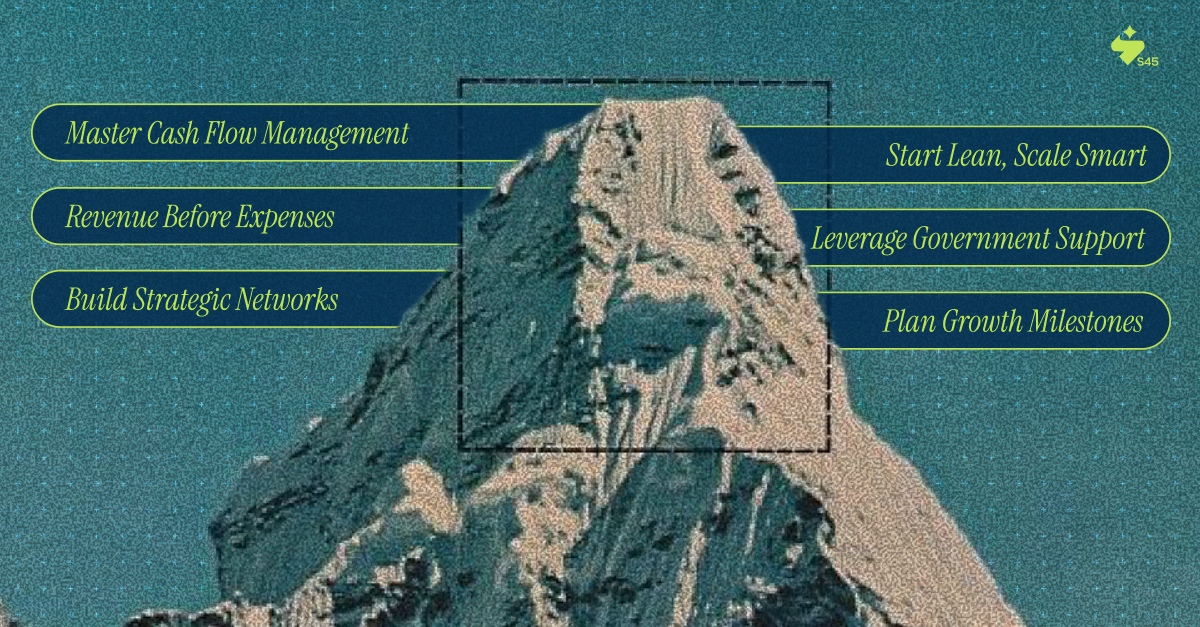

1. Master Cash Flow Management

- Track daily cash inflow and outflow.

- Negotiate better payment terms with vendors.

- Keep a 3 to 6-month emergency buffer.

- Use digital tools like Tally or Zoho Books.

Good cash visibility means fewer surprises and more control over decisions.

2. Start Lean, Scale Smart

- Begin with an MVP instead of a perfect product

- Avoid fancy offices or early full-time hiring

- Outsource non-core tasks

- Use budget-friendly SaaS tools

Lean beginnings lead to agile growth.

3. Revenue Before Expenses

- Charge early and validate pricing with real buyers.

- Focus on converting revenue streams fast

- Avoid long build times without customer feedback.

- Try pre-orders or advance billing

Money from customers beats money from investors.

4. Leverage Government Support

- MUDRA loans for small capital needs

- PMEGP subsidies for manufacturing or services

- CGTMSE guarantee schemes

- State-specific MSME support

This reduces personal capital pressure.

5. Build Strategic Networks

- Join MSME groups and chambers

- Seek mentors who have built before

- Collaborate with complementary businesses

- Learn from other bootstrapped founders

Networks save both time and mistakes.

6. Plan Growth Milestones

- Set quarterly revenue and product goals

- Define when outside capital may be required

- Track learnings and metrics proactively

- Stay ready to pivot if data signals it

These steps make self-funding sustainable instead of stressful. You now understand how to fund your journey wisely. But nothing inspires confidence like real success.

The S45 Approach: Bridging Self-Funding and Strategic Support

Many founders want control but also need guidance, capital, and a trusted growth partner. Self-funding keeps ownership intact but can feel lonely without expert direction or network access. This is where S45 steps in, not as a traditional investor, but as a partner in your climb.

This is what makes the S45 different:

- Access to capital without pressure to dilute early

- Business guidance and on-ground operational support

- Network reach for partnerships, talent, and markets

- Growth strategy focused on sustainability, not shortcuts

With S45, your vision stays in the driver's seat. We walk beside you, helping strengthen systems, streamline operations, and scale with confidence. You build legacy, not just revenue.

Ready to explore how we can support your self-funded journey while preserving your vision? Connect with our team to discuss sustainable growth pathways for your MSME