Key Takeaways

1. Settlement funding provides liquidity when legal cases take time. It helps plaintiffs manage essential expenses without waiting years for a settlement payout.

2. It’s non-recourse; repayment only happens if the case succeeds. This makes it a safer alternative for those who cannot access traditional loans, though it often comes at a high cost.

3. Costs and risks can be significant. High fees and compounding interest may reduce final settlements, so understanding the full terms is essential.

4. Alternatives exist and should be reviewed first. Personal loans, insurance coverage, or structured settlements can be more economical and transparent.

Legal disputes often take months, sometimes years, to resolve. During this time, plaintiffs can face significant financial strain, and medical bills, household expenses, or lost income can make waiting for a fair settlement difficult. Settlement funding offers a practical, though costly, solution to ease that burden.

Unlike a traditional loan, settlement funding provides a cash advance against a pending legal case.

The amount advanced depends on the strength of the claim and the estimated settlement value. If the case succeeds, the funder recovers its advance plus fees. If the plaintiff loses, there is usually no repayment required.

For many individuals, this funding acts as a financial lifeline during litigation. Yet, as with any form of financing, it demands careful understanding. This article explores what settlement funding is, how it works, its benefits, risks, and the questions to ask before considering it.

What is Settlement Funding: Basic Definition and Key Features

Settlement funding, sometimes called pre-settlement funding or lawsuit funding, is a financial arrangement that allows plaintiffs to receive a portion of their expected legal settlement before the case concludes.

Key Features

- Non-recourse structure: You repay only if the case succeeds. If the case is lost, repayment is not required.

- No credit checks: Approval depends on the case strength, not the plaintiff’s credit score.

- Used for essential expenses: Funds often cover rent, treatment costs, or daily living needs during litigation.

- High-risk pricing: Fees and interest reflect the risk borne by the funder.

Typical Situations Where Settlement Funding Is Used

- Personal injury or accident claims

- Medical malpractice cases

- Workplace injury or liability claims

- Product liability and class action lawsuits

These cases can take time, especially when negotiation or appeals are involved. Settlement funding helps plaintiffs cover immediate financial needs without accepting a low settlement offer out of pressure.

How It Differs from a Loan

Settlement funding is not a loan in the traditional sense. There are no monthly payments, no credit checks, and no collateral. Instead, repayment happens only if the plaintiff wins or settles.

However, the cost can be high, funding fees and interest accumulate over time, often making this one of the most expensive financing options available.

S45 Insight: We often remind business leaders and individuals that not all funding is equal. Settlement funding can provide short-term relief but should never replace disciplined financial planning or a well-advised legal strategy.

Also Read: Categories of Alternative Investment Funds Explained

How Settlement Funding Works?

Settlement funding follows a transparent but multi-step process. The funder evaluates the case, estimates settlement potential, and advances part of that value.

Step-by-Step Process

Stage | Description |

1. Application | The plaintiff or lawyer submits case details to the funding company. |

2. Case Review | The funder reviews evidence, liability, and the likelihood of success. |

3. Legal Consultation | The plaintiff’s lawyer provides additional information to confirm case validity. |

4. Offer and Disbursement | If approved, the funder offers a cash advance (typically 10–20% of the expected settlement). |

5. Repayment | On successful settlement, repayment plus fees is deducted from the proceeds. If the case fails, no repayment applies. |

Eligibility Factors

- Strength of legal claim

- Representation by a qualified attorney

- Estimated settlement value

- Expected duration of litigation

Typical Use of Funds

- Medical and rehabilitation expenses

- Rent, mortgage, or utility bills

- Legal and travel expenses

- Income replacement during recovery

S45 Insight: Funding should act as a bridge, not a crutch. We encourage individuals and founders to calculate not just the amount needed today, but how it affects what remains tomorrow.

Also Read: How Revenue-Based Financing Works Explained

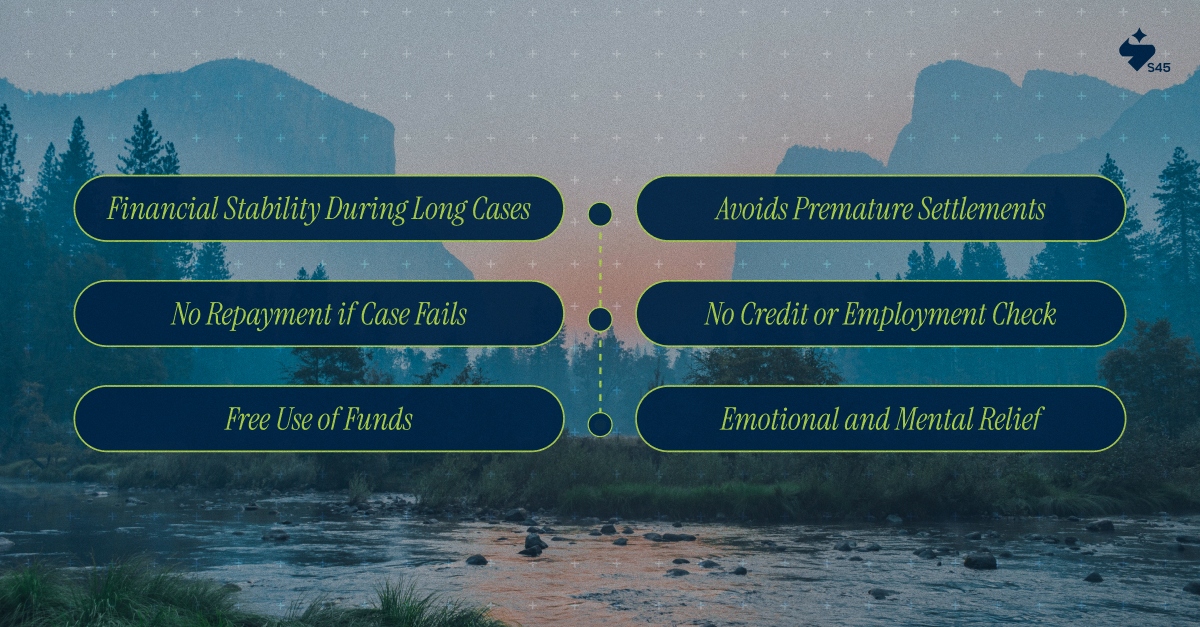

Benefits of Settlement Funding: When It Helps

When used strategically, settlement funding can provide essential financial support. It enables plaintiffs to maintain stability while pursuing fair compensation.

1. Financial Stability During Long Cases

Legal proceedings can take years. Settlement funding provides liquidity when income stops, but expenses continue, helping plaintiffs manage daily life confidently.

2. Avoids Premature Settlements

Financial stress often pushes plaintiffs to accept early, lower offers. Funding allows more time for negotiation, improving the chance of securing a fair and full settlement.

3. No Repayment if Case Fails

Because it’s non-recourse, repayment occurs only after a successful outcome. If the case is lost, the funder absorbs the loss, not the plaintiff.

4. No Credit or Employment Check

Approval depends entirely on case strength. This helps individuals who may not qualify for traditional loans due to damaged credit or employment gaps.

5. Free Use of Funds

Funds can be used at the plaintiff’s discretion. There are no spending restrictions, whether for medical care, legal costs, or personal needs.

6. Emotional and Mental Relief

With immediate financial pressure reduced, plaintiffs can focus on recovery and legal proceedings without distraction.

Risks and Downsides: What to Know Before Accepting Funding

While settlement funding can provide financial relief, it comes at a high cost. Understanding the risks ensures you make a decision grounded in reality, not urgency.

1. High Cost of Capital

- Settlement funding is one of the most expensive forms of financing.

- Fees and interest can reach 25–60% annually, depending on the case duration and risk.

- Long cases lead to compounding costs, reducing the plaintiff’s final payout.

Example: If a plaintiff receives ₹10 lakh and the case lasts two years, repayment could exceed ₹16–₹18 lakh, leaving little from the eventual settlement.

2. Reduced Final Settlement Value

- After deducting funding charges, plaintiffs often receive a fraction of their expected compensation.

- Always compare how much you receive upfront vs. how much you’ll owe after deductions.

3. Regulatory Gaps and Unclear Terms

- Many jurisdictions lack clear regulations for settlement funding.

- Some funders exploit this with hidden charges, unclear interest rates, or unfair repayment clauses.

- Always request a full written disclosure of fees.

4. Pressure to Settle Early

- Accruing fees may push plaintiffs to accept early settlements to avoid growing costs.

- This can weaken your legal position and compromise the value of your claim.

5. Limited Case Eligibility

- Funders approve only cases with high success probability.

- Weak or unverified claims are often rejected, which can leave applicants with few alternatives.

At S45 Club, we remind founders and individuals, every form of capital carries a cost. The goal isn’t to avoid risk entirely, but to understand it well enough to manage it wisely.

Also Read: Types of Private Equity Explained

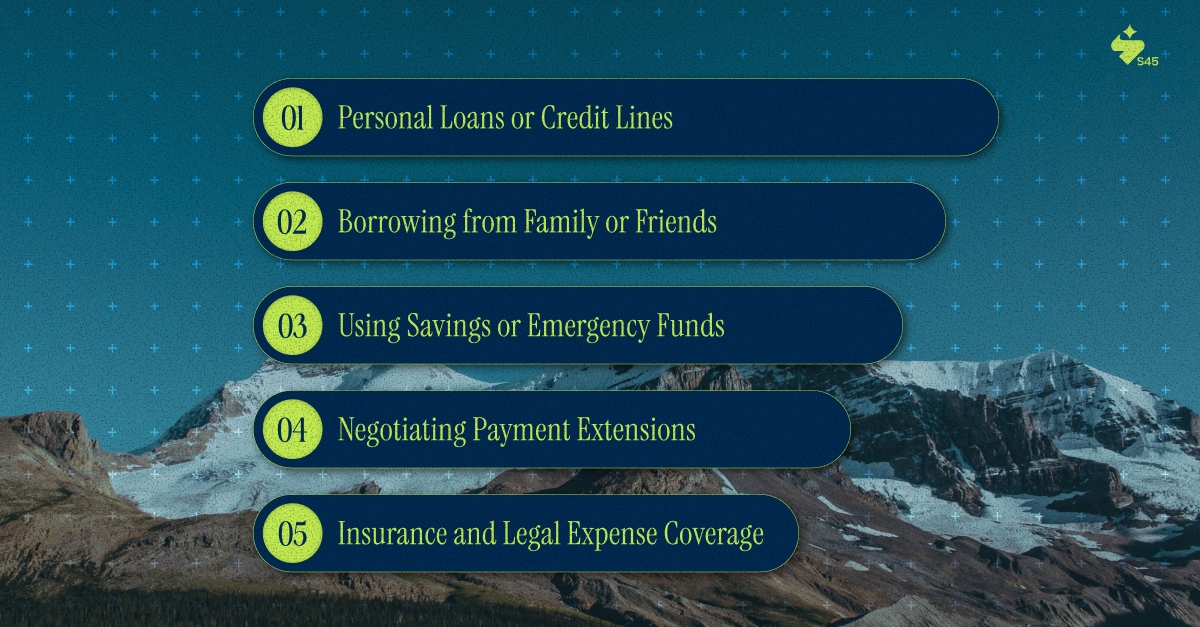

Alternatives to Settlement Funding

Before taking settlement funding, explore other financing routes. Many alternatives offer lower costs, clearer repayment terms, and better financial control.

1. Personal Loans or Credit Lines

- Suitable for individuals with a stable income and good credit.

- Interest rates are lower than settlement funding.

- Repayment is required regardless of the case outcome.

Pros: Predictable terms, transparent cost.

Cons: Requires creditworthiness and personal liability.

2. Borrowing from Family or Friends

- Interest-free or low-cost in most cases.

- Agreements should still be documented to avoid conflict.

Pros: Minimal cost, flexible repayment.

Cons: Can strain relationships if expectations are unclear.

3. Using Savings or Emergency Funds

- Utilising savings avoids interest or fees entirely.

- Recommended only if it doesn’t compromise critical goals like education, healthcare, or business capital.

Pros: No repayment risk.

Cons: Reduces financial cushion.

4. Negotiating Payment Extensions

- Request payment extensions from service providers (e.g., hospitals, landlords).

- Many institutions agree to temporary relief if informed early.

Pros: No borrowing cost.

Cons: May not cover all expenses.

5. Insurance and Legal Expense Coverage

- Some insurance policies cover part of medical or legal costs.

- Reviewing policies carefully may uncover hidden support.

Pros: Built-in benefit, no repayment.

Cons: Limited to specific conditions.

Option | Cost Level | Repayment Required? | Best For |

Settlement Funding | High | Only if the case succeeds | Urgent, high-need cases |

Personal Loan | Medium | Always | Strong credit profiles |

Family/Friends Loan | Low | Flexible | Short-term needs |

Savings | None | N/A | Liquidity holders |

Insurance | None | N/A | Covered claims |

The strongest financial decisions come from exploring every option, not choosing the fastest. At S45 Club, we help decision-makers weigh urgency against opportunity, and long-term outcomes over short-term ease.

Also Read: What Are Private Equity Firms? A Simple Guide for 2025

Checklist: Before Choosing Settlement Funding

Use this checklist to evaluate if settlement funding truly fits your situation. Treat it like a decision framework, not just a financial option.

Evaluate Case Strength

- Confirm with your lawyer the probability of success.

- Stronger cases mean better funding terms and lower costs.

Understand the Advance vs Settlement Ratio

- Most funders advance only 10–20% of the estimated settlement.

- Avoid over-borrowing; higher advances mean lower final returns.

Examine the Fee Structure

- Request a complete breakdown: setup fees, monthly or annual charges, compounding interest.

- Ask whether fees accrue even if the case delays beyond estimates.

Confirm Non-Recourse Terms

- Ensure the agreement clearly states you owe nothing if the case is lost.

- This clause protects against debt escalation.

Seek Legal Review

- Involve your attorney in all discussions.

- Never sign a funding contract without legal oversight.

Assess the Funder’s Credibility

- Check the firm’s background, reviews, and prior client feedback.

- Avoid unregistered or unverified providers.

Revisit Alternatives

- Review other options like insurance, loans, or savings one last time.

- Settlement funding should be your final resort, not your first.

Conclusion

Settlement funding can be a lifeline in difficult times, but like any financial product, it requires understanding, discipline, and caution. It offers speed and liquidity, yet comes with cost and consequence. The best outcomes come when it is treated as a strategic choice, not a desperate measure.

For plaintiffs and founders alike, every funding decision should protect tomorrow’s stability, not just today’s comfort.

When managed with awareness, transparency, and proper legal guidance, settlement funding can provide breathing room during long legal battles without compromising long-term financial goals.

At S45 Club, we help Indian entrepreneurs, investors, and individuals make capital decisions that build stronger foundations for growth, whether it’s structured finance, legal funding, or equity partnerships. The principle remains the same: choose clarity over speed, sustainability over shortcuts.