Need to Know

- Credit funding helps SMEs access external capital for growth, operations, expansion, and working capital.

- Understanding interest rates, credit terms, and risks is essential before choosing a funding source.

- Common types of credit funding include bank loans, credit lines, invoice financing, and asset-backed loans.

- Poor credit decisions can strain cash flow; structured evaluation prevents long-term financial stress.

- Platforms like S45 help SMEs assess credit options using data-driven frameworks and expert guidance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a qualified advisor before making any credit or loan-related decisions.

For many SMEs, growth isn’t limited by potential; it’s limited by cash flow. Whether it’s buying inventory, upgrading machines, paying vendors, or managing seasonal dips, businesses often need additional financial support.

This is where credit funding steps in. Yet, many SME owners find themselves confused:

- Which type of credit is right?

- What if interest rates change?

- Is short-term credit too risky?

- Will it strain cash flow?

The real challenge isn’t borrowing money, it’s borrowing wisely.

Before diving deeper, here’s a soft reminder: many successful Indian SMEs rely on structured guidance and financial expertise to avoid taking on the wrong credit or mismatching repayment obligations with their cash cycles.

Let’s explore what credit funding means, how it works, and how SMEs can use it strategically.

What Is Credit Funding?

Credit funding refers to the process of borrowing money from financial institutions, NBFCs, private lenders, or credit platforms to support business operations, manage cash flow, or finance expansion. Unlike equity, credit funding allows SMEs to access capital without giving up ownership, making it one of the most practical and commonly used financing tools for Indian businesses.

According to the IFC MSME Finance Gap Study, India’s MSME credit gap stands at ₹20-25 trillion, indicating that millions of businesses rely on external funding to survive and scale. These numbers highlight a simple truth: Credit isn’t optional for SMEs, it’s essential.

A well-structured credit strategy helps SMEs:

- Manage fluctuating cash flow

- Invest in growth

- Negotiate better vendor terms

- Stay competitive in dynamic markets

But choosing the wrong credit structure can quickly turn into repayment stress, cash-flow instability, and long-term financial strain. Understanding credit funding is the first step to using it wisely.

Now that we’ve seen the foundational role credit plays, let’s break down the specific reasons SMEs rely on credit funding to stay competitive.

Why SMEs Need Credit Funding?

SMEs operate in environments where revenue cycles, customer payments, and working-capital demands are constantly shifting. Even profitable businesses often face temporary liquidity shortages, making credit funding a crucial financial tool, not just for survival, but for sustainable growth.

Access to credit empowers SMEs to stabilize operations, take advantage of market opportunities, and protect themselves during downturns. Without timely credit support, SMEs may delay production, lose customers, or miss out on growth opportunities.

Key reasons SMEs rely on credit funding:

- To manage working capital: Smooth daily operations, pay vendors on time, and maintain production without disruptions.

- To handle delayed payments: On average, Indian SMEs wait 45–60 days to receive payments from buyers, and credit helps bridge this gap.

- To fund expansion and new projects: Opening new branches, purchasing equipment, hiring talent, or entering new markets requires upfront capital.

- To manage seasonal fluctuations: Businesses in manufacturing, textiles, FMCG, and trading face peak and off-peak cycles that require flexible funding.

- To deal with unexpected expenses: Credit facilities shield against unexpected costs, whether it’s machinery failure, rising material prices, logistics delays, or compliance-related expenses that disrupt your workflow.

- To improve cash-flow predictability: Credit facilities provide a buffer, helping SMEs maintain operational stability even in slow months.

- To seize time-sensitive opportunities: New tenders, sudden bulk orders, or market shifts require quick capital that SMEs may not have immediately.

- To build financial credibility: Responsible credit usage improves the SME’s credit score, enabling access to larger loans and better terms in the future.

- To protect the business during downturns: Credit acts as a safety net when sales drop, prices rise, or demand slows.

Understanding why SMEs rely on credit naturally leads to the next question: what kinds of credit options are available to support different business needs?

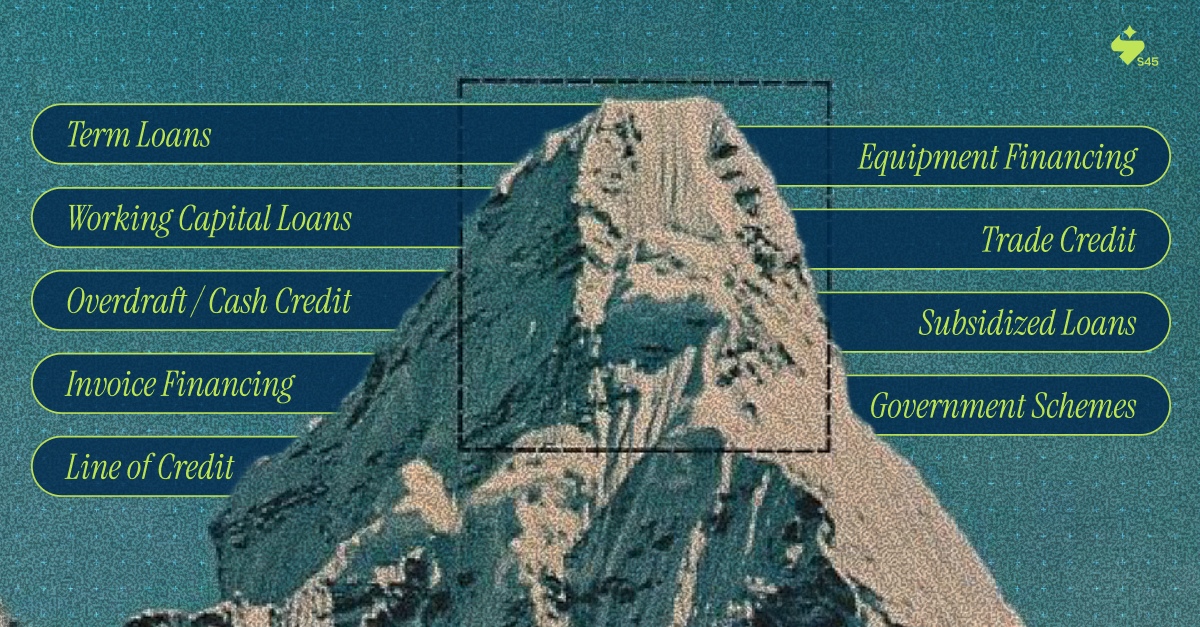

Types of Credit Funding for SMEs

Understanding the right type of credit is just as important as securing it. Different stages of business, launch, expansion, seasonal swings, or recovery, require different funding formats. SMEs that choose the right credit product tend to manage cash flow more efficiently, reduce financing costs, and grow with fewer disruptions.

Here’s a clear breakdown of the most commonly used credit options and how they support SME growth.

1. Term Loans

A term loan is a traditional business loan where SMEs borrow a fixed amount and repay it over a set period with interest. These can be short-term, medium-term, or long-term, depending on the business need.

How it benefits SMEs:

- Ideal for expansion projects, asset purchases, or upgrading machinery

- Predictable repayment schedule supports financial planning

- Helps build business credit over time

Example: A manufacturing SME takes a 3-year term loan to upgrade machinery, improving production speed and reducing operational costs.

2. Working Capital Loans

Working capital loans help SMEs manage daily operations such as payroll, inventory, vendor payments, and seasonal demand fluctuations.

How it benefits SMEs:

- Smooths out cash-flow gaps

- Prevents delays in operations during slow revenue cycles

- Supports seasonal businesses that face fluctuating demand

Example: A wholesale distributor uses a working capital loan to stock additional inventory before Diwali season, increasing sales and meeting customer demand.

3. Overdraft / Cash Credit

Banks provide an overdraft or cash credit facility that allows SMEs to withdraw funds beyond their account balance, up to a pre-approved limit.

How it benefits SMEs:

- Flexibility to withdraw only what’s needed

- Lower interest because you pay interest only on the amount used

- Reliable for handling sudden expenses or delayed receivables

Example: A textile exporter uses a cash credit facility to cover vendor payments while waiting for overseas buyers to clear invoices.

4. Invoice Financing (Invoice Discounting / Factoring)

This form of credit allows SMEs to borrow against unpaid customer invoices, giving them immediate liquidity instead of waiting 30–90 days.

How it benefits SMEs:

- Improves cash flow without taking on new debt

- Reduces dependence on slow-paying customers

- Useful for SMEs with long payment cycles

Example: A B2B furniture manufacturer receives 80% of invoice value upfront through invoice discounting, helping them start new orders faster.

5. Line of Credit

A revolving credit line gives SMEs ongoing access to funds up to a certain limit, similar to a credit card for business purposes.

How it benefits SMEs:

- Offers continuous liquidity

- Suitable for ongoing expenses, small investments, or emergencies

- Greater control because funds can be drawn and repaid multiple times

Example: A marketing agency taps into a ₹20-lakh credit line to hire temporary staff during a large campaign project.

6. Equipment Financing

Used specifically to purchase business equipment, where the asset itself becomes collateral. Common in manufacturing, logistics, construction, and healthcare.

How it benefits SMEs:

- Allows SMEs to acquire expensive machinery without immediate full payment

- Better interest rates due to asset-backed structure

- Preserves cash flow for other operational needs

Example: A logistics company finances delivery vans through equipment financing, scaling operations without blocking working capital.

7. Trade Credit

Trade credit is when suppliers allow businesses to purchase goods or raw materials on credit, usually with 30- to 90-day payment terms.

How it benefits SMEs:

- Zero-interest short-term financing

- Helps manage inventory without upfront cash

- Strengthens supplier relationships and negotiation power

Example: A small electronics retailer buys stock on 45-day credit terms, enabling continuous sales without cash-flow stress.

8. Government Schemes and Subsidized Loans

Government-backed programs like CGTMSE, MUDRA loans, and SIDBI schemes offer collateral-free loans and lower interest rates for SMEs.

How it benefits SMEs:

- Easier approval due to the government guarantee

- Lower financing costs

- Encourages formalization and financial discipline

Example: A food processing unit secures an MUDRA loan to expand production capacity at a lower interest rate than private lenders.

9. Venture Debt

Venture debt is a form of credit offered to high-growth SMEs or startups backed by investors. It complements equity without diluting ownership.

How it benefits SMEs:

- Extends runway without giving up shares

- Useful for tech-led or rapidly scaling businesses

- Helps bridge funding rounds

Example: A fast-growing SaaS SME raises venture debt to invest in product upgrades while awaiting the next equity round.

Now that we’ve explored the major credit options, let’s break down how to choose the one that works best for your SME.

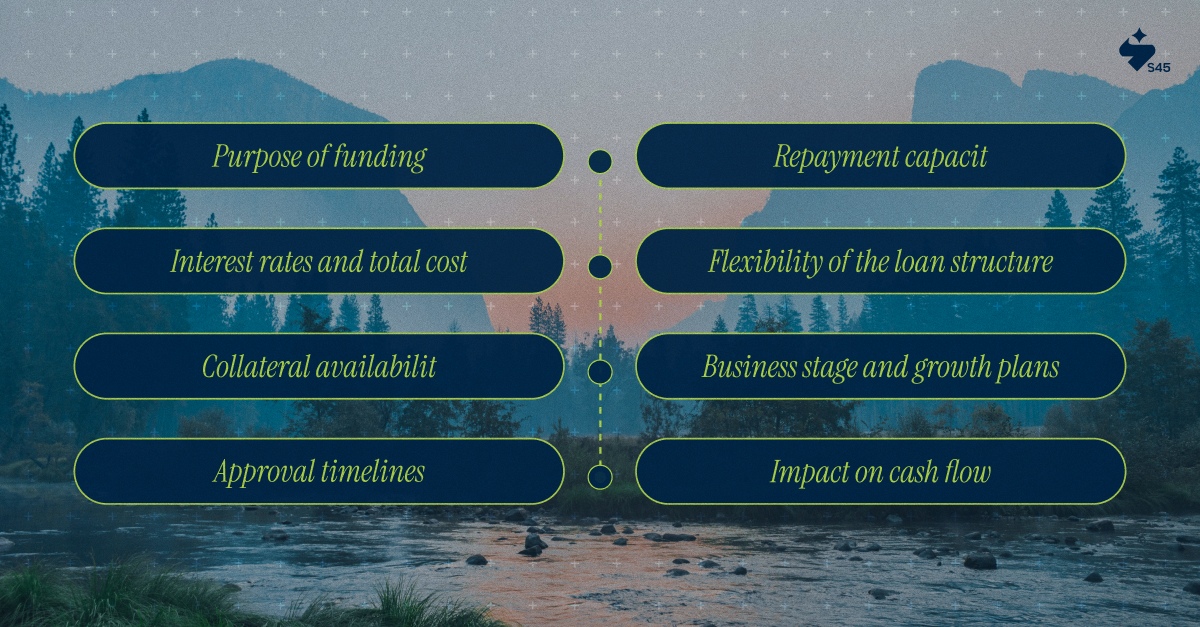

How to Choose the Right Credit Funding Option

Choosing the right credit product is just as important as accessing credit itself. Each option influences cash flow, risk, and long-term business planning differently. A structured evaluation helps SMEs avoid mismatched loans, high interest costs, or unnecessary debt.

Key factors to consider:

- Purpose of funding: Identify whether the need is short-term (working capital), long-term (expansion), or project-specific (equipment purchase).

- Repayment capacity: Assess monthly cash flow stability to ensure repayments don't strain operations.

- Interest rates and total cost: Compare not just interest rates but processing fees, penalties, terms, and collateral requirements.

- Flexibility of the loan structure: Choose products like overdrafts or credit lines if your business requires variable access to funds.

- Collateral availability: Determine whether you’re comfortable pledging assets or need collateral-free options.

- Business stage and growth plans: Early-stage, growing, and established SMEs require different funding types with different levels of risk.

- Approval timelines: Time-sensitive needs (like inventory restocking or urgent vendor payments) may require fast-disbursing credit options.

- Impact on cash flow: Understand how interest and repayment cycles influence your working capital month to month.

At S45, SMEs are matched with seasoned mentors and financial specialists who offer far more than surface-level guidance. They help challenge assumptions, stress-test funding decisions, and provide practical clarity so every credit choice supports long-term stability and growth.

To make smarter borrowing decisions, SMEs must first know what lenders consider a good credit score.

What Is Considered a Good Credit Score?

A credit score reflects how trustworthy a business or individual is when it comes to repaying loans. For SMEs, lenders often assess both the business credit profile and the founder’s personal credit score before approving funding.

In India, credit scores are typically calculated by agencies like CIBIL, Experian, CRIF High Mark, and Equifax, usually ranging from 300 to 900.

A higher score signals lower risk, faster approval, and better interest rates. Most banks and NBFCs consider anything above 700 to be strong, but the ideal range can vary depending on the type of credit you are applying for.

Credit Score Range Breakdown

- 750 – 900 (Excellent): Fastest approvals, lowest interest rates, and access to premium credit products.

- 700 – 749 (Good): Strong eligibility with competitive interest rates; most SME loans fall in this range.

- 650 – 699 (Fair): Loans may still be approved, but with higher interest rates or additional collateral demands.

- 600 – 649 (Weak): Higher risk category; approvals are limited, and terms are often less favorable.

- Below 600 (Poor): Very low chances of approval; lenders may require strong collateral or co-applicants.

Also Read: Understanding Micro Venture Capital for Startups

A good credit score opens doors to better funding, so here are actionable steps SMEs can take to build and maintain a strong profile.

Practical Ways SMEs Can Strengthen Their Credit Score

A healthy credit score doesn’t just boost loan approval chances; it reduces borrowing costs, strengthens lender confidence, and gives SMEs more room to negotiate terms. Improving your credit score is a gradual process, but even small, consistent changes can make a significant impact on your financial profile.

- Maintain timely repayments: Repayment history has the highest weight in credit scoring. Paying EMIs, credit card bills, and vendor dues on time helps build trust with lenders.

- Reduce credit utilization: Keeping credit usage below 30–40% of your approved limit signals financial discipline. Maxing out credit lines, even temporarily, can lower your score.

- Regularly review your credit report: Errors, outdated records, or incorrect defaults can pull down scores. Reviewing reports from agencies like CIBIL or Experian helps you dispute inaccuracies early.

- Avoid multiple loan applications at once: Each application triggers a “hard inquiry,” and too many inquiries in a short period can indicate financial stress.

- Keep older credit accounts open: Long-standing accounts with positive repayment history boost the average age of credit, a key factor in scoring.

- Diversify your credit mix: A balanced combination of short-term and long-term credit, or secured and unsecured loans, improves credibility.

- Lower outstanding debt gradually: Reducing current loan balances improves your debt-to-income ratio, a major indicator lenders evaluate.

- Build transparent financial records: Clear bookkeeping, audited statements, and consistent cash-flow reports help lenders trust your financial strength, indirectly supporting better lending outcomes.

Credit Card Warning Signs or Mistakes to Avoid

While business credit cards can be incredibly useful for managing day-to-day expenses, they can also become a source of financial stress if not handled carefully. Recognizing the warning signs early helps SMEs avoid unnecessary debt, higher interest costs, and long-term credit damage.

Common mistakes SMEs should avoid:

- Carrying high balances every month: Revolving large amounts leads to higher interest payments and increases credit utilization, which can pull down your credit score.

- Missing or delaying payments: Late payments are one of the quickest ways to damage credit health. Even a single missed payment can significantly lower your score.

- Using personal credit cards for business expenses: This blurs financial tracking, complicates tax filings, and exposes personal credit to business risks.

- Maxing out the credit limit: Consistently using 80–100% of the limit signals financial instability to lenders, even if payments are made on time.

- Ignoring hidden fees and charges: Annual fees, late fees, cash-withdrawal charges, and foreign transaction fees can add up quickly if not monitored.

- Taking cash advances frequently: Cash advances have higher interest rates and no interest-free period, making them an expensive habit for SMEs.

- Opening too many cards at once: Multiple new accounts lead to repeated hard inquiries, lowering credit scores, and giving an impression of credit desperation.

- Not reconciling monthly statements: Overlooking errors, duplicate charges, or unauthorized transactions can cost SMEs significantly in the long run.

Suggested read: India's SME Growth: Challenges and Opportunities

To avoid these costly mistakes and navigate credit decisions with more clarity, SMEs often need a trusted partner who can bring objectivity, structure, and expertise to the process.

How S45 Guides You on Credit Funding Decisions

The S45 Club supports India’s leading SMEs by strengthening their access to capital, improving financial discipline, and aligning funding decisions with long-term growth goals. We help you handle complex credit queries with clear, actionable guidance tailored to your business model and financial realities. Whether you operate in manufacturing, trading, or any other sector, our approach ensures your credit choices strengthen, not strain your business.

Here's how we assist with your credit funding decisions:

- Tailored Credit Planning: Loan structures and funding options aligned with your cash-flow needs, repayment capacity, and growth objectives.

- Industry-Specific Guidance: Insights on selecting the right credit products for sectors like manufacturing, trading, logistics, and services.

- Risk & Cost Evaluation: Assessment of interest rates, repayment terms, collateral requirements, and overall borrowing costs to ensure sustainable decisions.

- Cash-Flow Impact Analysis: Clear evaluation of how EMI schedules, working capital loans, or credit lines will influence your operational liquidity.

S45 works alongside you to simplify credit funding, reduce risk, and help your business grow with confidence. Connect with S45 today to make smarter, data-backed credit decisions.

Final Words

Credit funding is more than just securing money; it’s about making informed choices that strengthen cash flow, reduce financial stress, and fuel long-term business growth. When SMEs understand their credit options, maintain strong financial discipline, and avoid common borrowing mistakes, they unlock far greater stability and resilience in a competitive market.

With the right guidance, credit stops being a challenge and becomes a powerful tool for expansion, sustainability, and smart financial planning.

Ready to make stronger credit decisions? S45 is built for ambitious Indian SMEs that want to scale with confidence. From evaluating loan structures to selecting the most cost-efficient credit options, our mentors and financial experts guide you through every step.

Become a part of Club S45 today, and let’s build lasting value, side by side.