Here’s a Quick Overview:

- What Equity Warrants Are: An equity warrant is a financial tool that lets investors buy a company's stock at a fixed price within a certain time. If the stock price goes up, the investor can buy it cheaper than the market price, potentially making a profit.

- Warrants vs. Options: Unlike options, equity warrants are issued by the company itself, and if exercised, they result in the creation of new shares, which can dilute existing ownership.

- Types of Equity Warrants: Common types include traditional warrants, detachable warrants, and convertible warrants. Each type affects how dilution occurs and when conversion happens.

- Risks for Investors and Companies: Investors risk losing their investment if the stock price doesn’t exceed the strike price. For companies, issuing warrants can lead to future dilution if warrants are exercised in large numbers.

- Capital Raising for MSMEs: For MSMEs, issuing equity warrants is a way to raise funds without immediately giving up ownership, allowing them to attract investors with future stock purchase opportunities.

Raising capital is a challenge faced by many businesses, whether you're an MSME founder looking to expand or an investor seeking new opportunities.

Equity warrants have emerged as a unique financial tool, offering businesses a way to raise funds without immediate dilution of ownership.

In 2024, over 71% of Indian SMEs explored external funding options, with many considering equity warrants as part of their strategy.

For investors, these warrants can provide a chance to buy shares at a fixed price in the future, potentially offering significant returns. This article delves into how equity warrants work, their types, and the benefits they offer both businesses and investors.

What is an Equity Warrant?

An equity warrant is a financial instrument that gives the holder the right to purchase a company’s stock at a specific price (called the exercise or strike price) within a set timeframe.

You're not buying the shares immediately. You're buying the right to make that purchase later if conditions look favorable.

Think of it as a reservation. You pay upfront to lock in a price. The company gets immediate capital. You get the flexibility to convert when the timing makes sense.

The exercise price stays constant regardless of market movements. If shares trade at ₹200 and your warrant locks in ₹150, you pocket the difference upon conversion. If shares drop to ₹100, you let the warrant expire worthless.

Warrants in India must be converted within 18 months from issuance. That clock starts ticking the moment you receive the warrant certificate. Miss that window and your option disappears.

The mechanics differ from buying shares outright. With shares, you own a piece of the company immediately. With warrants, you own a time-bound claim on future ownership. The distinction matters when dividends get distributed or voting rights come into play.

However, term sheets don't just say "warrants." They specify call warrants, detachable structures, or naked issuances. Each variant reshapes how dilution unfolds and who controls the conversion timeline.

Need help understanding how these different types of warrants could impact your business or investment decisions? At S45 Club, we work with you to make sense of these complex financial tools, so you can make confident, informed choices.

Whether you're an MSME founder exploring funding options or an investor looking for opportunities, we simplify the process. Connect with us today and let us guide you through the nuances of equity warrants and other investment opportunities.

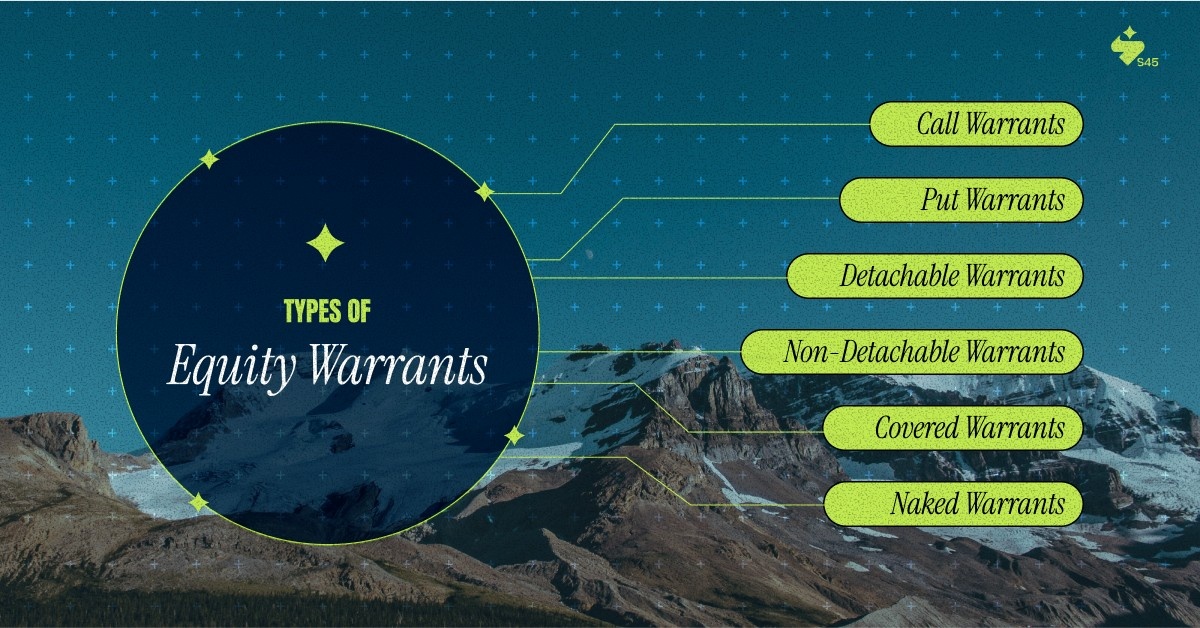

Types of Equity Warrants

Six main structures dominate warrant agreements. The type determines whether you can trade the warrant separately, who bears the dilution burden, and what happens if market conditions sour.

1. Call Warrants

Call warrants let you buy shares at the strike price. Most warrants you'll encounter fall into this category. They make money when share prices climb above your exercise price.

Say you hold a call warrant with a ₹100 strike price. Shares jump to ₹180. You exercise the warrant, pay ₹100 per share, and immediately own stock worth ₹180. That ₹80 spread represents your gain.

Investors favor call warrants during growth phases. Founders issue them to sweeten funding rounds without immediately diluting equity. The warrant sits dormant until conversion happens.

2. Put Warrants

Put warrants work in reverse. They give you the right to sell shares back to the company at a predetermined price. These show up rarely in private deals but exist in certain structured arrangements.

A put warrant with a ₹150 strike price becomes valuable if shares fall to ₹90. You exercise the warrant and force the company to buy your shares at ₹150. The company bears the downside risk.

Most startups avoid putting warrants because they create buyback obligations. Cash-strapped ventures can't guarantee liquidity when investors want out. You'll see these more often in mature companies with stable cash flows.

3. Detachable Warrants

Detachable warrants separate from the underlying security after issuance. You can trade them independently on exchanges or transfer them to other investors.

Companies bundle these with bonds or debentures to make debt offerings more attractive. Once issued, the warrant and the bond live separate lives. You could sell the warrant while keeping the bond, or vice versa.

The separate trading creates price discovery. Warrant values fluctuate based on the underlying share performance and time remaining until expiry. This liquidity appeals to investors who want flexibility.

4. Non-Detachable Warrants

Non-detachable warrants stay permanently attached to the original security. You can't trade them separately. If you sell the bond, the warrant goes with it.

These appear in preferential allotments where companies want to maintain tighter control over who holds conversion rights. The attachment limits secondary market activity.

Founders prefer non-detachable structures when they're selective about future shareholders. The lack of separate trading keeps the cap table more predictable.

5. Covered Warrants

Covered warrants get issued by financial institutions rather than the company itself. Banks create these instruments using shares they already own or have hedged positions in.

The institution guarantees delivery if you exercise the warrant. They've already secured the underlying shares. This removes counterparty risk because you're dealing with a regulated entity instead of hoping the company can deliver shares.

Retail investors see covered warrants more often in public markets. The standardization makes them easier to understand and trade. Pricing tends to be transparent because multiple institutions compete to offer better terms.

6. Naked Warrants

Naked warrants come straight from the company. When you exercise, the company issues fresh shares. This creates immediate dilution for existing shareholders.

Most private funding rounds involve naked warrants. The company hasn't set aside treasury shares. Conversion means printing new stock certificates and adjusting everyone's ownership percentages downward.

The dilution factor makes naked warrants contentious during negotiations. Existing shareholders push back because their stakes get watered down. You'll see anti-dilution clauses emerge to protect earlier investors from excessive dilution.

Having said that, classification alone doesn't tell you when to exercise or how to value what you're holding.

How Equity Warrants Work

Equity warrants work by giving the holder the right to purchase shares of a company at a fixed price within a specific time frame.

If the stock price rises above the strike price, the holder can exercise the warrant to buy the shares at the lower price and sell them at the market price for a profit. If the stock price doesn’t exceed the strike price, the warrant expires worthless.

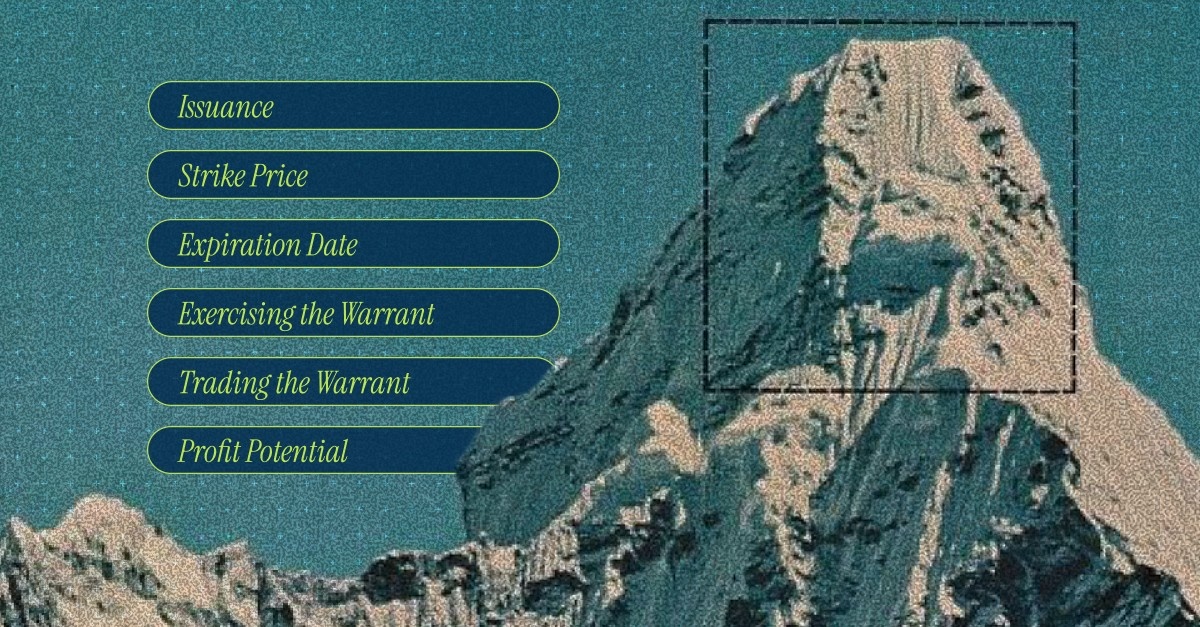

Key Steps in How Warrants Work:

- Issuance: Warrants are issued by a company, often alongside a bond or as part of a special offer to raise capital.

- Strike Price: The fixed price at which the holder can buy the stock. This price is set when the warrant is issued.

- Expiration Date: Warrants have an expiration date, typically ranging from a few months to several years. After this period, the warrant becomes invalid.

- Exercising the Warrant: The holder can exercise the warrant by paying the strike price to buy the company’s shares.

- Trading the Warrant: Warrants are tradable on secondary markets, so they can be sold to another investor before being exercised.

- Profit Potential: If the stock price is higher than the strike price, the holder can profit by exercising the warrant or selling it. If the stock price is lower, the warrant expires without any value.

Example:

- A company issues a warrant with a strike price of ₹100, expiring in 2 years.

- If the stock price rises to ₹150, the holder can buy at ₹100 and sell at ₹150, making a profit of ₹50 per share.

- If the stock price stays below ₹100, the warrant expires worthless, and the investor loses the premium paid for the warrant.

In essence, warrants offer a way for investors to speculate on the future price of a company’s stock, while giving businesses a way to raise capital without immediate dilution of shares.

Warrant mechanics and types paint the technical picture. But the real decision comes down to whether the advantages outweigh the drawbacks for your specific situation.

The Pros and Cons of Equity Warrants

Equity warrants offer distinct advantages and challenges for both investors and companies.

Before diving into them, it's essential to understand that while equity warrants can be a valuable tool for raising capital and generating potential profits, they also carry risks and complexities. Here's a breakdown of the main pros and cons:

Pros:

1. For Investors:

- Leverage: Warrants allow investors to control a large number of shares with a relatively small upfront investment.

- Potential for Profit: If the stock price rises above the strike price, investors can benefit from significant returns.

- Flexibility: Investors have the option to exercise the warrant or sell it, offering flexibility based on market conditions.

- Lower Upfront Investment: Compared to purchasing stocks outright, the initial cost of warrants is lower.

2. For Companies:

- Raising Capital without Immediate Dilution: Companies can secure funding without diluting ownership right away.

- Attracting Investment: Offering warrants can incentivize investors to buy bonds or stocks by providing potential upside in the future.

Cons:

1. For Investors:

- Risk of Loss: If the stock price doesn't exceed the exercise price, the warrant expires worthless.

- Complexity and Time Sensitivity: Understanding the intricacies of warrant terms and their expiration deadlines can be tricky.

2. For Companies:

- Future Dilution: When warrants are exercised, it results in issuing new shares, which dilutes existing ownership.

- Impact on Stock Price: If many warrants are exercised, it could negatively impact the company's stock price due to the increased share count.

These pros and cons need to be carefully weighed by both investors and companies when considering equity warrants as part of a financial strategy.

How S45 Club Can Help You Scale and Grow Your Business

S45 Club is designed to support MSME founders who are focused on long-term growth and creating businesses that stand the test of time.

Regardless of whether you’re looking to raise capital, innovate, or build a legacy, S45 Club is a partner you can rely on. Here's how S45 Club can guide you through your entrepreneurial journey:

- Capital & Expertise: Gain access to the financial support and expert advice you need to scale your business sustainably. S45 Club doesn’t just offer funds; they bring valuable industry insights that can steer your company in the right direction.

- Focus on Sustainable Growth: S45 Club understands the importance of steady, sustainable progress. They help you build a growth strategy that focuses on long-term viability, avoiding the temptation of short-term gains that could harm your business down the road.

- Innovation & Legacy: With a balance of honoring traditional business practices while fostering innovation, S45 Club helps you integrate new ideas and technologies to drive growth while preserving the core values of your business.

- Collaborative Partnership: S45 Club’s approach is based on collaboration, not just investment. They walk beside you as a true business partner, supporting you every step of the way.

- Community of Founders: Join a network of like-minded MSME founders, share insights, and collaborate on challenges to elevate your business alongside others.

Conclusion

Equity warrants offer a strategic way to raise capital, providing flexibility and the potential for growth, while allowing investors and businesses to share in future success. However, they also come with risks, including the possibility of loss if the stock price doesn't meet expectations.

Understanding the nuances of different types of warrants helps ensure you’re equipped to make informed decisions that align with your business goals or investment strategy.

For MSME founders aiming for sustainable growth and long-term success, partnering with the right organization is super critical.

S45 Club provides not just capital, but the expertise and support necessary to build a legacy. Their focus on innovation, steady growth, and collaboration ensures that businesses thrive in a way that’s both sustainable and impactful.

Join our community today to access valuable resources, expert guidance, and a network that helps you scale and create lasting success.