Need to Know

- A funding gap is the difference between the capital your SME needs and what’s actually available.

- It happens due to delayed payments, rising costs, limited credit access, or seasonal cash flow issues.

- Funding gaps slow growth by affecting operations, hiring, expansion, and cash flow stability.

- SMEs commonly face working capital gaps, expansion gaps, timing mismatches, credit barriers, and emergency gaps.

- Early warning signs include frequent cash shortages, rising debt, delayed supplier payments, and slow receivables.

- Closing the gap requires better forecasting, diversified funding, smarter credit planning, and expert guidance.

Disclaimer: The information provided in this article is for general educational purposes only and should not be considered financial advice.

Have you ever felt like your business is ready to grow, your customers are interested, your operations are stable, your team is capable, yet the money you need just doesn't line up? If yes, you’re in the same place as millions of ambitious SME owners who face a challenge that has nothing to do with ideas or efforts and everything to do with funding.

Here’s a powerful reality check: Over the next decade, an estimated 1.2 billion young people will reach working age, but only about 420 million jobs are expected to be created. That means more entrepreneurs will emerge, more small businesses will be born, and more demand for funds will rise, while access to capital continues tightening.

So even if your business has demand, a clear roadmap, and steady operations, you might still find yourself struggling with limited capital. This silent barrier has a name: the funding gap.

Understanding what the funding gap is and why it happens can help you spot early warning signs, plan better, and protect your business from stalled growth. Let’s get started.

What Is a Funding Gap?

A funding gap occurs when a business needs more capital to operate or grow than what it currently has access to. In simple terms, it’s the difference between the money required and the money available, whether through revenue, credit, or investment.

What makes this gap especially challenging for SMEs is that it often appears even when the business is performing well. You might have rising demand, healthy orders, or new growth opportunities, but the capital needed to execute those plans just doesn’t show up at the right time.

To put things into perspective, bank credit to micro and small enterprises in April 2024 grew by 15.6%. While this looks promising, the demand for funds is growing much faster than the supply. This widening mismatch is exactly what creates the funding gap for thousands of SMEs every year.

A funding gap can show up when:

- You need more working capital than your limits allow

- Your receivables come in late, but expenses continue

- You want to expand, but can’t secure timely funding

- Lenders hesitate due to limited collateral or credit history

Understanding why funding gaps occur is only the first step; it's equally important to recognise the different forms these gaps take and how each one affects daily operations.

Understanding the Causes of Funding Gaps in SMEs

Funding gaps rarely appear overnight; they usually build up over time due to internal challenges, market realities, or financial misalignment. For many SMEs, even healthy revenue streams can feel insufficient when cash cycles, credit terms, and operational demands don’t match. Understanding these causes is the first step toward preventing long-term financial stress.

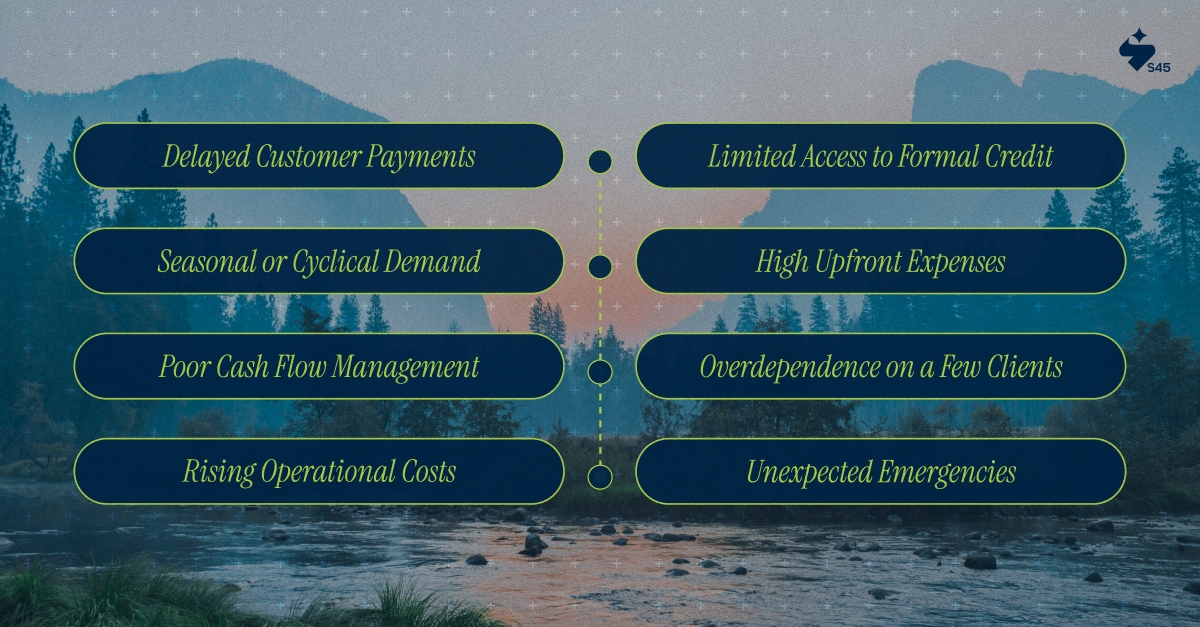

Key Causes of Funding Gaps:

- Delayed Customer Payments: Long credit periods or inconsistent client payments create gaps between revenue earned and cash received.

- Limited Access to Formal Credit: Strict documentation requirements, insufficient collateral, or weak credit scores restrict SMEs from securing loans.

- Seasonal or Cyclical Demand: Businesses with peak and off-peak cycles struggle to maintain consistent cash flow throughout the year.

- High Upfront Expenses: Costs like machinery, bulk inventory purchases, or new facility setup can stretch finances thin.

- Poor Cash Flow Management: Inaccurate forecasting, unplanned spending, or lack of financial discipline leads to unbalanced inflows and outflows.

- Overdependence on a Few Clients: When one major client delays payment, the entire cash cycle gets disrupted.

- Rising Operational Costs: Inflation, supply chain disruptions, and fluctuating raw material prices widen the gap between expenses and available capital.

- Unexpected Emergencies: Equipment breakdowns, regulatory penalties, or sudden market shifts create immediate funding pressure.

Many SMEs benefit from expert support to evaluate their cash cycles and credit readiness more accurately, something platforms like S45 help simplify for growing businesses.

How Funding Gaps Impact SME Growth

When a business doesn't have consistent access to funds at the right time, the impact goes far beyond delayed payments. Funding gaps slowly influence how an SME operates, grows, and competes in the market. Even profitable companies struggle when liquidity is unpredictable, because stability, not just revenue, drives sustainable growth.

Here’s how funding gaps hold SMEs back:

- Slows Expansion Opportunities: SMEs delay opening new units, adopting better technology, or tapping into new markets.

- Reduces Operational Efficiency: Lack of money for inventory, raw materials, or maintenance affects production cycles.

- Creates Cash Flow Instability: Irregular inflows and outflows force SMEs to depend on expensive short-term loans.

- Limits Hiring and Talent Retention: Without funds, businesses struggle to attract skilled staff or retain high-performing teams.

- Prevents Innovation: R&D, product improvements, and market testing require capital; funding gaps stop these initiatives.

- Increases Borrowing Costs: SMEs turn to informal lenders or high-interest loans, reducing profit margins.

- Adds Financial Stress: Payment delays, penalties, and supplier pressure add long-term strain on the business.

To understand how SMEs can prevent these challenges, it's important first to explore the root causes behind funding gaps and why they appear in growing businesses.

Types of Funding Gaps SMEs Commonly Face

Not all funding shortages look the same. Depending on the industry, business model, and growth stage, SMEs experience different kinds of financial shortfalls that disrupt operations in unique ways. Understanding these variations helps SMEs identify problems early and choose the right financing tools.

1. Working Capital Gap

This occurs when day-to-day operational expenses exceed available short-term funds.

Common reasons include:

- Slow customer payments

- Seasonal sales fluctuations

- Rising costs of raw materials

- Delayed invoice cycles

Impact: Difficulty managing salaries, inventory purchases, and utility expenses on time.

2. Growth & Expansion Gap

A financing gap arises when an SME has opportunities to grow but lacks the capital to pursue them.

Examples include:

- Opening new branches

- Investing in new machinery

- Entering new markets

- Increasing production capacity

Impact: Missed opportunities and delayed expansion strategies.

3. Cash Flow Timing Gap

A timing mismatch happens when payments from customers come later than payments due to suppliers.

Usually caused by:

- Long credit terms are given to customers

- Immediate cash requirements from vendors

- High dependency on a few large clients

Impact: SMEs struggle to maintain stability even when profitability is strong.

4. Credit Access Gap

This occurs when SMEs cannot qualify for formal credit due to documentation issues, low credit scores, or insufficient collateral.

Common barriers:

- Limited financial history

- High perceived risk

- Inadequate formal records

- Sector-specific constraints

Impact: Reliance on expensive informal lending sources and higher borrowing costs.

5. Emergency or Crisis Gap

Unexpected events can create sudden financing shortfalls.

Triggers include:

- Supply chain disruptions

- Machinery breakdown

- Economic downturn

- Health or safety events

Impact: Increased operational pressure and potential halts in production.

Why Bridging Funding Gaps Is Important for Long-Term Growth?

When SMEs maintain steady liquidity, they can invest in expansion, upgrade technology, hire better talent, and respond quickly to market opportunities.

A well-managed cash cycle also strengthens creditworthiness, making it easier to secure future funding at better terms. Simply put, bridging funding gaps builds financial stability today and creates room for sustainable, long-term growth tomorrow.

How to Identify a Funding Gap in Your Business

Funding gaps don’t always show up as major financial crises; most start as subtle signs in your cash flow, operations, or customer payment behaviour. The earlier an SME identifies these signals, the easier it becomes to take corrective action and prevent long-term financial strain. A structured approach helps business owners understand whether the issue lies in revenue timing, rising expenses, or a lack of external credit support.

Key Indicators of a Funding Gap:

- Frequent Cash Shortages: Regular difficulty covering daily expenses like salaries, rent, or inventory purchases.

- Increasing Dependence on Short-Term Loans: Relying on overdrafts or quick credit to bridge routine expenses is a major warning sign.

- Delayed Payments to Suppliers: If you’re consistently extending payment cycles, it usually indicates a liquidity crunch.

- Mismatch Between Invoices and Cash Received: High outstanding receivables or slow-paying customers create timing gaps in your cash cycle.

- Inability to Fulfill New Orders: Turning down business opportunities due to lack of working capital signals a deeper funding issue.

- Declining Cash Reserves: Savings or emergency funds depleting faster than expected is a clear indicator of financial pressure.

- Stretched Inventory Levels: When you can’t maintain stock because of insufficient funds, production and sales begin to suffer.

- Rising Debt Levels Without Revenue Growth: Taking more credit without proportional business expansion suggests a widening funding gap.

- Difficulty Meeting Tax or Compliance Obligations: Struggling with statutory payments is often linked to cash flow issues.

Also Read: Exit Strategy Guide for Investors: Definition and Importance

While these strategies can help strengthen your cash flow, navigating funding gaps still requires clarity, experience, and the right financial guidance, especially when decisions affect long-term stability. This is where having a trusted strategic partner like S45 can make all the difference.

How S45 Helps You Make Smarter Credit Funding Decisions

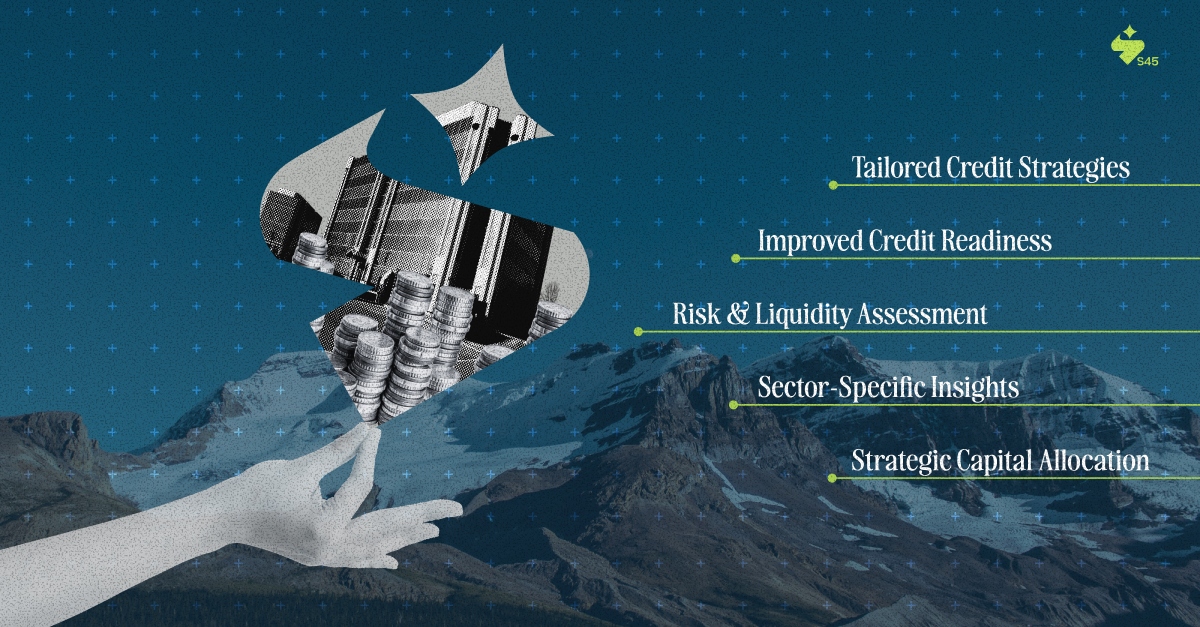

The S45 Club supports high-performing Indian SMEs by offering deep financial expertise, strategic guidance, and access to reliable credit funding pathways. Instead of navigating complex financing options alone, SMEs gain a structured approach to borrowing, repayment planning, and long-term capital allocation.

How S45 Supports Your Credit Funding Decisions:

- Tailored Credit Strategies: Guidance on choosing the right type of credit, whether working capital, term loans, bill discounting, or unsecured funding, based on your cash cycle, sector, and growth goals.

- Improved Credit Readiness: Support in strengthening financial documentation, credit profiles, and compliance so that you qualify for better loan terms and higher credit limits.

- Risk & Liquidity Assessment: Expert evaluation of your repayment capacity, operational cash flows, and risk exposure to prevent over-leveraging or mismatched repayments.

- Sector-Specific Insights: Customised recommendations for manufacturing, trading, distribution, and other SME-heavy sectors, ensuring financing choices align with real-world operational needs.

- Strategic Capital Allocation: Guidance on how to use borrowed capital efficiently, so funding supports expansion, not financial strain.

S45 walks beside you at every stage of your credit journey, helping you avoid borrowing mistakes and make decisions backed by data, insight, and long-term strategy.

Conclusion

Funding gaps are a reality for many SMEs, but they don’t have to slow down growth. With the right financial understanding, clear cash flow planning, smart credit management, and early detection of liquidity issues, businesses can stay resilient even in uncertain conditions. The key is not just securing funds, but doing it in a way that supports long-term stability and expansion.

When SMEs take a structured approach to borrowing and capital allocation, they gain the clarity and confidence needed to pursue new opportunities, strengthen operations, and grow sustainably.

If you're ready to make stronger, more informed credit decisions and build a financially secure future for your business, connect with S45 today. Let’s build lasting value together.