Key Takeaways

- India's PE market has crossed $70 billion in deployments, with firms actively seeking growth-stage MSMEs across 12+ sectors, including manufacturing, healthcare, and infrastructure.

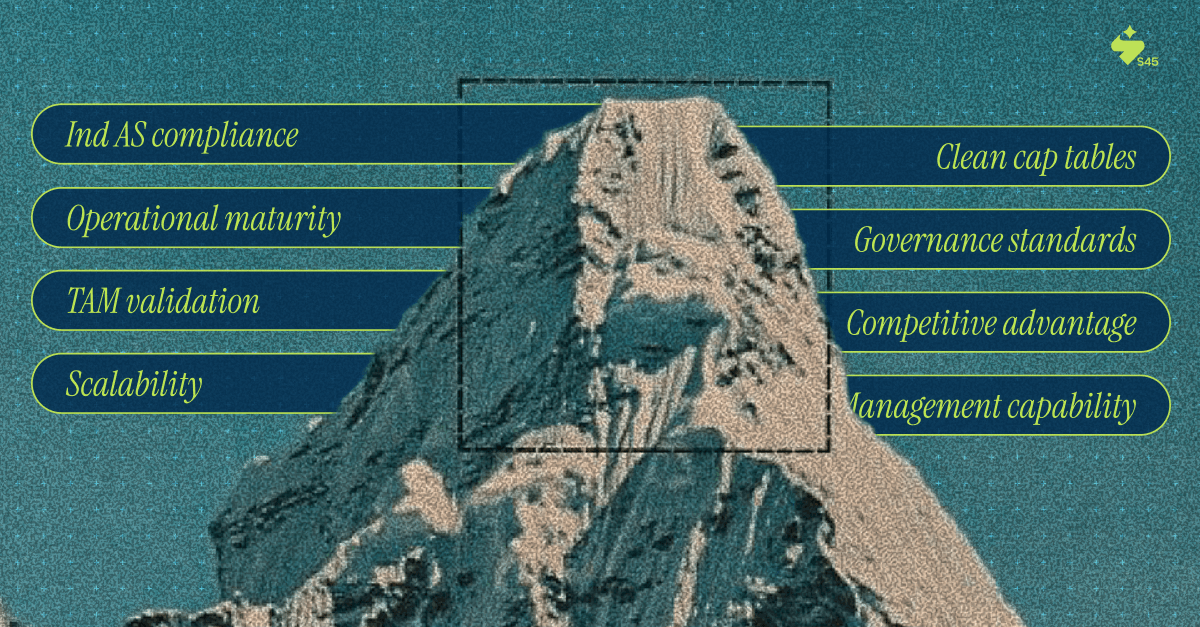

- The right PE partner evaluates more than financials—they assess Ind-AS compliance, cap table hygiene, operational maturity, and your readiness for institutional governance.

- Recent PE-backed listings like Zomato, PolicyBazaar, and Delhivery prove that institutional capital paired with execution discipline creates liquidity events that reward founders and investors alike.

- S45 bridges the chaos by preparing mid-market companies for PE scrutiny through our IPO Readiness Scan and transforming operationally strong businesses into institutionally disciplined, listing-ready enterprises.

Disclaimer: This content is for educational purposes only and should not be considered as financial advice. Every business situation is unique, and we recommend consulting with qualified financial advisors before making important business decisions.

You have built a business with strong revenue, improving margins, and clear market demand, but internal cash and bank funding can no longer support your next growth phase.

This is where private equity becomes relevant, not just as capital, but as a signal of institutional trust and long-term scale potential. In India, private equity firms have deployed over $5.3 billion in 2025, backing companies in consumer, technology, healthcare, and infrastructure sectors.

However, these firms invest only in businesses that show financial discipline, transparent reporting, and systems ready for regulatory scrutiny. This guide helps you identify leading private equity firms in India and prepare your business for credible institutional investment and future public listing.

What Makes a PE Firm the Right Partner for Your Business?

Private equity is not a commodity. The firm you choose shapes board control, strategic direction, exit timing, and how much long-term ownership you retain. Choosing well protects both value and legacy.

- Investment thesis alignment matters first. Does the firm truly understand your sector dynamics and growth cycles? Firms like ChrysCapital and OrbiMed bring healthcare depth, while Brookfield focuses on infrastructure and manufacturing. Sector knowledge enables sharper guidance, realistic growth targets, and relevant industry access.

- Deal structure preferences differ widely. Some firms take majority stakes above 51 percent and drive governance decisions. Others prefer minority positions with board seats and defined veto rights. Founders focused on control often prefer minority aligned investors.

- Value creation goes beyond capital. Strong PE partners support DRHP preparation, strengthen governance, and prepare companies for public markets. They bring IPO-ready CFOs, banker networks, and help simplify complex cap tables before listing.

- Exit alignment is critical. If your goal is an IPO within three to five years, choose firms with proven public market exits. Firms focused on strategic sales may push M&A paths that conflict with listing plans.

At S45, we see misalignment often derail strong businesses. Founders approach PE without institutional readiness, leading to weak terms or stalled deals. Our Pre-IPO Capital Structure Management service resolves this by simplifying share structures, rationalizing instruments, and preparing companies for institutional capital.

Also Read: What Are Private Equity Firms?

Top 10 Private Equity Firms Actively Backing Indian Enterprises

India's PE ecosystem combines global capital giants with specialized sector investors. The firms below represent the most active players backing growth-stage enterprises positioned for public market exits.

1. Blackstone Group

Blackstone entered India in 2005 and has since become the country's largest real estate investor and a major player in IT services, logistics, and infrastructure. The firm focuses on control deals and operational transformations that prepare businesses for significant scale.

- Investment Focus: Real estate, technology services, infrastructure, logistics, warehousing

- Deal Size: $50 million to $500 million, typically acquiring majority stakes

- Notable Investments: Mphasis (IT services), Embassy Office Parks REIT (commercial real estate), Nexus Malls, Allcargo Logistics

Why MSMEs Should Consider Them:

Blackstone brings operational rigor and governance frameworks that directly translate to IPO readiness. Their portfolio companies undergo intensive financial systems upgrades, making eventual SEBI compliance smoother. For manufacturing and logistics firms eyeing Main Board listings, Blackstone's infrastructure expertise accelerates scale.

2. KKR (Kohlberg Kravis Roberts)

KKR takes a collaborative approach, working alongside founders rather than imposing top-down mandates. This partnership model appeals to legacy-driven entrepreneurs.

- Investment Focus: Healthcare, financial services, technology, consumer goods, infrastructure

- Deal Size: $100 million to $1 billion, flexible on majority vs. minority structures

- Notable Investments: Reliance Jio (telecom), Bharti Infratel (tower infrastructure), Max Healthcare, Avendus Capital

Why MSMEs Should Consider Them:

KKR introduces board-level discipline, quarterly reporting rigor, and segment reporting frameworks that SEBI mandates for listed entities. For founders concerned about maintaining influence post-investment, KKR's collaborative style offers breathing room.

3. Carlyle Group

Carlyle has operated in India for over two decades, building a reputation for patient capital and long-term value creation. The firm actively supports portfolio companies through IPO processes, often retaining partial stakes post-listing to signal confidence.

- Investment Focus: Financial services, technology, healthcare, consumer goods, infrastructure

- Deal Size: $50 million to $500 million, with flexibility on deal structures

- Notable Investments: SBI Cards, PNB Housing Finance, Quest Global Services, VLCC, YES Bank

Why MSMEs Should Consider Them:

Carlyle guides companies through Ind-AS transitions, internal controls implementation, and audit committee formation. For businesses in regulated sectors like financial services or healthcare, Carlyle's compliance expertise reduces listing timeline friction.

4. Warburg Pincus

Warburg Pincus pioneered PE investing in India. This first-mover advantage gives them deep networks across sectors and an understanding of India's regulatory evolution. They prefer minority stakes, making them attractive to control-focused founders.

- Investment Focus: Healthcare, financial services, technology, media, energy, industrials

- Deal Size: $25 million to $300 million, primarily minority investments

- Notable Investments: Bharti Airtel, Gangavaram Port, QuEST Global, Apollo Hospitals, AU Small Finance Bank

Why MSMEs Should Consider Them: Warburg's minority-focused approach preserves founder control while bringing institutional governance. They excel at pre-IPO fundraising coordination, helping companies attract QIB and AIF participation before the public offering.

5. Sequoia Capital India (Peak XV Partners)

Sequoia entered India in the early 2000s and became synonymous with backing category-defining startups. The recent rebranding to Peak XV signals operational independence while maintaining the legacy of backing over 400 companies and 35+ unicorns.

Investment Focus: Technology, fintech, edtech, healthtech, consumer internet, SaaS

Deal Size: $5 million to $150 million, covering seed to growth stages

Notable Investments: Zomato, BYJU's, OYO, Freshworks, Razorpay, PharmEasy

Why MSMEs Should Consider Them:

Peak XV emphasizes unit economics, product-market fit validation, and technology-driven efficiency. For businesses leveraging AI or automation in manufacturing, logistics, or services, Peak XV's tech expertise accelerates digital transformation initiatives that institutional investors value.

6. Accel Partners

Accel India has carved a niche backing category creators in consumer tech and SaaS. The firm's hands-on approach includes product strategy guidance, go-to-market optimization, and international expansion support. They typically enter early and support companies through multiple growth rounds.

- Investment Focus: Consumer technology, fintech, healthcare tech, B2B SaaS, edtech

- Deal Size: $1 million to $100 million, from seed through Series C

- Notable Investments: Flipkart, Swiggy, Freshworks, Urban Company, Cure.fit, BlackBuck

Why MSMEs Should Consider Them:

Accel excels at building repeatable revenue models and subscription-based businesses. For service-oriented MSMEs considering product pivots or platform strategies, Accel's product thinking adds value. Their network opens doors to enterprise customers and channel partners, accelerating revenue scale that drives higher valuations at IPO.

7. ChrysCapital

ChrysCapital combines local market knowledge with institutional investment discipline. As one of India's oldest homegrown PE firms, they understand regulatory nuances and maintain strong relationships with SEBI, stock exchanges, and the merchant banking community.

- Investment Focus: Healthcare, pharmaceuticals, financial services, manufacturing, consumer goods

- Deal Size: $30 million to $250 million, flexible on majority vs. minority

- Notable Investments: Mankind Pharma, Hero FinCorp, Intas Pharmaceuticals, Edelweiss Financial Services

Why MSMEs Should Consider Them:

ChrysCapital guides companies through ICDR compliance, promoter contribution requirements, and minimum public shareholding norms. For healthcare and pharma MSMEs, their sector expertise accelerates licensing, IP protection, and quality certification processes that regulators scrutinize during IPO reviews.

8. OrbiMed

OrbiMed specializes exclusively in healthcare, covering pharmaceuticals, medical devices, diagnostics, and healthcare services. They understand CDSCO approvals, clinical trial requirements, and drug pricing regulations.

- Investment Focus: Healthcare services, pharmaceuticals, diagnostics, medical technology, biotech

- Deal Size: $20 million to $200 million, typically minority stakes

- Notable Investments: Suraksha Diagnostics, MedGenome, Bharat Serums and Vaccines, Metro Hospitals

Why MSMEs Should Consider Them:

For healthcare MSMEs planning Main Board listings, OrbiMed's guidance on segment reporting for healthcare services, medical equipment depreciation schedules, and patient data privacy compliance proves invaluable. They introduce hospital-grade governance systems that translate directly to SEBI-mandated internal controls.

9. Temasek Holdings

Temasek, Singapore's sovereign wealth fund, takes a generational investment view. Unlike traditional PE funds with 5 to 7-year horizons, Temasek can hold investments for decades.

- Investment Focus: Financial services, technology, consumer, healthcare, infrastructure

- Deal Size: $50 million to $1 billion+, primarily minority stakes in late-stage companies

- Notable Investments: Zomato (1.94% stake valued at ₹4,000 crore), ICICI Bank, HDFC Bank, Manipal Health Enterprises, PolicyBazaar

Why MSMEs Should Consider Them:

Temasek's long-term orientation aligns with legacy-focused founders. They do not pressure for premature exits and support measured international expansion. For businesses eyeing both Indian listing and eventual international presence, Temasek's Singapore base provides strategic offshore structuring guidance and access to Southeast Asian markets.

10. Brookfield Asset Management

Brookfield specializes in real assets, infrastructure, renewable energy, and real estate, where capital intensity and long gestation periods deter traditional PE.

- Investment Focus: Infrastructure, real estate, renewable energy, manufacturing, utilities

- Deal Size: $100 million to $2 billion, often acquiring controlling stakes in capital-intensive businesses

- Notable Investments: Reliance Industries' telecom tower assets, renewable energy platforms, warehousing portfolios

Why MSMEs Should Consider Them:

For manufacturing and infrastructure businesses requiring heavy capex to scale, Brookfield brings patient capital and project execution expertise. They guide companies through environmental clearances, land acquisition, and construction project management.

These are some of the best PE firms in India 2026. However, to prepare your business for credible institutional investment and future public listing, you must know how PE firms evaluate businesses.

Also Read: Carried Interest: What Founders Need to Know in Private Equity

How PE Firms Evaluate Investment Opportunities: Preparing Your Business

Private equity firms review financial, legal, commercial, and ESG readiness to judge true investment risk. Understanding this process helps you fix gaps before pitching.

- Ind AS compliance leads the financial review. PE firms expect restated accounts, not basic Companies Act statements. This includes revenue recognition, lease accounting under Ind AS 116, and fair value treatment of instruments.

- Clean cap tables separate investable companies from risky ones. Multiple preference classes, unclear liquidation rights, and undocumented founder agreements raise red flags. PE firms often reduce valuations or exit deals when structures cannot be simplified.

- Operational maturity matters as much as revenue growth. PE firms test whether systems can scale three times without failure. They review ERP usage, contract standardization, and documented operating processes. These factors indicate whether growth can be sustained without breakdowns.

- Governance standards face close scrutiny. Firms expect documented board decisions, regular audit committee reviews, and formal related party policies. Independent oversight signals discipline and lowers perceived risk. Early governance setup improves deal confidence.

- TAM validation goes beyond market size claims. PE firms verify demand through customer interviews, competitor analysis, and realistic share capture models. Inflated projections weaken credibility and delay investment decisions.

- Competitive advantage drives valuation outcomes. Firms assess how easily competitors can replicate your offering. Proprietary technology, exclusive access, or strong brand positioning justify higher multiples and longer-term confidence.

- Scalability depends on unit economics. PE teams model cost behavior as revenue grows. They expect to improve margins with scale. Businesses showing negative operating leverage face valuation pressure or rejection.

- Management capability often determines final outcomes. PE firms assess whether founders can lead institutional growth. They look for strong functional leaders, clear delegation, and execution discipline beyond founder control.

At S45, we help MSMEs prepare across these dimensions. Our IPO Readiness Scan identifies gaps across finance, governance, and operations within 30 days. Strong preparation ensures you meet PE expectations before entering negotiations.

Also Read: India's Private Equity Trends and Growth

Choosing the Right Capital Partner for Your IPO Journey

Private equity is not just about the money. The firm you partner with shapes your board dynamics, influences your strategic priorities, and determines how smoothly you navigate toward public listing. Choose partners who have taken companies public in your sector, understand your regulatory environment, and share your exit timeline.

At S45, we help you become the kind of company PE firms want to back, and then take you public with institutional discipline. Our technology-first IPO readiness assessment benchmarks your business against Main Board and SME Exchange requirements.

We clean up cap tables, implement governance frameworks, and draft DRHP sections with evidence-linked precision that withstands SEBI scrutiny.

For ambitious MSMEs targeting public markets, PE capital paired with execution discipline creates a competitive advantage. But you must enter these conversations prepared.

Ready to assess your PE readiness? Start with S45's IPO Readiness Scan and discover what institutional investors will see when they evaluate your business.